- This investment is not only an important step for the company to explore the overseas green infrastructure market

On the outskirts of the historic city of Bukhara in Uzbekistan, a vast expanse of land is about to witness a green transformation. On February 5, 2026, an environmental protection company from China announced a major investment to build a modern "waste to treasure" base here, using technology to solve environmental problems caused by urban development.

Project details and strategic layout

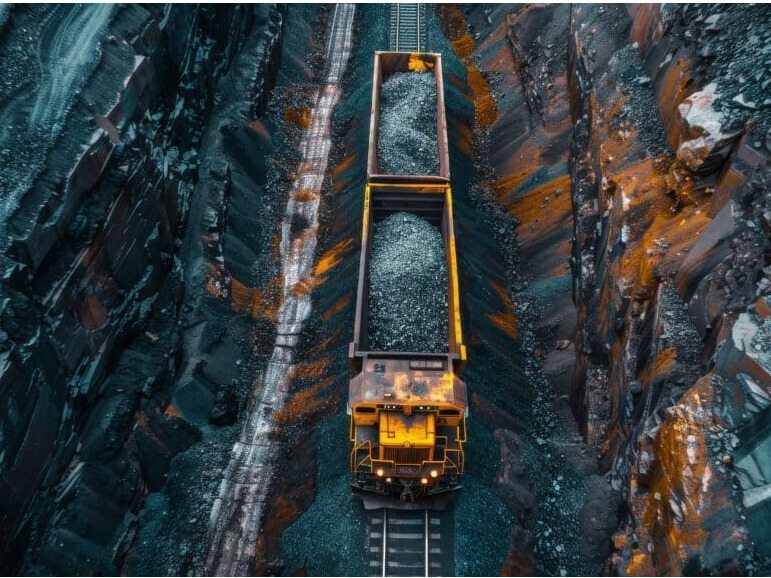

The project is invested and constructed by Wangneng Environment Co., Ltd., with a total investment of 1.2 billion yuan. It will build a new domestic waste incineration power plant with a daily processing capacity of 1500 tons in Bukhara Oblast, Uzbekistan, and provide supporting power generation facilities with an installed capacity of 50 megawatts. The project is implemented by Wangneng Uzi Environmental Protection Energy Co., Ltd., a wholly-owned subsidiary of Wangneng Environment, and has been approved by the company's board of directors. From a strategic perspective, this move is not only a practice for enterprises to respond to the initiative of jointly building the Silk Road Economic Belt, but also a key layout for them to actively explore emerging markets in Central Asia and find new growth points in the context of the saturation of the domestic market. Uzbekistan, as a populous country in Central Asia, is facing increasing pressure on garbage disposal and energy transformation in the process of urbanization, providing a broad market space for the implementation of this project.

Core agreement and revenue guarantee

The smooth implementation of the project relies on a 30-year garbage supply agreement signed with Uzbekistan government agencies. This agreement provides multiple guarantees for the core commercial terms: firstly, it clarifies the exclusive franchise rights for the project covering the regions of Bukhara and Navoi; Secondly, a dual income model has been established, which includes garbage disposal fees denominated in US dollars and guaranteed to be paid by the government budget, as well as electricity sales revenue implemented according to local unified standards; Thirdly, a price adjustment mechanism has been established to cope with cost fluctuations, as well as exchange rate loss compensation clauses for local currency depreciation; Fourthly, strict government payment breach liability has been established. These arrangements aim to establish a solid legal and financial foundation for long-term stable operation. Keywords: Interconnected News and Information, Interconnected News Network

Potential challenges and risk response

Despite the broad prospects, the project still needs to carefully address multiple challenges. Firstly, there may be uncertainties brought about by geopolitics and international relations. Secondly, there is financial pressure, as the 1.2 billion yuan investment relies on about 70% of external financing, which poses a challenge to the company's cash flow management. Once again, there may be fluctuations in the fiscal payment capacity and foreign exchange control risks of the operating country, despite the relevant hedging clauses in the agreement. Finally, the construction period control, technological adaptability, and long-term market demand changes in cross-border projects are all aspects that require fine management. However, the provision of a minimum supply of garbage in the agreement, the expected profitability of the project over similar domestic projects, and the current close cooperation between China and Ukraine provide a certain buffer to hedge the above risks.Editor/Gao Xue

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~