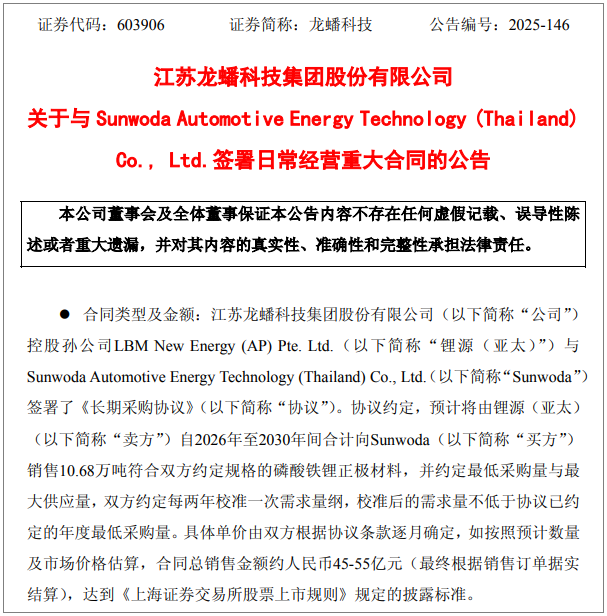

- The Indonesian subsidiary has signed a long-term agreement with Xinwangda Thailand to supply over 100000 tons of lithium iron phosphate

On December 3, 2025, Longpan Technology announced that its Indonesian subsidiary has received a total of up to 5.5 billion yuan in positive electrode material orders from Xinwangda Thailand. Behind this contract is a close handshake between two Chinese companies based on their respective overseas bases, which also marks an unprecedented wave of global supply of lithium iron phosphate materials.

The production capacity linkage behind 100000 tons of materials

On December 2nd, Longpan Technology announced that its controlling subsidiary, Lithium Source, had signed a long-term procurement agreement with Xinwangda Automotive Battery Co., Ltd. According to the agreement, Longpan Technology is expected to sell a total of 106800 tons of lithium iron phosphate cathode materials to the latter from 2026 to 2030, with a total contract sales amount expected to be between 4.5 billion and 5.5 billion yuan. This not only brings long-term stable performance expectations for Longpan Technology, but also reveals a new model of overseas collaborative layout for the upstream and downstream of China's battery industry chain.

The realization of this order directly relies on the overseas production capacity that both parties have quickly implemented. The supplier Longpan Technology's lithium iron phosphate production base in Indonesia is making rapid progress: the first phase of the 30000 ton project has been put into operation in early 2025, and the second phase of the 90000 ton project is also under full construction, with an expected completion of commissioning by the end of 2025. The purchaser Xinwangda's battery factory in Thailand has started trial production for the first phase, and the second phase will also be launched in October 2025, with a total planned production capacity of 17.4GWh. Based on the commonly used material consumption ratio in the industry, the purchase of over 100000 tons of positive electrode materials this time is sufficient to support the production of approximately 40 to 45 GWh of batteries, closely matching Xinwangda's overseas expansion pace.

The Global Chess Game of Seeking Growth

For Xinwangda, this huge purchase is a crucial step in its firm commitment to advancing its globalization strategy. As one of the earliest lithium battery manufacturers in China to go global, Xinwangda has long regarded overseas markets as important growth poles. Data shows that in 2024, its overseas market revenue reached 23.431 billion yuan, accounting for 41.83% of the total revenue. Facing the challenges of industry competition and self-development, accelerating the exploration of overseas space has become an inevitable choice.

In recent years, Xinwangda's global layout has significantly accelerated: investing in the construction of a power battery factory in Hungary; Establishing a consumer lithium battery factory project in Vietnam; Establish production bases in India, Morocco and other places; And established overseas marketing agencies in seven places including the United States, Germany, and Japan. The large-scale procurement of lithium iron phosphate materials through its Thai subsidiary is aimed at ensuring the stable supply of its overseas battery production capacity, in order to achieve growth strategies and enhance competitiveness in the international market. Wang Huawen, Vice President of Xinwangda Power, once stated that going global is an inevitable choice for the power battery industry, and the company's capabilities are honed in this process.

Global supply chain competition for lithium iron phosphate

This order from Longpan Technology is not an isolated case, but a microcosm of the overseas order boom for Chinese lithium iron phosphate material companies. In 2025 alone, its Indonesian subsidiary has successively won multiple international large orders: in January, it signed a supply agreement with Blue Oval, a subsidiary of Ford Motor Company; Expected to sign a contract worth over 5 billion yuan with EVE Energy Malaysia in June; In September, we reached a long-term cooperation agreement with CATL on overseas factory supply. These orders collectively point to a trend: the demand for lithium iron phosphate batteries in overseas markets is exploding. Keywords: construction news, foreign construction news

According to UBS calculations, the global market size of lithium iron phosphate is expected to reach approximately 180 billion yuan by 2025, with the overseas market share expected to increase from 15% in 2024 to 25%. However, currently there is a severe shortage of domestic production capacity for lithium iron phosphate overseas, and Chinese companies dominate the global market in key areas such as cathode materials. To seize the market window, Chinese companies are actively building factories overseas. In addition to the Longpan Technology Indonesia project that has been put into operation, Zhongwei Corporation's joint venture project in Morocco has also been put into operation, while overseas projects of companies such as Huayou Cobalt, German Nano, and Hunan Yuneng are all being promoted. Editor/Yang Beihua

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~