- Brazil's abundant solar energy resources collide with huge market potential

Brazil is the fourth largest photovoltaic market in the world and one of the countries with the highest solar irradiance. The annual irradiance in most regions ranges from 1500 to 2400 kWh/m ², providing a natural advantage for efficient power generation in photovoltaic systems. In 2024, Brazil's newly installed photovoltaic capacity reached 18.9 GW, with an investment cost of approximately 0.7 US dollars per watt system, bringing an annual market increase of approximately 13.2 billion US dollars, and achieving remarkable results in an economic downturn environment. As of 2025, Brazil's installed photovoltaic capacity has reached 60GW, and it is expected to jump to 88GW by the end of 2029, accounting for 32.9% of the national power structure.

The outbreak of the Brazilian photovoltaic market is closely related to high electricity prices. Brazil is the country with the second highest electricity bill in the world, with an average household electricity consumption of over R $0.80/kWh (approximately RMB 1.1/kWh), and some regions and high electricity consuming classes have even higher electricity prices. Since July this year, electricity prices have risen by about 14%. This makes the investment return period for photovoltaic power generation usually only 3-6 years, which is highly economically attractive. Since starting from almost zero in 2012, the Brazilian photovoltaic market has achieved exponential growth over the past decade, with solar energy accounting for 23.5% of the total installed capacity of the Brazilian power grid, second only to hydropower, and reducing approximately 88.3 million tons of carbon dioxide emissions. Since 2012, the photovoltaic industry has brought over 270 billion Brazilian reals in investment, created 1.7 million green jobs, and contributed over 84.2 billion Brazilian reals in tax revenue, becoming a strategic pillar industry driving Brazil's energy transformation and sustainable economic development.

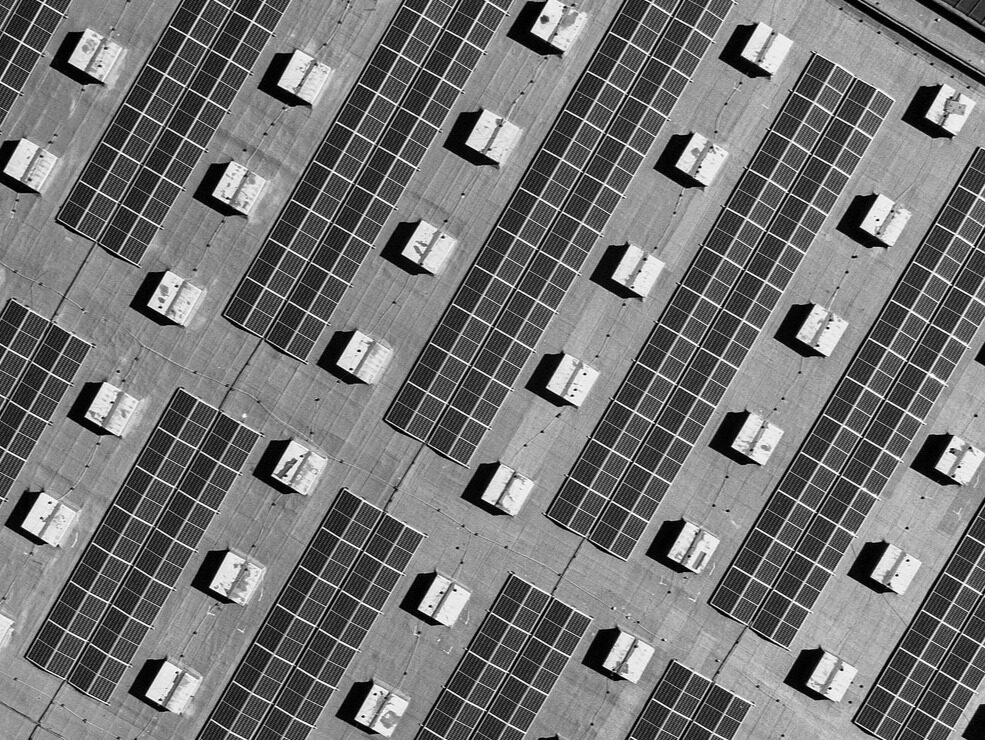

Currently, the Brazilian photovoltaic market presents a distributed dominant and centralized steady growth pattern. By 2025, distributed power generation will account for 42.1GW, accounting for 70%, while large-scale centralized power generation will account for 17.9GW. Centralized power generation is usually a large-scale photovoltaic power station that directly supplies power to the State Grid through government bidding or long-term power purchase agreements signed in the free electricity market; Distributed generation is a small-scale system installed near power consumption points, operating under a net metering system.

At present, Brazil's photovoltaic industry is in the era of grid connection, but with the expansion of photovoltaic scale, relying solely on the grid will bring huge pressure, and physical energy storage becomes essential. Moreover, Brazil will adjust its incentive policies for distributed power generation in 2022, gradually phasing out full net metering subsidies, making it more cost-effective for users to store photovoltaic electricity for their own use, which directly stimulates the energy storage market. At present, distributed photovoltaic systems have been installed in more than 5500 cities in Brazil, but only about 5% of electricity users in the country have installed them. The market is far from saturated, and there is a huge demand for solar storage. In the future, integrated solar storage and charging systems are expected to become standard for households and enterprises. Keywords: Photovoltaic New Energy News, Photovoltaic New Energy Information

For Chinese companies going global, the Brazilian photovoltaic market holds huge dividends. China has significant advantages in the photovoltaic industry chain, with 70% to 90% of the global supply chain from silicon materials and wafers to batteries, modules, and inverters located in China. At the same time, the Brazilian government is promoting the transition to green energy through tax incentives and bidding projects, with plans to bid for 2.8GW of photovoltaic and 900MWh of energy storage in the next three years, accounting for 25% of market demand. Chinese enterprises can leverage their technological and cost advantages to showcase their strengths in the Brazilian photovoltaic market and achieve mutual benefit and win-win outcomes.Editor/Cheng Liting

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~