- Saudi Arabia's 8.7 billion infrastructure order has landed, and Chinese enterprises have ushered in the opportunity of the 2030 vision

Saudi local contractor Almabani won two major road projects worth 8.7 billion Saudi riyals (about US$2.3 billion) on August 15, setting a new record for the amount of bids won by local Saudi companies. The two benchmark projects, the King Abdullah Financial District (KAFD) project and the Tomamama Road project, are not only huge, but also achieve technological breakthroughs: the former uses new composite materials to cope with extreme desert temperature differences, and the latter introduces the first 5G intelligent traffic management system in the Middle East, both of which strictly follow Saudi Arabia's latest "green building" standards.

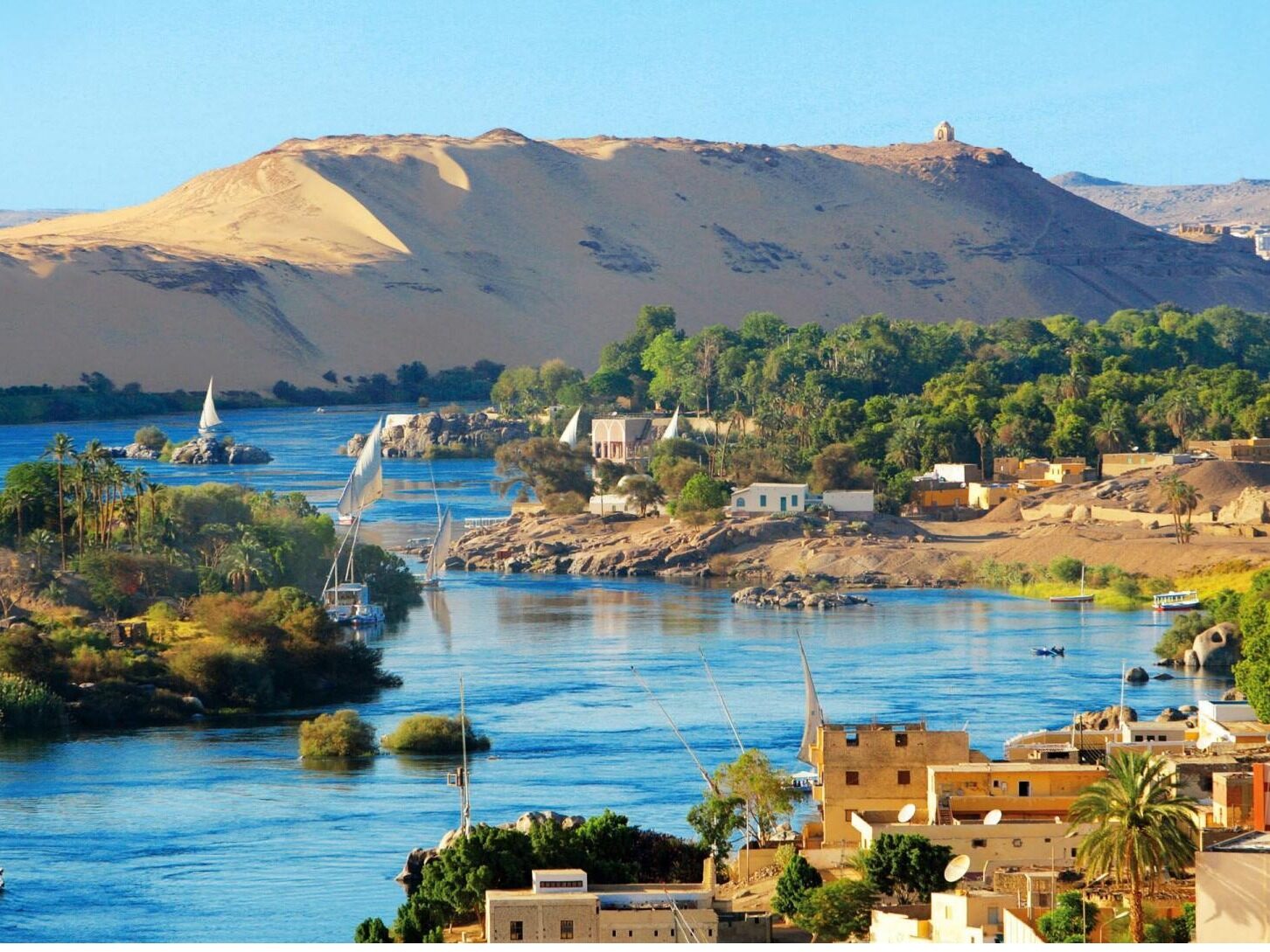

This infrastructure boom stems from the in-depth promotion of Saudi Arabia's "Vision 2030". To diversify its economy, Saudi Arabia plans to double Riyadh's population over the next six years and invest more than $500 billion in six super projects. As Expo 2030 and the 2034 World Cup approach, Saudi Arabia's demand for smart, green, and sustainable infrastructure has surged.

Chinese companies are ushering in unprecedented opportunities in the Saudi market. At present, more than 20 Chinese enterprises have set up branches in Saudi Arabia, with a cumulative project amount of more than US$30 billion. In Almabani's winning project, key components such as bridge bearings and smart sensors made in China have been applied. What is more noteworthy is that Saudi Arabia's "Localization Rate Improvement Plan" requires the localization rate of government projects to reach 60% by 2030, providing policy guarantees for Chinese enterprises to participate in in-depth cooperation through technical cooperation and joint ventures.

However, if Chinese companies want to truly share this pie, they still need to break through the triple barrier: adapting to the strict technical specifications that integrate European and American standards with Islamic culture, solving localized employment requirements, and transforming from an "engineering contractor" to an "urban solution provider". Experts suggest that Chinese companies can focus on breakthroughs in intelligent transportation systems, green building technology and modular construction technology, especially in the field of "photovoltaic infrastructure" comprehensive projects.

At present, the annual size of the Saudi building materials market has reached US$74.1 billion and is expected to exceed US$1.3 trillion by 2030. China Building Materials, China Railway Construction and other enterprises have actively deployed through exhibitions. With the start of the "golden decade" of Saudi Arabia's construction industry, enterprises that can combine China's new infrastructure experience with Saudi Arabia's local demand innovation are expected to occupy a dominant position in this round of infrastructure boom. (This article is from the official website of Jiandao www.seetao.com it must not be reproduced without permission, otherwise it must be investigated, please indicate the original link of Jiandao.com for reprinting) See the Middle East column editor/Gao Xue of Dao.com

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~