- Led by a consortium led by ACWA Power, in collaboration with the hydropower holding company under the Public Investment Fund

China Power Construction Corporation Limited recently announced that it has signed a contract with Saudi Afif Renewable Energy Company for the Afif 1 and 2 Photovoltaic IPP projects, with a total value exceeding RMB 11.7 billion. This project marks the deepening of Chinese enterprises' presence in Saudi Arabia's renewable energy sector and may help accelerate the implementation of Saudi Arabia's "Vision 2030".

On October 11, 2025, Beijing time, Power Construction Corporation of China, Ltd. (hereinafter referred to as "Power Construction Corporation of China", 601669.SH) issued an announcement disclosing that its subsidiaries, Sinohydro Corporation Limited and Power Construction Corporation of China Huadong Engineering Corporation Limited, together with Power Construction Corporation of China Group, recently signed contracts with Power Construction Corporation of China Group and Saudi Afif Renewable Energy Company for the Saudi Afif 1 Photovoltaic IPP Project and the Saudi Afif 2 Photovoltaic IPP Project. The contract amounts for the two projects, converted to RMB, are approximately 5.843 billion yuan and 5.876 billion yuan respectively, totaling over 11.7 billion yuan.

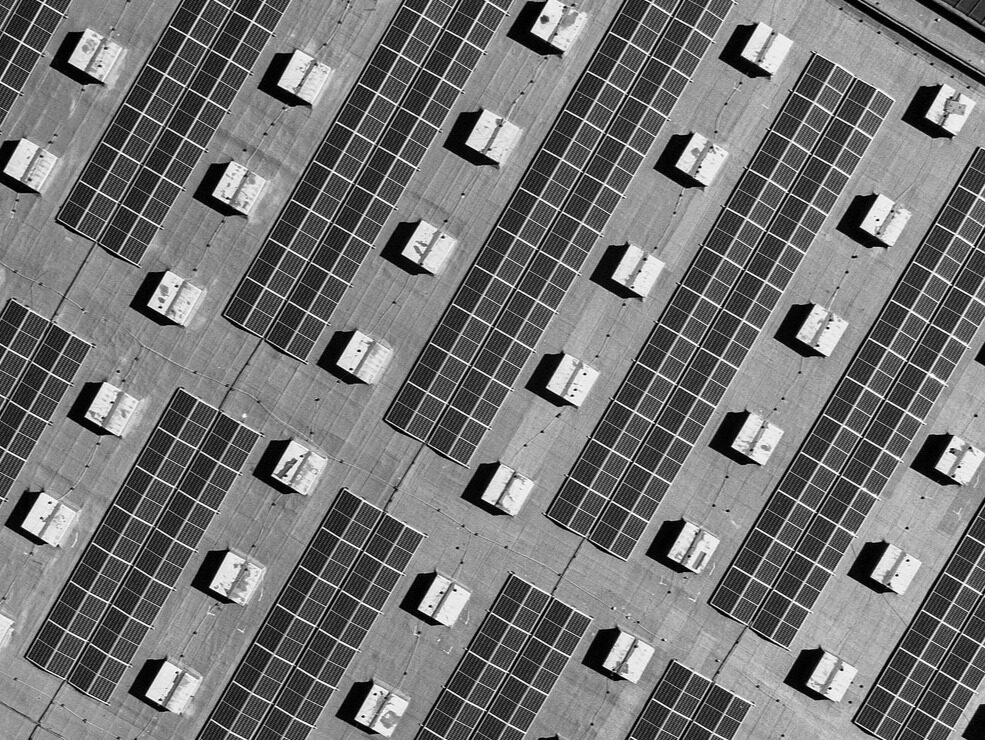

Both of these photovoltaic Independent Power Producer (IPP) projects are located in Afif town, Riyadh province, in the central region of Saudi Arabia. The scope of work encompasses the construction of photovoltaic fields with a total capacity of 2000 megawatts (MW), 33/132kV field step-up stations, 132kV transmission lines, some connection and interface facilities for the power grid, as well as supporting facilities such as connecting roads. The contract duration for both projects is 26 months.

As an important component of Saudi Arabia's National Renewable Energy Program (NREP), the Afif 1 and Afif 2 projects originated from a major tender led by the Saudi Ministry of Energy on July 13, 2025. On that day, in the presence of Prince Abdulaziz bin Salman bin Abdulaziz Al Saud, Minister of Energy and Chairman of the Board of Directors of the main buyer, Saudi Arabia signed seven agreements for solar and wind energy projects with a total capacity of 15000 MW and a total investment of approximately 8.3 billion US dollars (approximately 59 billion yuan).

These projects are led by a consortium led by ACWA Power, in collaboration with Badeel, a water and electricity holding company under the Public Investment Fund, and Aramco Power, a subsidiary of Saudi Aramco. Among them, the Afif 1 project has a capacity of 2000MW and a levelized cost of electricity (LCOE) of 4.74736 Hararas per kilowatt hour (approximately 1.26596 US cents); The Afif 2 project also has a capacity of 2000MW, with an LCOE of 4.72346 Harara/kWh (approximately 1.25959 US cents).

These cost levels highlight Saudi Arabia's competitiveness in global renewable energy development, reflecting the effectiveness of efficient financing and development models, as well as investors' confidence in Saudi Arabia's investment environment. The Saudi NREP program, supervised by the Ministry of Energy, aims to promote the construction of renewable energy infrastructure through bidding for power generation projects and signing power purchase agreements (PPAs). As of now, the plan has launched projects with a total capacity of 43213MW, of which 38713MW have signed PPA agreements and 10213MW have been connected to the grid. It is expected that by the end of 2025, the grid connected capacity will increase to 12713MW and reach 20013MW by the end of 2026.

The signing of the Afif project this time is not only a key link in the photovoltaic field under the plan, but also reflects Saudi Arabia's leading position in the world's largest single-stage renewable energy contracted capacity. As a leading global energy engineering enterprise, China Power Construction Corporation's winning bid further consolidates its layout in the Middle East market. As early as 2024, China Power Construction obtained the EPC (Engineering, Procurement, and Construction) contract for the 500MW Waad Al Shamal wind power project in Saudi Arabia. The project was jointly developed by a consortium led by Japan's Marubeni Corporation and Abdulaziz Alajlan Sons, a subsidiary of Saudi Arabia's Ajlan Brothers. On May 21, 2024, Saudi Power Procurement Company (SPPC) signed a PPA agreement with Marubeni, including the 600MW Al Ghat wind farm and the wind farm. China Power Construction Group and Shandong Electric Power Construction Third Company were selected as EPC contractors. This cooperation marks the expansion momentum of Chinese enterprises in the international new energy field.

In addition, China Power Construction's footprint in the Middle East is rapidly expanding.

On August 14, 2025, its subsidiary Guizhou Engineering Company announced the groundbreaking of the Al Masa'a (MAS) and Al Henakiyah 2 (AHK2) photovoltaic projects in Saudi Arabia. This project belongs to the fifth round of NREP solar energy bidding, with a total capacity of 1.75GW (MAS 1.25GW, AHK2 500MW), covering an area of approximately 3386 hectares.

After the completion of the project, the annual power generation is expected to reach 4.4 billion kilowatt hours, providing clean energy for about 550000 Saudi households and reducing carbon dioxide emissions by 2.88 million tons, supporting Saudi Arabia's "2030 Vision" to build a clean and low-carbon national energy system. As early as December 2024, SPPC signed a PPA with the developer.

The winning bids and promotion of these projects highlight the comprehensive strength of China Power Construction in the fields of renewable energy such as photovoltaics and wind power. As an important practice of the "the Belt and Road" initiative, POWERCHINA cooperates deeply with international partners through the consortium model, not only to export engineering technology, but also to help the host country's energy transformation.

As the world's largest oil exporting country, Saudi Arabia is vigorously developing renewable energy through NREP to diversify its energy structure and reduce carbon emissions. The implementation of the Afif project may become another model of energy cooperation between China and Saudi Arabia, promoting the deepening of bilateral economic and trade relations towards a green direction. Major overseas contracts like those of China Power Construction can help it expand its international market and improve its performance, but it also faces risks such as geopolitical and exchange rate fluctuations.Editor/Bian Wenjun

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~