- This is not only a victory for the capital market, but also a key milestone in the process of China's localization of storage chips

From Beijing to Hong Kong, GigaDevice has opened a new chapter in international financing with its "A+H" dual platform layout. This IPO raised over HKD 4.6 billion, which will accelerate technology research and industrial expansion, help Chinese chips break overseas monopolies in core areas such as automobiles and the Internet of Things, and reshape the global supply chain landscape.

The Hong Kong Stock Exchange in winter, applause and chimes intertwined. At 9:30 am on January 15, 2026, the logo of domestic storage chip giant GigaDevice lit up prominently on the trading hall screen. As the opening bell rang, the stock price surged from the issue price of HKD 162, with a rapid increase of over 40%, and the total market value climbed to HKD 158 billion. In the crowd, an investor who has long been following the semiconductor industry exclaimed, "This is not only a leap in numbers, but also an explosion of confidence in China's chip industry

From 'invisible champion' to dual platform listing

GigaDevices did not emerge out of nowhere. Since its establishment in 2005, it has always focused on the fields of storage chips and microcontrollers, and was the first to list on the A-share market of the Shanghai Stock Exchange in 2016. As of 2024, the company's product line covers Flash, niche dynamic random access memory, microcontrollers, analog chips, and sensor chips, widely used in consumer electronics, automotive, IoT, and other scenarios. The solid technical foundation enables it to stand firm in the industry cycle fluctuations: from 2022 to 2024, the company's revenue reached 8.13 billion yuan, 5.761 billion yuan, and 7.356 billion yuan respectively, and the net profit remained at 1.103 billion yuan (2024) after adjusting from 2.053 billion yuan, highlighting its business resilience.

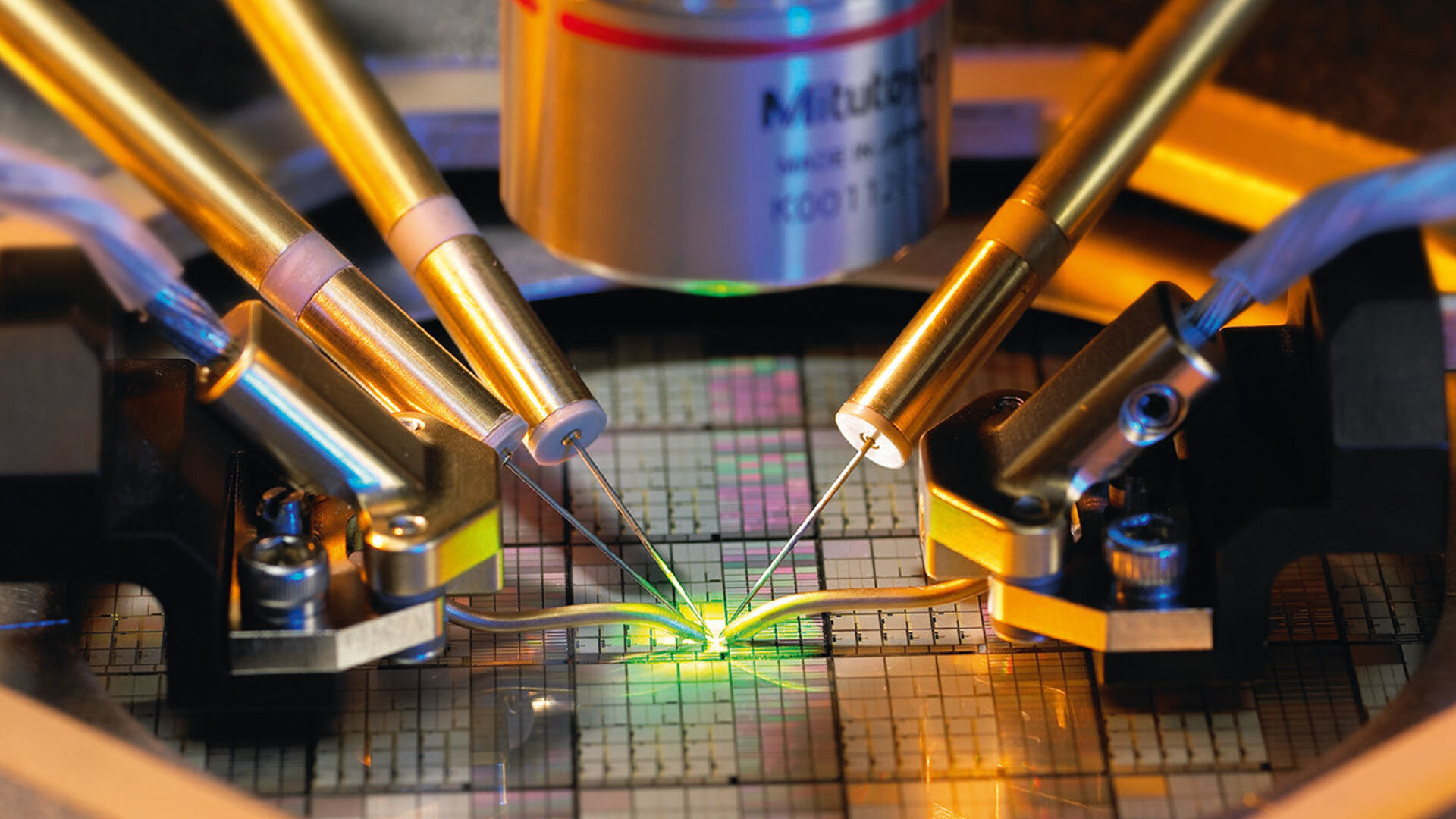

Dual drive of technology research and development and global layout

According to the listing announcement, the Hong Kong stock issuance is priced at HKD 162 per share, with a total of 28.9158 million shares issued and a net fundraising of approximately HKD 4.611 billion. The funds will mainly be used for advanced process chip research and development, overseas market expansion, and supply chain construction. Analysts pointed out that under the background of technology blockade in Europe and America, this financing has opened up an international capital channel for Chinese chip companies, and can also attract global investors and enhance brand influence through the Hong Kong platform.

The New Global Narrative of Chinese Chips

Currently, global semiconductor competition has risen to the level of national strategy. The listing of GigaDevice on the Hong Kong stock market is seen as a crucial step in the "internal and external linkage" of China's chip industry. The company's financial report shows that the revenue share of its products in high-end fields such as automotive electronics and industrial automation has been increasing year by year, and some storage chips have performance comparable to international giants. Industry experts evaluate: "The growth path of this enterprise is a microcosm of China's chip industry from replacing low-end to tackling high-end

With the listing of GigaDevice on the Hong Kong stock market, the layout of China's semiconductor industry's "dual capital market" has become a new model. Faced with technological games and market changes, this chip veteran with 20 years of deep cultivation is using capital as wings and technology as spears to write a new chapter in China's hard technology on the global stage. As stated in its promotional video for listing, "The direction of the chip, although far away, must be reachedEditor/Yang Meiling

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~