- On one hand, there is the brutal reshuffle and value reconstruction of the domestic market in the "involution"

In 2025, the Chinese construction machinery industry will move forward amidst the dual changes of data recovery and survival pressure. The internal competition in the domestic market is intensifying, and overseas efforts have entered the deep water zone. The industry is experiencing the necessary pain from scale expansion to value reconstruction.

The domestic market presents a fragmented landscape: earthmoving machinery takes the lead in growth, road and concrete machinery follow suit and heat up, and construction cranes accelerate their recovery in the second half of the year. This wave of recovery is due to policy support and equipment updates - environmental pressure and subsidy policies have forced old equipment to exit, new infrastructure has brought a temporary demand pulse, and major manufacturers' operating cash flow has surged by more than 30% year-on-year.

However, the chill still lingers behind the data. Frontline car owners are facing a "scissors gap" between new car costs and second-hand car prices, resulting in meager incremental market profits. Agents are also the direct pressure layer of internal competition: OEMs continue to pressure goods for impulse, and the cost of capital devours profits. The price of small digging agents has dropped by 5 percentage points in a year, and the gross profit margin has been compressed from 15% to less than 8%. The extension of the user's payment cycle and the strict payment requirements of the host factory have formed a double squeeze, and some agents have withdrawn due to a broken capital chain.

The aftermarket should have been a lifesaver, but it faces multiple challenges: host manufacturers building their own e-commerce platforms to directly reach users, third-party low-priced accessories impacting the market, users preferring "acquaintance repairs", leaving agents in a dilemma of "losing market share in the front market and losing profits in the back market".

Faced with pressure, enterprise transformation has shifted from a "multiple-choice question" to a "survival question". OEMs are shifting towards technological differentiation and seeking value innovation in fields such as new energy and intelligence; Agents are exploring service innovation, and some top agents have achieved a revenue share of over 40% and a gross profit margin of over 10% through preventive services, operational leasing, and second-hand equipment business.

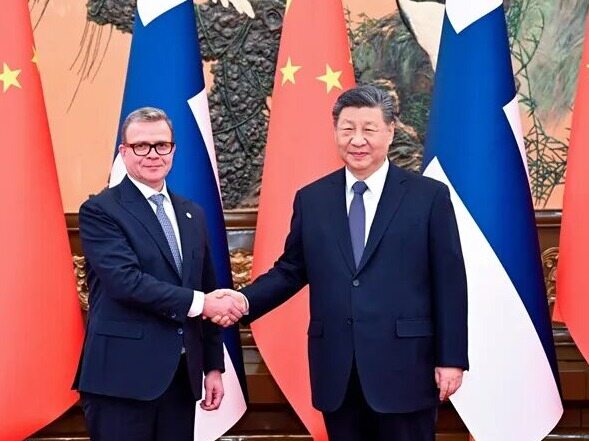

Overseas markets have become an important growth pole, with exports reaching 38.597 billion US dollars from January to August, a year-on-year increase of 11.4%. But the challenge of going global has escalated: the European and American markets are facing a "double reverse" investigation, Southeast Asian Japanese brands dominate the high-end market, and there is a shortage of after-sales parts in Africa. It is worth noting that overseas capabilities still rely on local support - the main brand's overseas service team training system originates from China, and product iteration relies on domestic construction site data. Leading enterprises generate over half of their overseas revenue, yet they keep 70% of their R&D investment in China.

The core trend of the industry landscape in 2025 is intensifying differentiation and moving towards reality. In the next 3-5 years, the market will accelerate its reshuffle: the share of top host manufacturers will continue to increase, and some small and medium-sized brands will withdraw; The penetration rate of electrification in fixed scenarios will exceed 50%, while intelligence focuses more on practical value; The profit model is transitioning to the aftermarket, and globalization is moving from "product exports" to "deep localization". The enlightenment of this transformation is very clear: only enterprises that hold the technological bottom line and polish their service capabilities in domestic refining can truly have the confidence to embark on a global expedition. Editor/Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~