- With the implementation of the project, Southeast Asia's position in the global power battery market will be further highlighted

On October 29th, Xinwangda announced that its subsidiary Xinwangda Power and Hong Kong Xinwangda Power plan to invest in the construction of the second phase of a green energy lithium battery factory project in Thailand, with an investment amount not exceeding 481556800 US dollars (approximately 3.419 billion yuan). This is another important measure of Xinwangda's production capacity layout in Southeast Asia after the trial production of the first phase project in Thailand, marking a solid step for Chinese power battery enterprises in their globalization strategy.

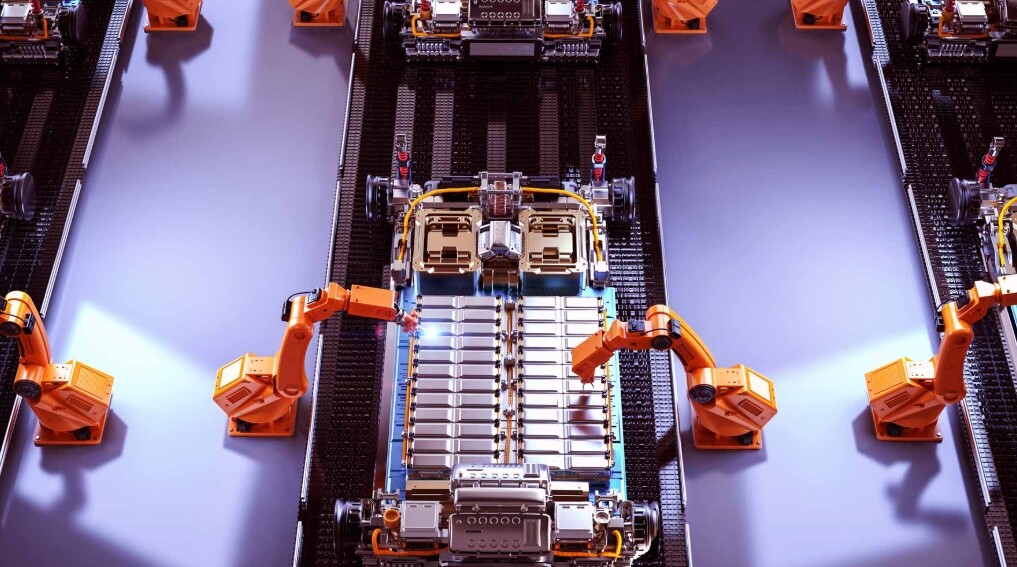

According to the announcement, the Phase II project in Thailand will mainly be used for park construction, decoration, and water and electricity supporting projects, with a planned total production capacity of 17.4GWh. The project is implemented by Thailand's Xinwangda Power, and the equity structure shows that Hong Kong's Xinwangda Power holds 99% of the shares and Xinwangda Power directly holds 1% of the shares. The funding comes from self owned and self raised funds, and the final investment amount will be determined based on the actual construction situation.

This layout is not an isolated case. Previously, a subsidiary of Xinwangda had invested in the construction of a phase one project in Thailand, with an investment amount not exceeding 258.8487 million US dollars. As of now, the first phase project in Thailand has completed overseas investment filing, the main company has been established, and has entered the trial production stage. The launch of the second phase project further demonstrates Xinwangda's confidence in Thailand as a regional manufacturing hub.

The announcement clearly states that this investment aims to improve the production capacity layout of Xinwangda Power in Thailand, meet the needs of future business development and overseas market expansion, and combine with customer order demands. Thailand is located in the center of Southeast Asia and is an important node in the global layout of the new energy vehicle industry chain. In recent years, several Chinese battery companies, including CATL and Guoxuan High Tech, have established factories in Thailand, forming an industrial cluster effect.

The "30.30" policy launched by the Thai government (aiming to achieve a 30% share of total automobile production in electric vehicle production by 2030) provides a broad market space for battery industry chain enterprises. Through continuous investment in the first and second phases of the project, Xinwangda is expected to reduce trade barrier costs by leveraging localized production capacity, and respond more quickly to customer demands in Southeast Asia and globally.

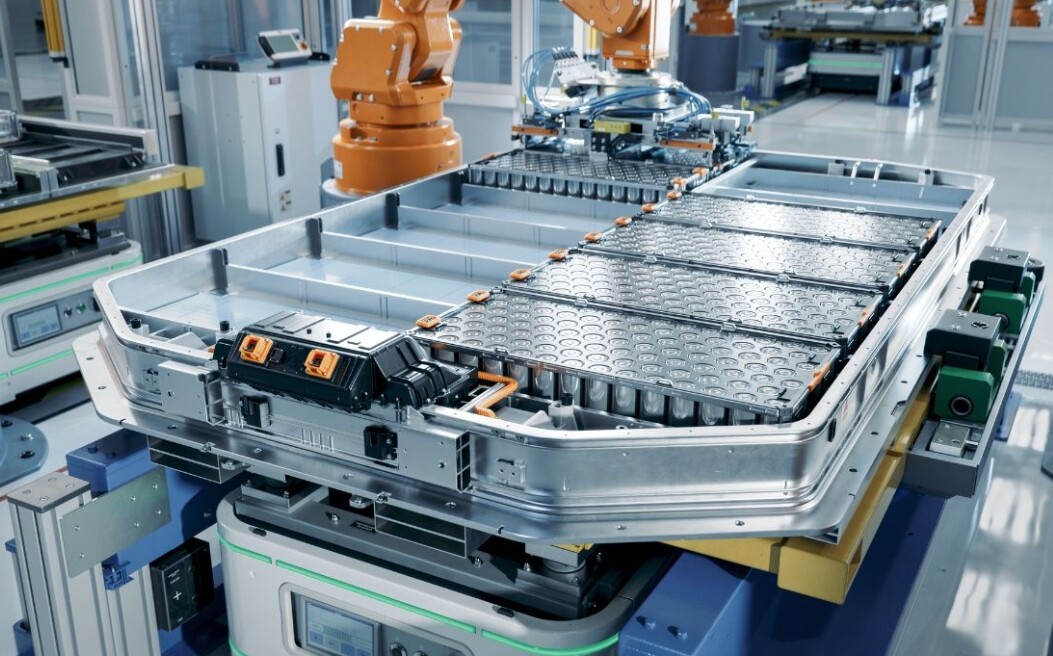

The continuous promotion of the Xinwangda Thailand project is a microcosm of the upgrading of the overseas model of Chinese power battery enterprises. From initially exporting battery modules to now building full process production bases overseas, Chinese companies are deeply integrating into the global new energy industry chain through localized research and development, manufacturing, and operation. Keywords: Southeast Asian Engineering Information Network

This production capacity implementation model can not only avoid some trade barriers, but also drive local employment and technological upgrading, achieving a win-win situation for enterprises and host countries. According to incomplete statistics, China's leading battery companies have established over 20 overseas production bases in Europe, Southeast Asia, South America, and other regions, accelerating the process of globalization.Editor/Cheng Liting

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~