- Chinese companies have participated in 20 overseas waste incineration projects as investors or winning bidders, with a total investment

- In 2025, Chinese companies will win multiple major projects in the overseas waste incineration market, with a maximum investment of 500 million

The dream of a future 'waste free city' worth $1 billion is attracting global environmental companies to compete fiercely on the shores of the Gulf of Oman. Among the 18 international consortia that have submitted pre qualification applications, Chinese companies are particularly prominent - occupying 10 seats. This cross-border competition is a vivid reflection of China's environmental protection companies accelerating their overseas expansion and competing for the global waste incineration market in 2025.

According to publicly available industry data, by 2025, Chinese environmental protection companies are expanding their overseas presence with unprecedented efforts. As of now, there have been 20 overseas waste incineration power generation projects participated in as the winning bidder or investor, covering 11 countries around the world, with an estimated total investment of over 3 billion US dollars and a total processing capacity of over 29000 tons per day. From Indonesia in Southeast Asia to Uzbekistan in Central Asia, from Iraq in the Middle East to Ethiopia in Africa, Chinese technology, equipment, and management models with Chinese characteristics are deeply integrated into the new wave of global green infrastructure construction, injecting green momentum into the sustainable development of jointly built countries.

Central Asia becomes a hot spot for investment

Among numerous overseas regional markets, Central Asian countries, especially Uzbekistan, have become prominent highlights in 2025. According to statistics, the country has confirmed six intentions to cooperate with Chinese enterprises on waste incineration power generation projects this year, among which projects in Fergana and Samarkand have officially signed contracts and started construction. This investment boom is closely related to Uzbekistan's policy orientation - in March 2025, the country's president signed a special presidential decree to launch the construction plan of eight waste incineration power plants nationwide, and officially designated 2025 as the "Year of Environmental Protection and Green Economy". The plan is to use waste to electricity technology to become the first country in Central Asia to promote large-scale waste to energy conversion.

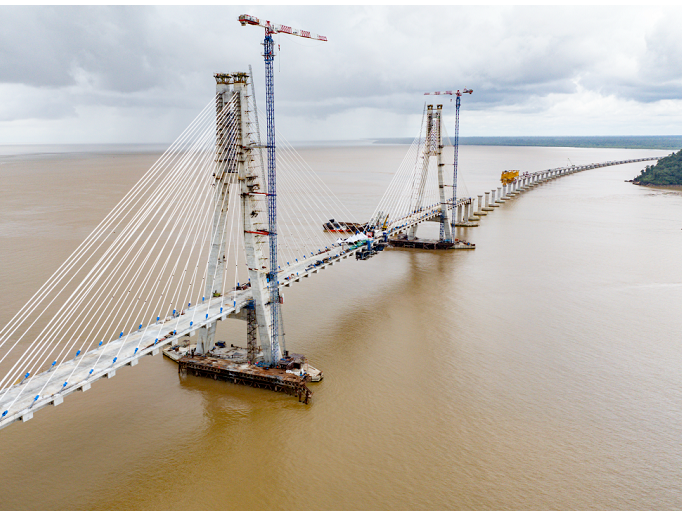

At the corporate level, several leading Chinese environmental protection companies have shown impressive performance. Everbright Environment has successfully landed projects such as Fergana and Namangan in Uzbekistan, achieving the first investment breakthrough in the Central Asian market; Junxin Group has won the Almaty solid waste disposal power generation project in Kazakhstan and successfully expanded multiple projects in the Kyrgyz Republic; Kangheng Environment will usher in a harvest year for overseas markets in 2025, not only starting two projects simultaneously in Uzbekistan, but also successfully winning the bid for the iconic 3000 ton/day project in Baghdad, the capital of Iraq, opening a new chapter in the Middle East market. These strategic layouts demonstrate the forward-looking vision and strong execution ability of Chinese environmental protection enterprises in emerging markets.

The global market center of gravity is quietly shifting

In depth analysis of these overseas projects reveals two significant features worth paying attention to. Firstly, the processing scale of individual projects is generally large, mostly above 1000 tons per day, which is in sharp contrast to the current situation of project scale contraction in the Chinese domestic market. Secondly, the investment per ton of projects is generally high, for example, the investment per ton of the Baghdad project in Iraq reached about 160000 US dollars, and the Almaty project in Kazakhstan reached about 140000 US dollars, both significantly exceeding the investment level of similar advanced projects in China.

More noteworthy is the structural shift of the global market center of gravity. According to statistics from professional organizations in the environmental protection industry, the number of projects in Southeast Asia reached a peak of 15 in 2024 and will significantly decline to 4 in 2025; At the same time, the number of projects from emerging regions such as Central Asia and Africa has significantly increased. This change indicates that, with the large-scale planning projects in Southeast Asian countries such as Vietnam and Indonesia being completed and put into operation in the next three to five years, the regional market may gradually become saturated, while the "the Belt and Road" countries such as Central Asia and Africa are becoming the new focus for Chinese environmental protection enterprises to explore overseas markets.

Chinese enterprises steadily move forward in the wind and waves

Chinese environmental protection enterprises collectively set sail to the sea, which is not only a reflection of the increasing recognition of China's solid waste treatment industry chain solutions by the international community, but also a strategic choice for domestic enterprises to actively explore growth space in the new market environment. Data shows that the number of Chinese listed environmental protection companies with overseas business revenue accounting for more than 10% has increased from 2-3 a few years ago to over 10 now, and internationalization has become an important development path for industry leaders. Keywords: Engineering Information Platform, Construction News

However, the path of expanding into overseas markets is full of challenges. The differences in environmental policies and emission standards among countries, the imperfect garbage collection and transportation system in the project location, the strict requirements of international technical standards, and various obstacles in cross-cultural management all pose higher and more complex comprehensive requirements for Chinese overseas enterprises than the domestic market. This green journey to the world is not only filled with the ambition to explore new markets, but also tests the wisdom and resilience of enterprises in solving problems in complex environments. In the overseas market where opportunities and risks coexist, Chinese environmental protection companies are exploring a sustainable development path that meets international standards and has Chinese characteristics. Editor/Yang Beihua

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~