- As an important importer of batteries, the United States will face pressure on its AI data center and grid upgrade plans

Against the backdrop of the global energy transition and the wave of artificial intelligence, battery technology has become a strategic resource that combines economic and security significance. China recently announced export controls on lithium batteries and related technologies, marking the formal inclusion of this key industry into the national strategic management scope and promoting a new round of adjustment in the global energy storage supply chain.

1、 The regulatory scope covers the entire industry chain, highlighting the intention of strategic control

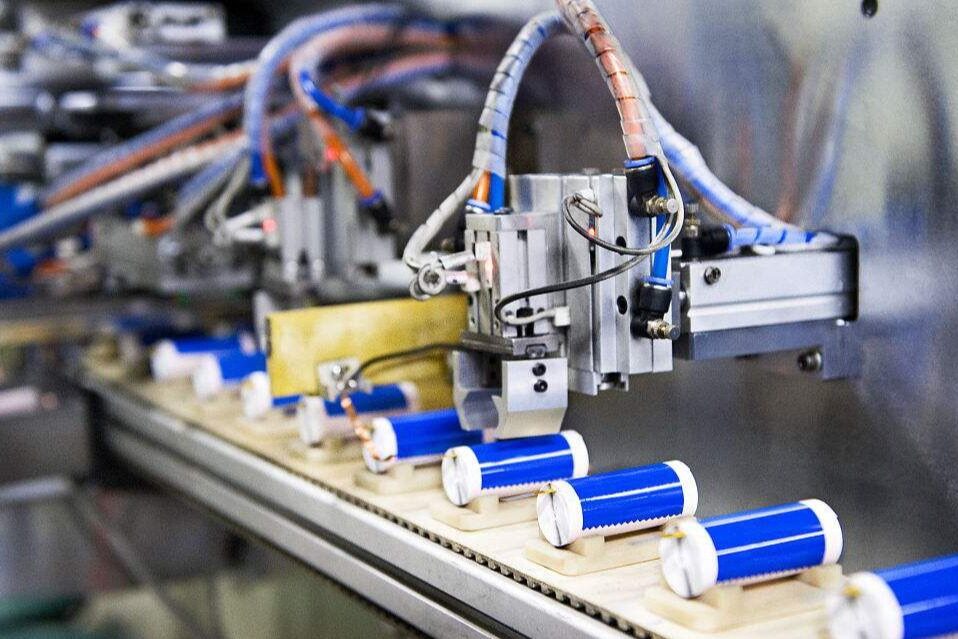

This export control involves large-scale lithium-ion batteries, positive and negative electrode materials, and manufacturing equipment, covering the core areas of battery manufacturing. It is worth noting that the policy focuses on advanced battery products with energy densities exceeding 300Wh/kg. This standard excludes mainstream liquid batteries and mainly targets next-generation technologies such as solid-state batteries that are still at the forefront of research and development.

The Ministry of Commerce has clearly stated that this move is based on considerations of national security and international non-proliferation obligations. High energy density batteries have a wide range of applications in military fields such as drones and individual soldier systems, and implementing an export licensing system is in line with international practices.

2、 The development of energy storage in the United States is facing challenges, and local production capacity is still difficult to replace

China dominates key links in the battery supply chain:

Control approximately 96% of the global negative electrode material and 85% of the positive electrode material production capacity

By the first seven months of 2025, approximately 65% of US grid grade lithium-ion battery imports will come from China

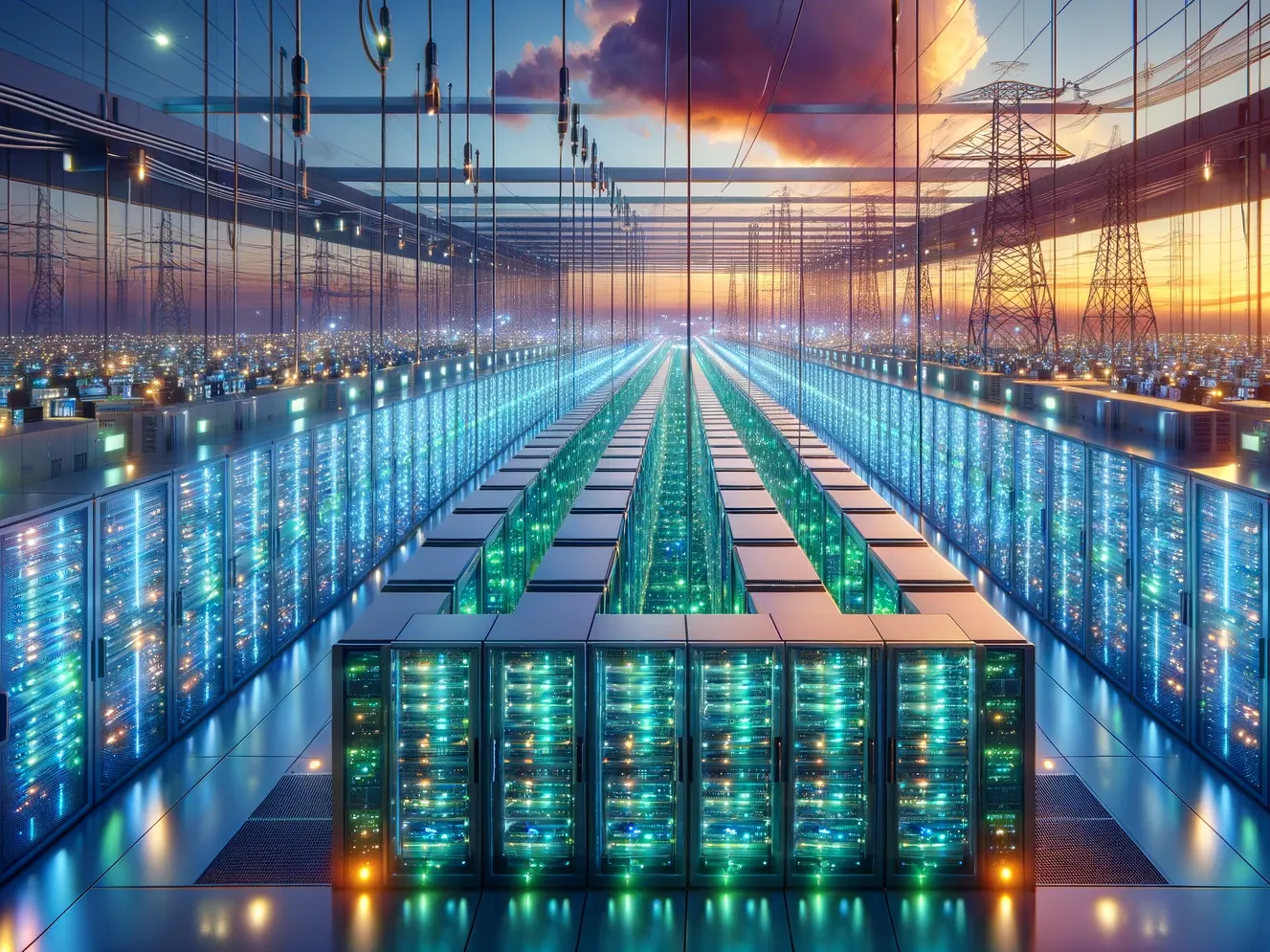

With the surge in energy consumption in AI data centers - expected to triple the power consumption of data centers in the United States by 2023 by 2028- battery energy storage has become the key to ensuring grid stability. Bloomberg New Energy Finance predicts that the United States will add 136 gigawatts of battery capacity in the next decade, a significant portion of which originally relied on Chinese supply.

Despite the increase in domestic battery production capacity in the United States, it still heavily relies on China in the materials sector. Ce Wei Consulting analyst Corey Kooms pointed out that bringing key materials under regulation is a "major upgrade" that will directly affect the raw material supply of newly built battery factories in Southeast Asia and other regions.

3、 Dual consideration of technology protection and industrial competition as policies

This regulation is a continuation of China's systematic strengthening of battery technology protection. In July 2025, China has included the preparation technology of positive electrode materials such as lithium iron phosphate and lithium manganese iron phosphate in the "Catalogue of Prohibited and Restricted Export Technologies".

From an industrial perspective, China has established significant advantages in the field of lithium batteries:

The export value of lithium-ion batteries from January to August 2025 reached 48.296 billion US dollars, a year-on-year increase of 25.79%

Master the majority of global lithium processing capacity and core material technology

At the same time, the development of AI has elevated the strategic value of batteries. It is expected that the global data center energy storage market will grow by 12 times from 2024 to 2030. Batteries have been upgraded from new energy accessories to a "new type of oil" that supports the digital economy. Keywords: Energy Storage Latest News, Energy Storage New Energy News, China Energy Storage Network

4、 Policy balance in the international competitive landscape

Although the United States has reduced some clean energy subsidies in the Great America Act, it still maintains a relatively relaxed import policy for energy storage batteries, reflecting its real demand under the pressure of AI energy consumption. From January to August 2025, the United States will remain China's second largest export market for lithium batteries, with imports reaching $7.418 billion.

China's regulation this time aims to strike a balance between technological protection and international trade: on the one hand, it preserves regulatory space through a licensing system, and on the other hand, it emphasizes compliance with international conventions to avoid causing severe impacts on existing trade. Editor/Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~