- Saudi Arabia launches $57.9 billion loan plan for 2026 and detailed plans for the four major special economic zones simultaneously

What will happen when the oil kingdom decides to break free from its dependence on 'black gold'? Saudi Arabia has recently provided a clear answer: borrowing and financing on one hand, and attracting investment on the other hand. The 2026 loan plan, with a total amount of 57.9 billion US dollars, is synchronized with four tailored special economic zone plans, forming the most realistic "dual wheel drive" for Saudi Arabia to promote its "2030 Vision". This combination of "money" and "land" is not only a shot in the arm for its grand transformation goals, but also a clear invitation to global capital, marking that Saudi Arabia's future is no longer solely reliant on underground oil fields, but will be built on emerging industries and open investments.

Strategic Financing for the Future of Blood Transfusion

Faced with the huge capital demand brought about by large-scale infrastructure and the cultivation of emerging industries, Saudi Arabia has not solely relied on the volatile oil revenue. The core purpose of the $57.9 billion loan plan approved by the Ministry of Finance is to provide stable and predictable funding for transformation. This funding will mainly be used to cover budget deficits and repay maturing debts, and its deeper significance lies in sending a key signal to the international market: Saudi Arabia has a firm will for economic diversification reform, professional financial management capabilities, and its development path will not be shaken by short-term fluctuations in oil prices. Proactively utilizing the international capital market for long-term financing reflects Saudi Arabia's strategic shift from relying on natural resources to actively planning for the future, providing a solid financial foundation for its transition period.

Industrial carriers with mismatched development

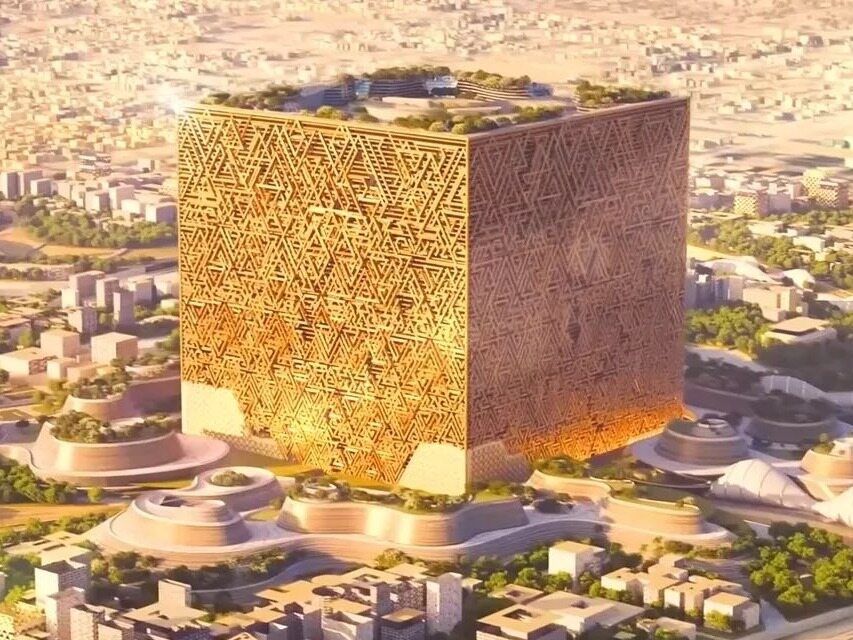

Accompanying the financing plan are four special economic zones with clear positioning and distinct characteristics. This is not a simple policy replication, but a precise industrial layout based on geography and resource endowment: Jizan Special Zone relies on the Red Sea Gateway, focusing on logistics, manufacturing, and food processing; The Rasheilt district is adjacent to Jordan and focuses on mining and heavy industry; King Abdullah Economic City is positioned as high-end, developing finance, technology, and modern service industries; Jeddah Special Zone will upgrade its traditional port advantages and strengthen its international trade and logistics functions. To attract global investors, these special zones have launched highly competitive "policy packages", including 20-year corporate income tax reductions, simplified administrative approval processes, relaxed restrictions on foreign shareholding, and preferential import and export tariffs. The core logic is to minimize the operating costs of enterprises and build Saudi Arabia into a new highland on the global value chain. Keywords: Middle East Latest News, Middle East News Latest News

Opportunities in China under the Combination of Reality and Reality

The dual measures of "borrowing+special zones" in Saudi Arabia reflect a multi-level and systematic transformation strategy. It achieves a combination of virtual and real (national capital leverages infrastructure, special zones attract private investment), a balance between long and short (borrowing to meet current funding needs, special zones cultivate long-term industrial competitiveness), and risk diversification (financing and industrial diversification). This change has opened up unprecedented blue oceans for global investors, especially Chinese companies. In the field of infrastructure, the demand for new cities, transportation, and energy projects under the "2030 Vision" has surged, which is highly compatible with the construction capabilities of Chinese enterprises. At the industrial level, the key development areas of the special zone, such as manufacturing, logistics, and digital economy, are also advantageous directions for Chinese enterprises to go global. More importantly, China's "the Belt and Road" initiative is closely linked with Saudi Arabia's "Vision 2030" strategy. China Saudi Arabia cooperation is moving from energy trade to deep collaboration in the whole industry chain, which has brought huge win-win space for both sides. (This article is from the official website of Jian Dao www.seetao.com. Reproduction without permission is prohibited, otherwise it will be prosecuted. Please indicate Jian Dao website+original link when reprinting.) Jian Dao website Middle East column editor/Gao Xue

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~