- Saudi Arabia is rapidly advancing into a new energy storage blue ocean worth billions of dollars at an average annual growth rate of 30%

In the wave of global energy transition, Saudi Arabia, once known for its oil, is quietly becoming a new blue ocean in the field of battery energy storage systems (BESS). With the deepening of the "2030 Vision" and the continuous release of policy dividends, the Saudi energy storage market has shown strong growth potential, attracting the attention of global capital and enterprises.

The research and markets market report shows that the Saudi battery energy storage system market has laid the foundation for a scale of $5 billion. Driven by both policy support and energy transformation, it is expected to maintain an average annual growth rate of 30% between 2025 and 2029, which has attracted the attention of global capital.

The outbreak of the Saudi energy storage market is inevitable. Since the launch of the National Renewable Energy Program (NREP) in 2017, the government has continuously activated the market through policy guidance and project bidding. Although no new regulations will be introduced in 2023, the intensive bidding for BESS projects and the implicit requirement for mandatory storage of renewable energy projects have made energy storage demand a rigid gap.

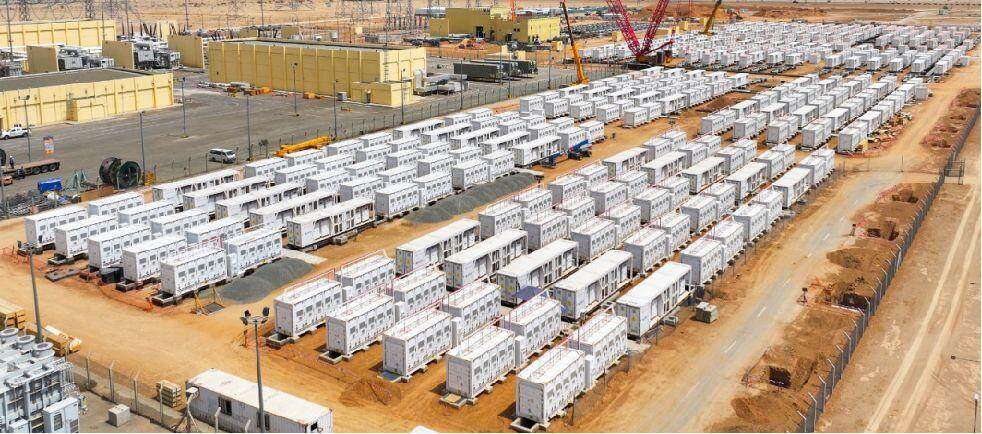

The financial support is significant. As a core component of the "2030 Vision" energy diversification strategy, Saudi Arabia not only leverages social capital through its sovereign fund (PIF), but also directly invests in key projects. Saudi Electricity Company has allocated 10 GWh of energy storage contracts to multiple locations such as Riyadh and Dawadami, while overseas cooperation projects with local giants such as ACWA Power have indirectly promoted technological upgrades.

Currently, the Saudi energy storage market is entering a golden period of triple demand:

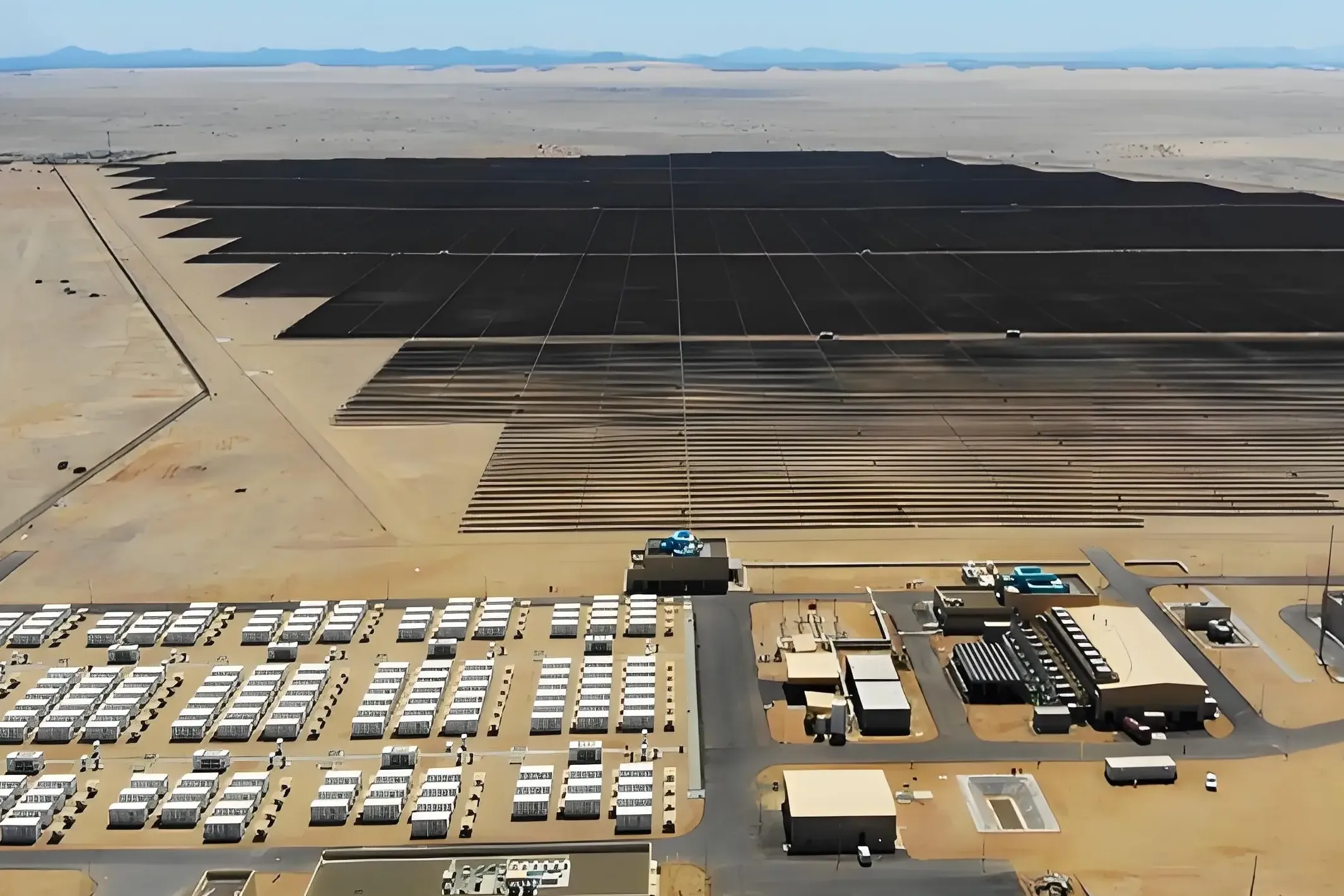

Firstly, the demand for renewable energy grid connection is the most urgent. Saudi Arabia plans to achieve 50% of its electricity from clean energy by 2030, and the intermittency of photovoltaic and wind power must rely on energy storage to smooth out fluctuations. Data shows that the country has tendered 26 gigawatt hours of energy storage projects through NREP, with an expected storage capacity of 8 gigawatt hours by 2025 and soaring to 22 gigawatt hours by 2026. The 200GWh energy storage system supporting NEOM New City and the 1.3GWh off grid energy storage project in the Red Sea are concrete manifestations of this demand.

Secondly, the pressure of power grid load is forcing energy storage to accelerate its implementation. Saudi Arabia's electricity demand grows at an average annual rate of 6%. When the summer temperature exceeds 50 ℃, air conditioning load accounts for 70% of peak electricity consumption, with a peak valley difference of up to 45%. After the Riyadh power grid overload and power outage event in 2022, the legislation for mandatory allocation and storage in industry and commerce is accelerating.

Thirdly, the expansion of electric vehicle infrastructure has opened up new scenarios. Saudi Arabia is accelerating the layout of 1000 EV charging stations, with "integrated light storage and charging" becoming standard. This collaborative demand has attracted companies such as LG Chem and CATL to enter the market.

At the same time as demand surges, technological progress and competition among enterprises drive the market from potential to reality. Lithium batteries are still the mainstream, accounting for over 80%, while solid-state batteries are listed as an important development direction due to their high energy density and long lifespan characteristics, which are suitable for the high-temperature environment in Saudi Arabia.

The market competition pattern presents international characteristics: Saudi Electricity Company dominates grid side projects with local resources, ABB、 Siemens provides technical support, and Chinese companies also play an important role - BYD has won a 15.1GWh grid side order, while CATL and PIF jointly build a 30GWh battery factory.

However, market development still faces challenges: high initial investment costs and insufficient understanding of energy storage technology among some entities are the main pain points. In addition, "Saudi specialization" requires foreign-funded enterprises to transfer 30% equity and ensure a 40% local employee ratio, which also poses a localization ability test for newcomers.

From the current base of 5 billion US dollars to the future scale of billions, the explosion of Saudi Arabia's energy storage market is the trend. With the decrease in the cost of solid-state batteries and the promotion of electricity marketization reform, the profit model of energy storage will become more diversified. For global enterprises, whoever can grasp the three major directions of renewable energy projects, "energy storage+EV charging" scenarios, and special technologies adapted to high-temperature environments, can seize the opportunity in this emerging blue ocean market. The future of Saudi Arabia's energy storage market is no longer just a question of whether it will grow, but also a question of how quickly it will achieve explosive growth. Editor/Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~