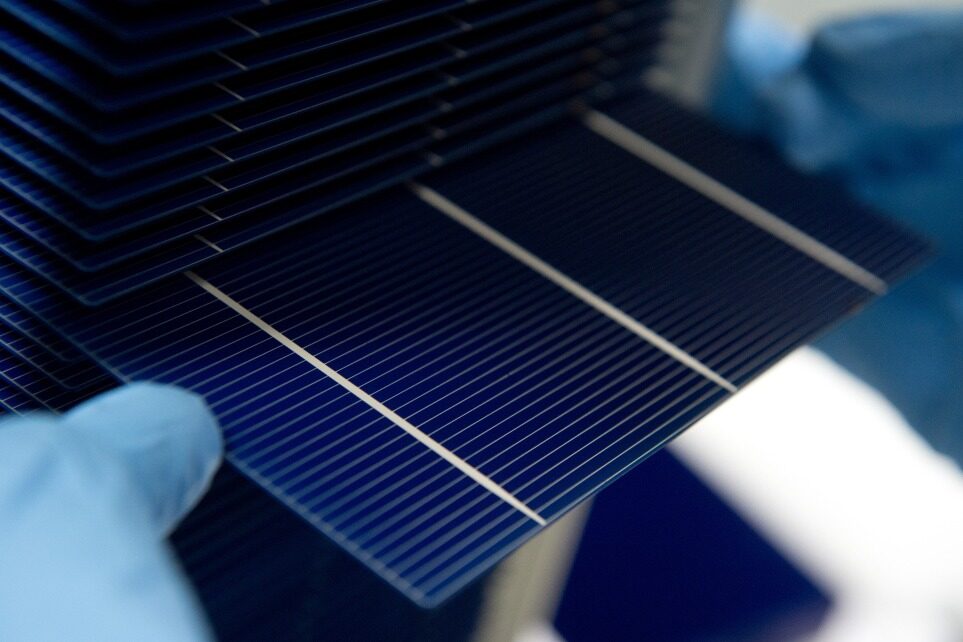

- Polysilicon is the most important material in the semiconductor, electronic information and solar photovoltaic cell industries

The new energy track has ushered in a series of blockbuster news. LONGi and Tongwei, the leaders in the two major photovoltaic sectors, have joined hands again. On March 21, 2022, LONGi Co., Ltd. announced that its eight subsidiaries and four subsidiaries of Tongwei Co., Ltd. signed a long-order purchase agreement for polysilicon materials, and will trade 203,600 tons of polysilicon materials within two years from 2022 to 2023. .

According to the average transaction price of single crystal high-purity silicon material announced on March 16 by the Silicon Industry Branch of China Nonferrous Metals Industry Association, it is estimated that the total contract value is about 44.2 billion yuan.

The four Tongwei subsidiaries involved in this transaction are: Sichuan Yongxiang Polysilicon Co., Ltd., Sichuan Yongxiang New Energy Co., Ltd., Inner Mongolia Tongwei High-Purity Crystalline Silicon Co., Ltd., and Yunnan Tongwei High-purity Crystalline Silicon Co., Ltd.

The eight LONGi subsidiaries involved are: Yinchuan LONGi Silicon Materials Co., Ltd., Ningxia LONGi Silicon Materials Co., Ltd., Lijiang LONGi Silicon Materials Co., Ltd., Huaping LONGi Silicon Materials Co., Ltd., Yinchuan LONGi Photovoltaic Technology Co., Ltd., Baoshan LONGi Silicon Materials Co., Ltd. Co., Ltd., Qujing LONGi Silicon Material Co., Ltd., Tengchong LONGi Silicon Material Co., Ltd., etc.

The two parties will negotiate the price of silicon material on a monthly basis according to market conditions and the pricing principles agreed in the contract. LONGi said that it is conducive to ensuring the long-term and stable supply of its polysilicon raw materials through the long-term order method of locking volume and not price, monthly negotiation and batch purchase.

The photovoltaic industry chain is roughly divided into four links: silicon material, silicon wafer, cell and module. LONGi is the world's largest silicon wafer and component supplier, while Tongwei is the world's largest supplier of silicon materials and batteries.

In September 2020, LONGi Co., Ltd. and Tongwei Co., Ltd. signed a number of strategic cooperation agreements, and reached a cooperation intention to establish a long-term and stable polysilicon supply and demand relationship.

Data shows that by the end of 2021, Tongwei has a polysilicon production capacity of 180,000 tons per year. Based on this calculation, about half of Tongwei's polysilicon will be sold to LONGi in the next two years.

It is understood that the cost of polysilicon is about 50,000/ton. After the third quarter of last year, the price of industrial silicon rose, and the cost rose to about 60,000/ton. Since the beginning of the year, the photovoltaic industry has been "not weak in the off-season", and the price of polysilicon has remained high, still maintaining a level of more than 240,000 yuan / ton.

From January to February 2022, Tongwei has achieved revenue of about 16 billion yuan, a year-on-year increase of about 130%; net profit attributable to shareholders of listed companies is about 3.3 billion yuan, a year-on-year increase of about 650%.

In addition to Tongwei, LONGi has many other silicon material suppliers.

According to LONGi's 2021 semi-annual report, the company has five silicon material procurement contracts under execution, with the signatories being Daqo Energy, Xinte Energy, Asia Silicon, OCIM Sdn. Bhd., and Jiangsu Zhongneng Silicon.

The silicon wafers produced by LONGi were also sold to Tongwei. A total of five long-term silicon wafer sales contracts are being executed by LONGi, including Tongwei Solar, a battery company under Tongwei.

In June 2021, LONGi stated on the investor interaction platform that by the end of 2021, its annual production capacity of monocrystalline silicon wafers will reach 105 GW, the annual production capacity of monocrystalline cells will reach 38 GW, and the production capacity of monocrystalline modules will reach 65 GW.

In the first three quarters of 2021, LONGi's revenue reached 56.206 billion yuan, a year-on-year increase of 66.13%; its net profit was 7.556 billion yuan, a year-on-year increase of 18.87%.

As of the close on March 21, LONGi shares rose 2.37% to close at 82.59 yuan per share, with a total market value of 447.06 billion yuan; Tongwei shares rose 1.08% to close at 44.78 yuan per share, with a total market value of 201.58 billion yuan. Editor/Sang Xiaomei

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~