- CR Power Continues to Advance its Strategic Goal of Adding 10GW of Clean Energy Capacity Annually

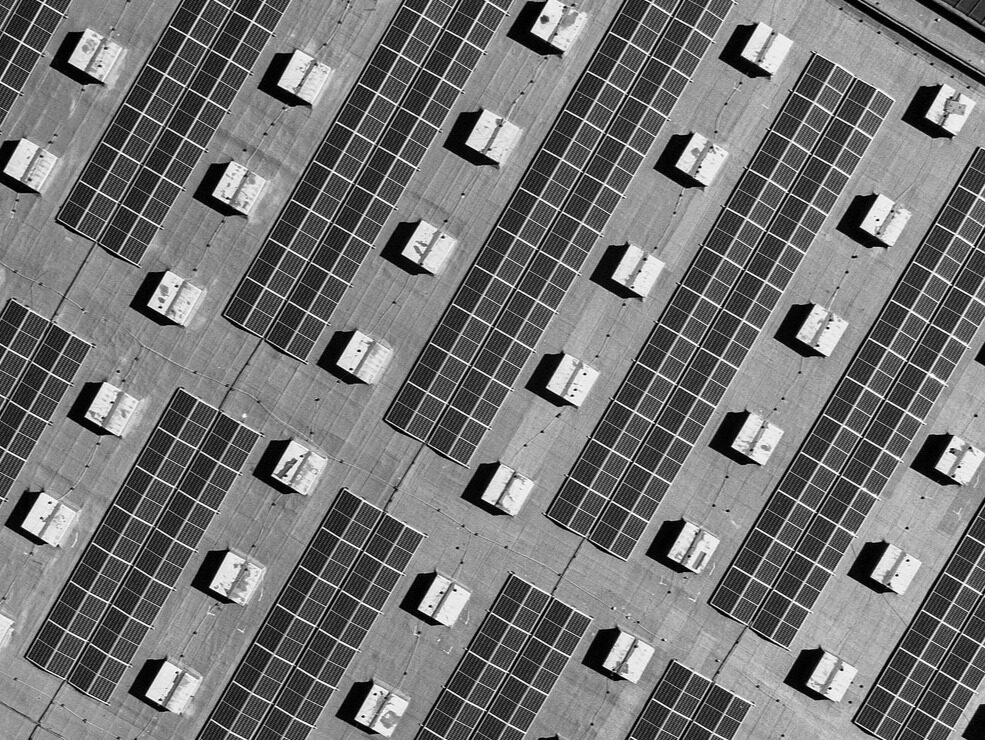

Driven by the dual goals of "Dual Carbon" targets and industry cost reduction and efficiency improvement, CR Power's new energy layout has taken another key step. Recently, the CR Power Sichuan Company's 200MW Kala Photovoltaic Project in Muli, Liangshan, officially commenced construction. Located in Kala Township, Muli County, Liangshan Prefecture, Sichuan Province, the project site has an altitude of 3,850 to 4,500 meters and is a key new energy construction project in Sichuan Province for 2025.

The project has a total investment of 8.With an investment of 400 million yuan, the project plans to construct 62 photovoltaic power generation arrays, install 381,368 620Wp monocrystalline silicon modules, equip 679 300kW string inverters and 62 box-type substations, and simultaneously deploy 20MW/40MWh energy storage system to enhance grid stability. The total construction period for the project is 614 days, with full completion planned for early 2027.

It is estimated that after the project is put into operation, the average annual power generation will be approximately 361 million kWh, equivalent to saving 112,400 tons of standard coal and reducing carbon dioxide emissions by 27.610,000 tons, which is of dual significance for optimizing Sichuan's energy structure and protecting the high-altitude ecological environment.

It is understood that China Resources Power, as the core energy platform of China Resources Group, has been accelerating its transition to clean energy in recent years.

According to the "China Resources Group 2024 Sustainable Development Report," the Group's total assets in 2024 reached RMB 2,713.85 billion, operating revenue RMB 932.66 billion, and total profit RMB 92.64 billion. Among them, China Resources Power's equity grid-connected installed capacity of renewable energy reached 34.20GW, accounting for 47.20% of the total installed capacity, an increase of 6% compared to the end of 2023.5 percentage points; newly added renewable energy quota of 13.60GW in 2024 (including 7.65GW of wind power and 5.93GW of photovoltaic power).

In 2025, the company further clarified its target of adding 10GW of wind and solar power capacity, planning to invest approximately HKD 42 billion in cash capital (approximately RMB 39 billion) to focus on promoting the construction of photovoltaic and wind power projects.

To achieve the installed capacity target, China Resources Power has recently made intensive arrangements for two key actions.On August 7th, China Resources Power Fujian Company and Qingliu County, Fujian Province, signed a clean energy mega-base agreement with a total investment of 8 billion yuan, covering photovoltaic, wind power, and pumped storage projects, to help the energy transition in the old revolutionary base area. In addition, in the second batch of photovoltaic module centralized procurement for 2025, which opened for bidding on August 18th, the average price of 3GW N-type TOPCon bifacial double-glass modules was as low as 0.725 yuan/W, with the lowest bid for 710W high-power modules reaching 0.673 yuan/W, setting a new industry low. The participation of 22 companies in the bidding reflects the intensity of the market.This centralized procurement covers project needs in Jiangsu, Zhejiang, Sichuan, and other regions, laying the supply chain foundation for accelerating new projects, including the Liangshan project.

In terms of performance, according to the 2024 annual report, the company achieved total revenue of HK$102.707 billion, a year-on-year increase of 1.19%; net profit attributable to the parent company was HK$14.716 billion, a year-on-year increase of 29.86%; and net cash flow from operating activities was HK$33.695 billion, a year-on-year increase of 16.72%.

China Resources Power's renewable energy business continued to increase its contribution to profits in 2024. In the first quarter of 2025, the company added 2.1GW, accounting for 21% of the annual target. Decreased component costs and optimized project yields through scaled procurement have further improved project returns. Taking the Liangshan project as an example, its component cost ratio has decreased to 38% of the total investment (approximately 319 million yuan), lower than the industry average.

With the commencement of the Liangshan high-altitude photovoltaic project, the signing of the Fujian clean energy base, and the significant decrease in component procurement costs, China Resources Power is synergistically leveraging resource acquisition, construction efficiency, and cost control to comprehensively enhance the competitiveness of its new energy business.Against the backdrop of continued price declines in the component industry, the company, leveraging its large-scale procurement and efficient project development capabilities, is expected to further optimize its project revenue structure and accelerate its strategic transformation from a traditional energy company to a green and low-carbon enterprise. Editor/Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~