- The research report predicts that the regional capacity will grow at an average annual rate of 9.7% from 2025 to 2028

- Thailand received over 7.7 billion US dollars in investment in the fourth quarter of 2024 and the first quarter of 2025

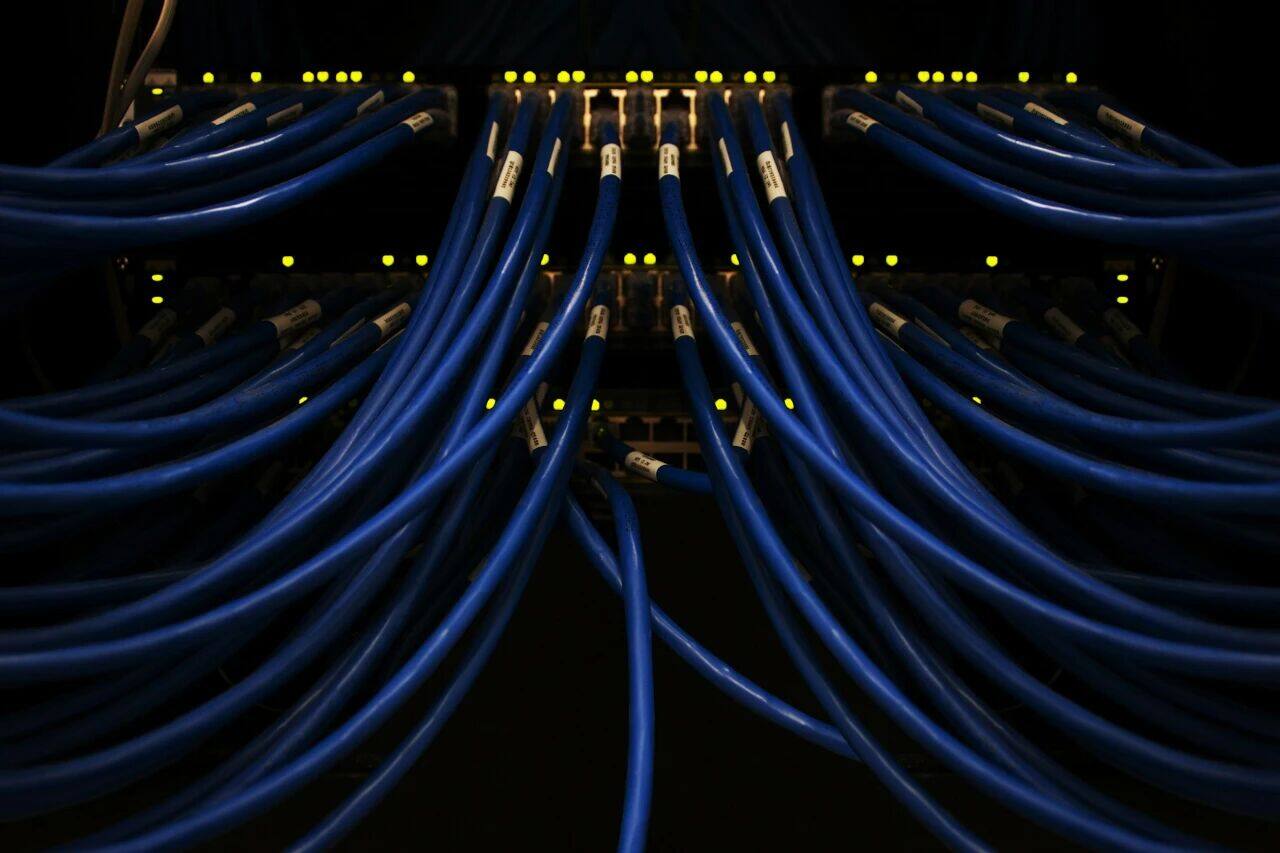

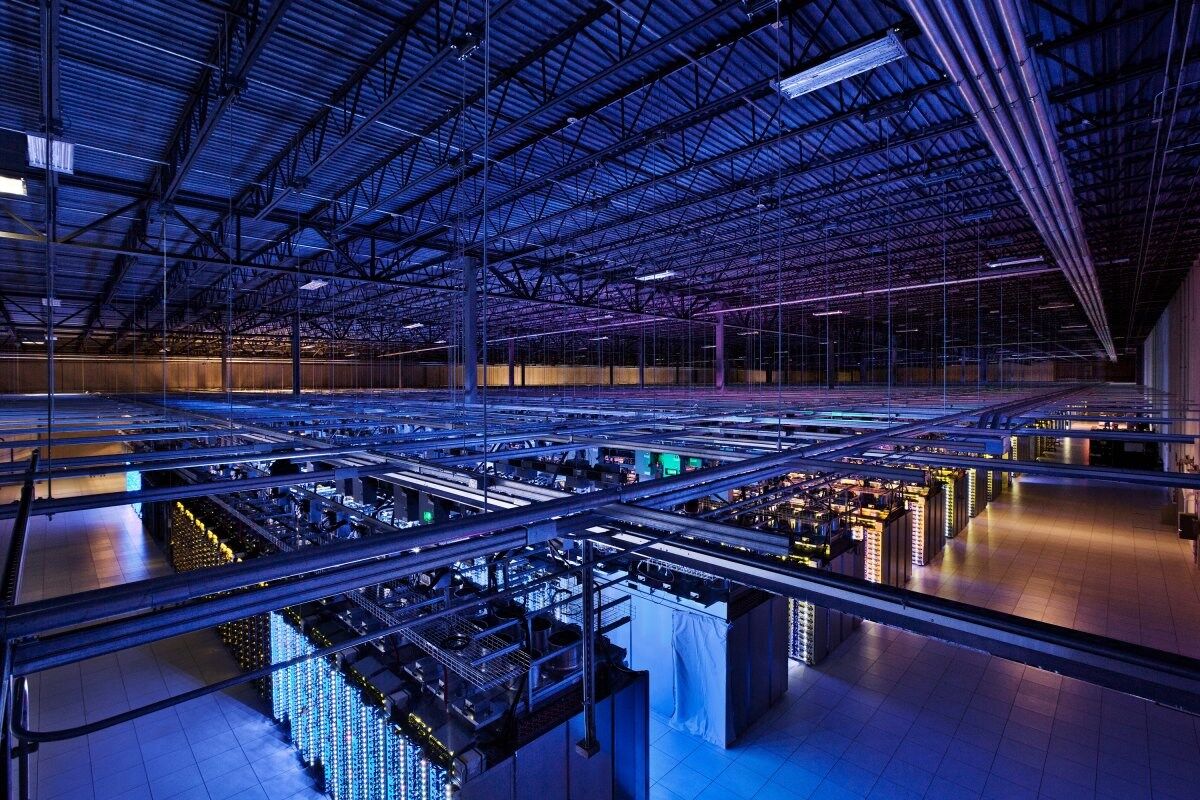

Under the global wave of digital transformation, data centers, as a key infrastructure of the digital economy, are profoundly reshaping the economic geography of the Asia Pacific region. Recently, the authoritative market research firm BMI released a report stating that due to Singapore's continued tightening of land, electricity, and approval policies, the Asia Pacific data center market is undergoing a significant "regional rebalancing". From 2025 to 2028, it is expected that the total regional capacity will grow at an average annual rate of 9.7%, and the main driving force for growth is shifting from traditional core markets to emerging hotspots such as Malaysia, Indonesia, and India. A new competition around power resources, construction costs, and policy stability has begun.

According to the report analysis, the direct trigger for this round of industrial transfer is the contraction of Singapore's supply side. The extended approval cycle, scarce land resources, and high operating costs have forced many companies to turn their attention to the surrounding areas. At the same time, the competitiveness of the US market has weakened due to soaring electricity prices and high power supply costs, further prompting capital to accelerate its flow to Asian markets that have more advantages in clean energy access and overall costs. In this context, Johor and Batam have quickly become "outposts" to absorb Singapore's demand overflow due to their geographical proximity and cost advantages.

Growth engine shifts towards emerging markets

Malaysia, Indonesia, and India are becoming the core engines driving this round of growth. Malaysia's construction speed is particularly rapid, with its data centers contributing nearly 20% of the country's new electricity consumption in 2024. It is expected that by 2025-2026, with new projects connected to the grid, this proportion may soar to 70% -90%. Indonesia relies on its rapidly expanding power generation capacity to attract investment, but the lagging transmission network poses a major challenge.

India's performance is considered relatively stable. The report predicts that in the next five years, its newly added data center load is expected to account for less than 10% of the renewable energy increment, and there is ample space for power supply. The flexible electricity procurement model (such as self built renewable energy projects) and continuous grid reform make it an important market with long-term certainty.

Capital influx and emergence of investment hotspots

Industrial transfer directly triggers large-scale capital flows. The Eastern Economic Corridor of Thailand has become one of the most anticipated investment hotspots. Data shows that in the fourth quarter of 2024 alone, GDS, DAMAC Proen, and Google invested $2.96 billion in this area; Then in the first quarter of 2025, GDS and ByteDance added an additional investment of 4.76 billion dollars.

In addition, the Philippines has gained significant attention due to its young population structure, rapidly growing data consumption, and superior location of submarine cable nodes. The recent policy of increasing data center electricity prices in Malaysia has objectively driven some demand to shift to other regions with better costs.

Core challenges focus on the power grid and green electricity

No matter how the market shifts, grid capacity and green power supply have become the most critical bottlenecks faced by all participants. The report points out that the expansion cycle of transmission networks in most countries is as long as five to ten years, far slower than solar power plants that can be built within a year. This "rhythm mismatch" seriously restricts the rapid landing of data centers.

This contradiction is particularly prominent in Malaysia and Indonesia. The growth rate of data center demand in both countries is nearly four times that of their renewable energy growth, and there is enormous pressure to obtain stable and sufficient clean electricity. Therefore, the competition in the future market will essentially be a competition of efficiency and determination among countries in accelerating the deployment of renewable energy and upgrading power grid infrastructure. Keywords: International News and Information, International News Network

The map of the Asia Pacific data center market is rapidly restructuring due to policy tightening in Singapore and global capital flows. From Malaysia's rapid rise to Thailand's huge investment, from Indonesia's potential and challenges to India's steady advantages, the new round of industrial layout has become clear. The key to determining future success or failure will no longer be simply geographical location or initial costs, but whether a stable, green, and efficient energy supply system can be built. In this competition called 'electricity', whoever can take the lead in upgrading the power grid and releasing clean energy will win the cornerstone of the next generation of digital economy. Editor/Yang Beihua

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~