- According to authoritative predictions, the electricity demand in the region is expected to soar by 50% by 2035

The report by the International Energy Agency (IEA) depicts a future picture of the power system in the Middle East and North Africa region, intertwined with pressure and ambition. By 2035, the electricity demand in the region is expected to surge by 50%, driven not only by population growth and economic expansion, but also by climate change itself - the explosive growth in cooling demand is evolving into the most urgent challenge to electricity security. At that time, the peak electricity demand for cooling alone will double, exceeding 500 terawatt hours, which is higher than France's total annual electricity consumption. In Saudi Arabia, the peak load in summer has increased by 50% compared to winter, posing a severe challenge to the stability of power supply.

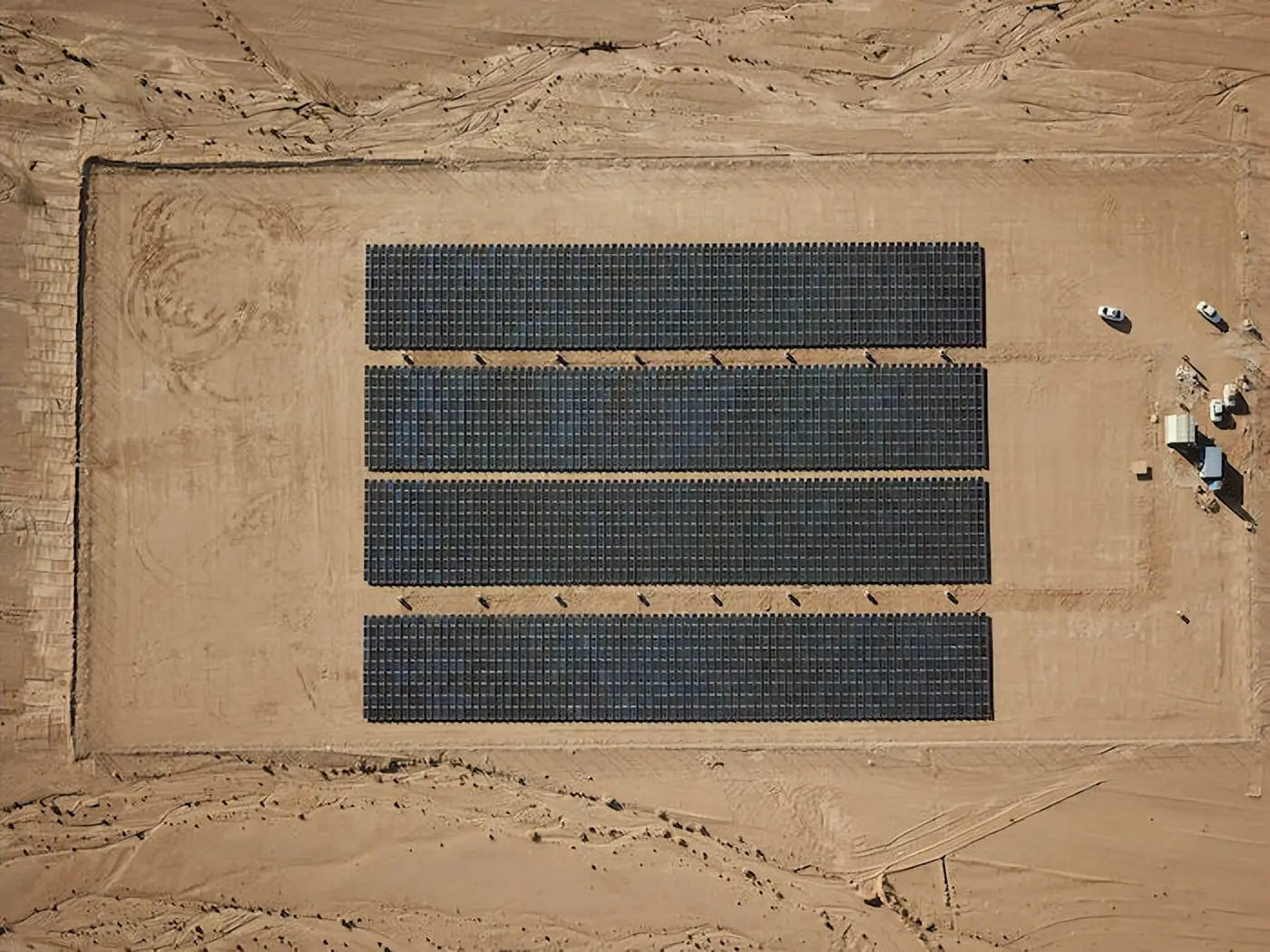

To address this challenge, governments around the world are actively shifting towards renewable energy. Competitive auctions have become the mainstream mode of project procurement, with 13 out of 17 countries in the region adopting this approach. Pioneers such as the United Arab Emirates, Jordan, Egypt, and Morocco have repeatedly set new lows in solar photovoltaic prices, once falling below $20 per megawatt hour. However, there is still a gap between the grand auction target and the actual implementation of the project, and delays in project debugging have become the main bottleneck in countries such as Algeria, Iraq, and Tunisia.

At the same time, the energy structure is undergoing a profound transformation. Oil based power generation has significantly decreased in countries such as Iraq and Saudi Arabia, and has been replaced by solar photovoltaics, wind energy, and nuclear energy. According to the IEA's forecast, by 2035, the dominant position of natural gas power generation in North Africa will drop to below 40%, especially due to Egypt's strong promotion in the fields of wind and nuclear energy.

But the road to transformation is not smooth. The lag of power grid infrastructure has become a key constraint factor. Despite a 76% increase in transmission lines in the Middle East over the past decade, there is a disconnect between the decade long construction cycle and rapidly advancing renewable energy projects, highlighting the urgent need for digital grids, smart technologies, and regional interconnectivity (such as the expansion of the Gulf Cooperation Council grid and the "Sea Interconnection" project connecting Europe).

The investment flow clearly confirms this trend. It is expected that by 2035, the annual investment in the power industry in the region will increase from $40 billion in 2023 to over $60 billion, of which 85% of the new investment will be directed towards low emission technologies, grid upgrades, and energy storage, while the share of expenditure on non reduced fossil fuels will shrink to 15%.

The transformation paths of various countries are also showing diversified characteristics: Saudi Arabia aims to achieve 50% of its electricity generation from renewable energy by 2030 to complement its economic diversification strategy; Under the support of nuclear energy, the United Arab Emirates aims to achieve a low emission power generation ratio of 32% during the same period; Morocco, on the other hand, has utilized its advantages in renewable energy and phosphate to attract a $1.3 billion battery factory from companies such as Guoxuan High Tech, aiming to build an electric vehicle manufacturing center. In Yemen and Lebanon, distributed solar photovoltaics have demonstrated their resilience in maintaining basic power supply during crises against the backdrop of the collapse of the national power grid.

The future of electricity in the Middle East and North Africa region depends on its ability to effectively balance the surging demand and green transformation. The key to success lies not only in continuing to promote renewable energy auctions, but also in accelerating project implementation, significantly improving grid resilience, and promoting regional power integration. If breakthroughs cannot be made in modernizing the power grid, the region may find it difficult to fulfill its climate and energy commitments for 2030 and 2035 as scheduled. Editor/Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~