- Incorporate housing construction into the core agenda of national development

As the world's largest oil exporter, Saudi Arabia is accelerating its economic diversification transformation driven by "Vision 2030," with housing and urban construction serving as a strategic core component. Under the combined influence of population growth, urbanization advancement, and policy stimuli, Saudi Arabia's housing market is undergoing unprecedented changes and holds enormous development potential.

Multidimensional Drivers of Surging Housing Demand

In recent years, housing demand in Saudi Arabia has experienced explosive growth. Riyadh, the capital and core development engine, needs to add approximately 130,000 new housing units annually to alleviate supply-demand contradictions. This pressure stems from three core drivers:

Sustained Population Expansion: The national population has exceeded 37 million, with an annual growth rate of 1.8%—far higher than the global average. This demographic dividend has translated into rigid residential demand.

Accelerated Urbanization: Younger generations are congregating in cities, driving diverse demands for modern apartments, rental housing, and particularly strong purchase demand from newly married families establishing households.

Policy Activation: The "Home Ownership Program" has effectively stimulated the market, pushing the home ownership rate from 46% in 2016 to 63.7% by the end of 2024, with significant growth potential remaining.

Government Strategic Planning and Implementation Pathways

Clear Quantitative Goals

The Saudi government has set a strategic target of achieving a national home ownership rate exceeding 70% by 2030, incorporating housing construction into the core agenda of national development. Through the implementation of a series of large-scale housing projects, it aims to systematically address the housing shortage.

Financial System Innovation

In mortgage reform, the government has led the development of flexible and affordable financial products, collaborating with banks and other financial institutions to introduce long-term low-interest loans. These measures lower the threshold for home purchases, enhance residents' purchasing power, and build an inclusive housing finance system.

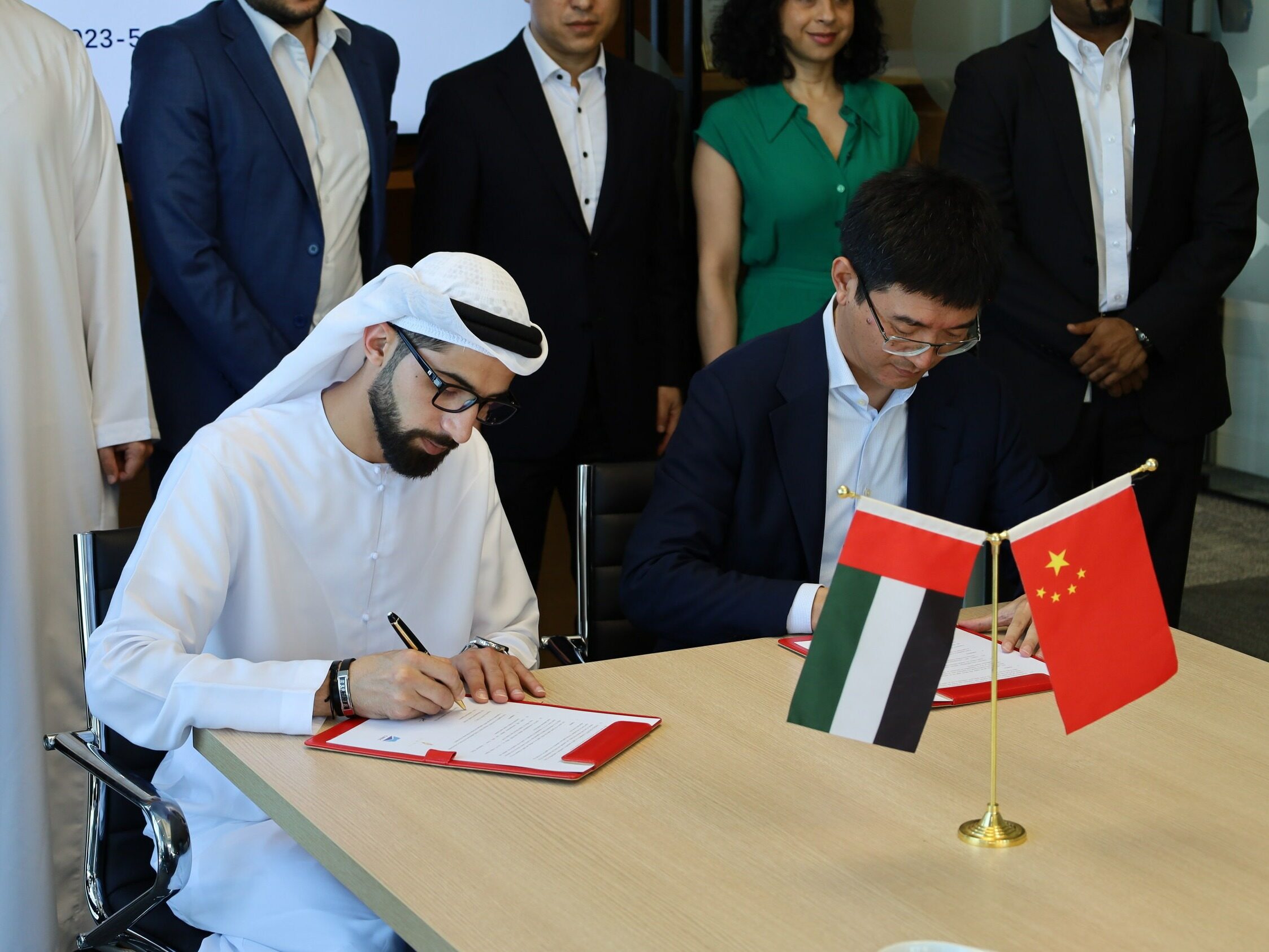

Attracting International Capital

Relying on international real estate exhibitions such as Cityscape Global, Saudi Arabia fully demonstrates the potential of its housing market to global investors. Meanwhile, through policy combinations such as streamlining foreign investment procedures, providing tax incentives, and facilitating land use rights, it attracts deep participation of international capital in housing construction.

Innovation in Public-Private Partnership (PPP) Models

The country actively promotes the PPP model, integrating government resource advantages with private-sector operational efficiency. It establishes deep cooperative relationships with real estate developers, construction enterprises, and investment funds to achieve optimized resource allocation and drive the efficient implementation of housing projects.

Within the strategic framework of "Vision 2030," Saudi Arabia's housing market is undergoing a historic transition from traditional dependence to diversified development. Through multi-dimensional efforts in government top-level design, financial innovation, international cooperation, and model reform, Saudi Arabia not only aims to solve the current housing shortage but also focuses on building a sustainable urban development system, injecting new momentum into its economic transformation.(This article is from the official website of Seetao.com, www.seetao.com. No reprinting is allowed without permission. Otherwise, legal liability will be pursued. If reprinting, please indicate Seetao.com + the original text link.) Editor of the Strategic Column of Seetao.com / Yin Shiqian

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~