- Chinese modified plastics giant Jinfa Technology quickly enters the high barrier track of PEEK and carbon fiber composite materials

Below a video showcasing the flexible finger movements of Tesla's latest humanoid robot Optimus Gen2, a hot topic comment is frequently mentioned: "What is the secret to successfully losing 10 kilograms?" The answer is hidden in a magical material called polyetheretherketone (PEEK), which has a density of only 58% of aluminum alloy but a strength eight times that of it. Now, the "lightweight battle" that concerns the future form and performance of robots has welcomed heavyweight Chinese participants: Jinfa Technology, a leading chemical materials company with a market value of tens of billions, is betting its future on the technological high ground of PEEK and its composite materials.

From flame retardant household appliances to robot joints

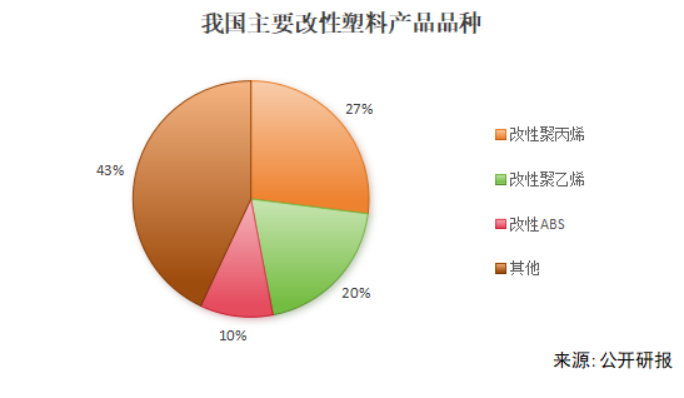

The story does not begin with humanoid robots. The starting point of Jinfa Technology was the application of flame retardant materials to household appliances more than 30 years ago. Subsequently, it keenly grasped the trend of lightweighting in automobiles by replacing steel with plastic, and accumulated core "formula driven" capabilities by deeply customizing modified plastics for different customers.

The so-called modification refers to the special processing of ordinary plastics to give them stronger hardness, corrosion resistance and other characteristics. This may sound simple, but it requires extremely high R&D investment and a long customer verification cycle. From 2020 to 2024, the R&D expenses of Jinfa Technology increased from 1.44 billion yuan to 2.49 billion yuan, and all expenses were expensed, demonstrating its determination to invest in technology.

It is this profound modification technology that has become the springboard for its entry into the top of the pyramid PEEK material. The company has successfully transferred its modification technology to the field of special engineering plastics such as PEEK and LCP, and developed ultra temperature resistant and wear-resistant materials to solve the long-term usability problems of key robot components, which have been applied in the industry.

It is worth mentioning that Jinfa Technology modified PEEK with carbon fiber, which increased the mechanical strength of the material by 50% and more than doubled the thermal performance, achieving a strengthening effect of "1+1>2". This has made it stand out among over 3000 domestic modified plastic manufacturers, building a high product premium barrier. In the past five years, the gross profit margin of its modified plastic business has remained stable at around 20%, leading its peers.

The Pain and Vision of Upward Mergers and Acquisitions

However, to support the ambition of cutting-edge materials, technology alone is not enough. The main raw materials for modified plastics come from petrochemical products. Faced with upstream price fluctuations, Jinfa Technology has chosen a more challenging but fundamental path: integrating upstream.

With the clearance of global chemical production capacity, the advantages of integration are beginning to emerge. In 2024, the company's revenue exceeded 60 billion yuan, and the gross profit margin of its green petrochemical business significantly rebounded. In the first three quarters of 2025, revenue and net profit saw significant year-on-year growth, surpassing peers. The synergistic effect of "pipeline direct supply" is laying a solid cost and supply foundation for its material empire.

Future challenges under economies of scale

With the support of technology and industrial chain, scale becomes the key to releasing benefits. As of the end of 2024, Jinfa Technology's annual production capacity has reached 3.72 million tons, ranking among the top in the world. At present, it still has over 500000 tons of production capacity under construction both domestically and internationally. This expansion is not blind, but a "companion style overseas" that closely follows the globalization pace of downstream customers. In the first half of 2025, its products will grow rapidly in the European and American markets, and its production capacity will be operating at near full capacity.

But expansion also means burden. From 2020 to the third quarter of 2025, the company's asset liability ratio climbed from 53.73% to 66.32%, with high interest expenses eroding profits. This requires Jinfa Technology to quickly and efficiently operate its new production capacity, unleashing economies of scale.

Creating a world brand, building a century old golden hair. "Golden Hair Technology, which has entered its thirties, is trying to expand new growth poles such as AI robots and servers by betting on cutting-edge materials like PEEK, and combining vertical integration layout to smooth out the fluctuations of strong cyclical industries. Keywords: New Infrastructure News

This road is full of technological challenges, capital pressures, and cyclical tests, but it is also the only way for China's materials industry to move from following to running parallel, and even to achieve leadership in certain fields. The 'weight loss revolution' of humanoid robots may just be the beginning of this story.Editor/Yang Meiling

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~