- The steady growth of FPSO market marks a shift in the focus of offshore oil and gas exploration towards deepwater and ultra deepwater

- The fundamental significance of this round of FPSO demand driven by multi regional resonance lies in the dual path of improving economic efficiency through technological upgrades and locking in cash flow through long-term contracts

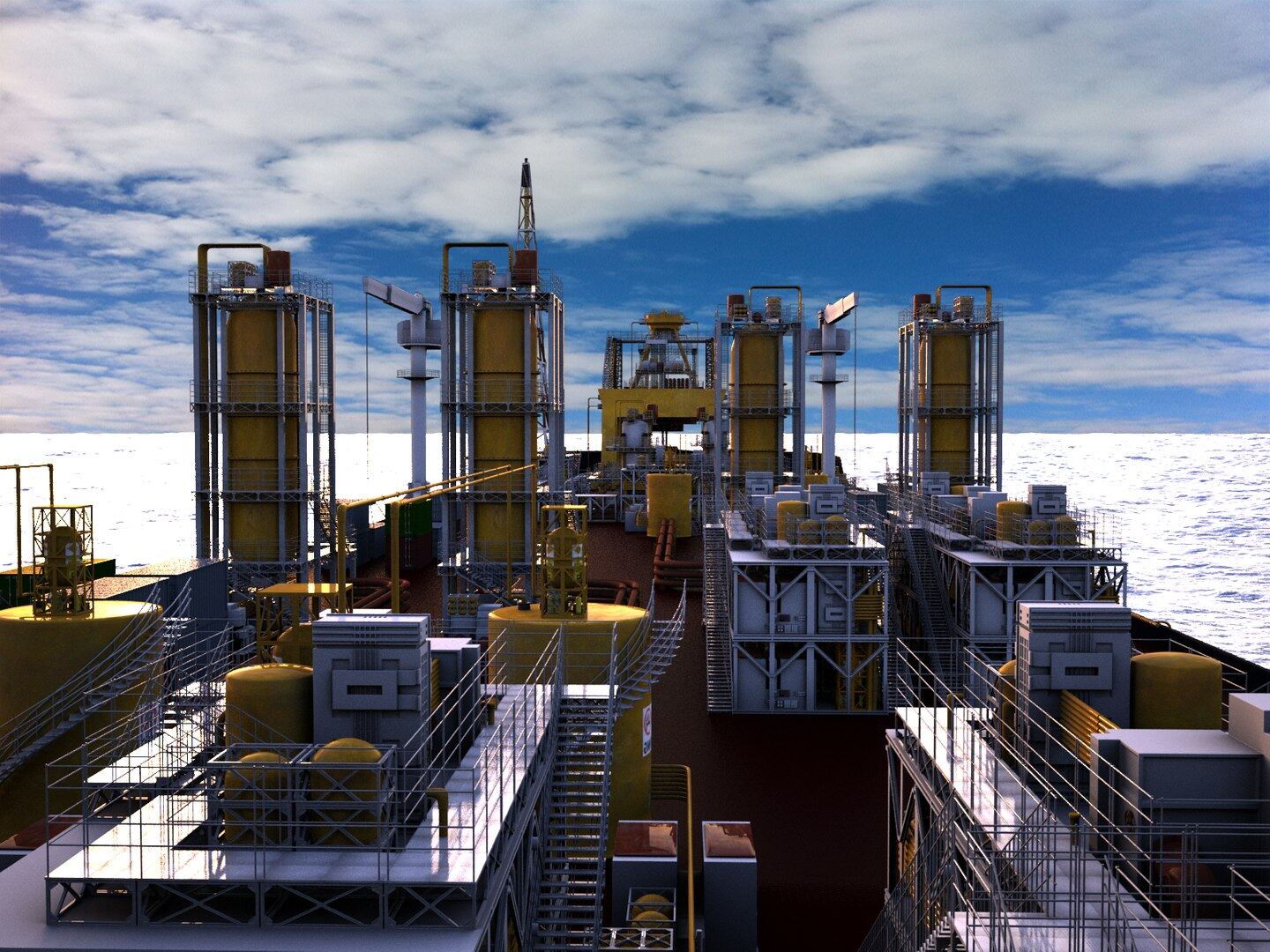

In the deep sea of over 2000 meters in the Santos Basin of Brazil, a 370 meter long giant ship is storing, processing, and transporting crude oil from the seabed to various parts of the world through pipelines. This is a microcosm of the rapid development of the global FPSO floating production, storage, and offloading industry.

The global FPSO market is steadily growing, expected to reach $8.47 billion by 2025 and expand to $14.86 billion by 2033, with a compound annual growth rate of approximately 7.28%. The core driving force behind this growth is the shift of the main battlefield of global energy development towards deep and ultra deep waters. More than 65% of newly built FPSO projects are concentrated in deepwater and ultra deepwater areas.

The key to breaking the deadlock in deep-sea development

Offshore oil extraction is facing unprecedented challenges: newly discovered oil and gas resources are getting farther and farther away from the coast, and the environment is becoming increasingly harsh. Traditional fixed platforms lose their economic viability in the deep sea, while FPSOs, with their mobility, integration, and reusability, have become the core equipment for unlocking deep-sea oil and gas treasures.

Technological upgrades are significantly expanding the application boundaries and economics of FPSOs. Modular design has successfully shortened the delivery cycle by 6 to 12 months, significantly improving capital efficiency. Even more revolutionary is the application of new generation power generation and emission reduction technologies, which can reduce the carbon emissions of FPSOs by 15-20%. This is not empty talk. The FPSO put into operation in the Mero oil field in Brazil is expected to reduce approximately 500000 tons of carbon dioxide emissions annually through 100% associated gas injection and zero conventional combustion design.

The changes brought about by digital technology are more intuitive. By deploying digital twin technology, the operational costs of FPSO can be reduced by 5-8%. These technologies not only improve efficiency, but also fundamentally change the cost model of deep-sea development, making marginal oil fields that were previously considered uneconomical valuable for development.

The demand pattern of a multipolar market

The market demand for FPSOs in this round exhibits distinct multipolar resonance characteristics, avoiding industry fluctuations caused by single market fluctuations.

Latin America, especially Brazil, is currently the undisputed market engine. This region holds over 40% of the world's newly added FPSO orders. Only Petrobras, the Brazilian national oil company, has over 16 FPSOs in clear scheduling by 2030.

Recently, giant sub salt oil fields such as Bacalhau and Mero in the Santos Basin of Brazil have been put into operation. The peak daily production of Bacalhau oil field can reach 220000 barrels, and the total production capacity of Mero oil field has reached 770000 barrels per day. These projects clearly demonstrate the sustained and intensive pace of FPSO demand in the region.

The West African market is significantly recovering, marked by the recovery of projects in Angola and the restart of Nigeria, coupled with world-class new discoveries such as Venus off the coast of Namibia. The next 3 to 5 years will be a critical period for FPSO deployment in the region.

At the same time, the Asia Pacific market maintains stable demand for modification and life extension projects. Although the project scale is generally medium-sized, the considerable quantity provides a solid foundation for the market.

The deterministic future of top enterprises

The sustained prosperity of the market is profoundly reshaping the competitive landscape of the FPSO industry, and a significant trend is that value and orders are accelerating towards top enterprises.

Currently, there are less than ten companies worldwide that truly possess FPSO full cycle capability. Among them, SBM Offshore, MODEC, BW Offshore, and Yinson, four companies, with their technological, capital, and operational advantages, occupy over 60% of the world's active and under construction project shares. This concentration has been confirmed financially. Industry giant SBM Offshore saw a year-on-year revenue growth of 26% in the first half of 2025, with a net cash order reserve of up to $9 billion, providing strong visibility into future revenue.

Business models are also evolving. In order to lock in long-term stable cash flow, more and more FPSO suppliers are signing leasing and operating contracts with oil companies for up to 20 years or even longer. For example, BW Offshore provides FPSO for the Barossa gas field in Australia, with an initial contract period of 15 years and the option to extend for another 10 years. This service-oriented operation model not only reduces the risk of upfront capital expenditures for energy companies, but also transforms FPSO providers from mere builders to long-term asset operators, achieving profit stability that transcends industry cycles.

The latest FPSO order from Petrobras, the ship's hull is being cut into steel plates in South Korea, and the design drawings of the upper modules are being simultaneously modified on engineers' computers in China and Singapore. Keywords: international news, energy news

When over 65% of the world's new oil and gas supply relies on the deep sea, the work scattered in shipyards, design companies, and laboratories around the world is quietly reshaping the geographical map of the world's energy supply through the massive system engineering of FPSO.Editor/Cheng Liting

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~