- This procurement includes four sections, with a quotation range of approximately 0.193 yuan/Wh to 0.416 yuan/Wh.

- This is a large-scale procurement by Huaneng Group in the field of energy storage, marking a new stage of large-scale development in China's energy storage industry.

This procurement includes multiple fields such as lithium iron phosphate batteries, high-voltage direct hanging energy storage systems, DC cabin materials, and AC/DC integrated cabins. Leading companies such as Chu Neng New Energy, CATL, and BYD have all been shortlisted. Against the backdrop of sustained high demand for energy storage and a rebound in lithium iron phosphate prices, this large-scale procurement will inject strong momentum into the energy storage industry chain, driving the industry from a "price war" to a "value war".

The four major sections are fully covered, and 13 companies are fiercely competing

The energy storage frame procurement of Huaneng Qingneng Institute this time is divided into four sections, with a total procurement capacity of 8GWh, involving multiple fields such as lithium iron phosphate batteries, high-voltage direct hanging energy storage systems, DC cabin materials and integration, AC/DC integrated cabin materials and integrated processing. The procurement of 2GWh energy storage raw materials (lithium iron phosphate batteries) framework agreement has become the focus of this procurement. This section requires a single battery capacity of not less than 314Ah, a single battery energy of not less than 1004.8Wh, and a rated charging and discharging power of 0.5P. After fierce competition, three companies, Chu Neng New Energy, Tianhe Energy Storage, and Ningde Times, were successfully shortlisted with a winning bid price range of 0.29/Wh-0.35/Wh.

The integrated processing section of the high-voltage direct hanging energy storage system also purchases a capacity of 2GWh, of which approximately 1.6GWh is a 0.25P grid type energy storage system, 0.2GWh is a 0.5P grid following energy storage system, and 0.2GWh is a 0.25P grid following energy storage system. Five companies, namely Zhiguang Energy Storage, CRRC Zhuzhou Institute, Mingyang Longyuan Power Electronics, Xinfengguang, and Xi'an Xidian, have been shortlisted, with winning bid prices ranging from 0.193 yuan/Wh to 0.257 yuan/Wh.

The procurement capacity of the DC cabin whole cabin materials and integration section is 2GWh, and five companies including Dongfang Xuneng, BYD, CRRC Zhuzhou Institute, Xuji Dianke Energy Storage, and Zhiguang Energy Storage have been shortlisted, with a quotation range of 0.381/Wh to 0.411/Wh.

The procurement scale of AC/DC integrated cabin materials and integrated processing section is 2GWh, and five enterprises including CRRC Zhuzhou Institute, Zhiguang Energy Storage, Dongfang Xuneng, Haibosichuang, and Pinggao Energy Storage have been shortlisted, with a quotation range of 0.416 yuan/Wh to 0.523 yuan/Wh.

Lithium iron phosphate prices hit bottom and rebounded, industry welcomes value return

The acquisition of Huaneng's 8GWh energy storage frame coincides with a critical moment when the price of lithium iron phosphate has bottomed out and rebounded. Since October 2025, the price of lithium iron phosphate has quietly rebounded, with the average price of the power type market rising from 33600 yuan/ton in early October to 41000 yuan/ton in December, an increase of about 10%.

Behind this price rebound is the explosive growth of energy storage demand. As of the end of September 2025, the installed capacity of new energy storage in China has exceeded 100 million kilowatts, a surge of more than 30 times compared to the end of the 13th Five Year Plan, accounting for more than 40% of the world's total installed capacity and firmly ranking first in the world. Domestic energy storage demand continues to rise, with enterprise orders scheduled until next year and some companies reaching full capacity.

Several lithium iron phosphate companies have raised their prices to downstream power battery manufacturers. One of the leading enterprises plans to uniformly increase the processing fees for all series of iron lithium products by 3000 yuan/ton from January 1, 2026. This marks a shift in the lithium iron phosphate industry from a fierce "price war" to a "value war" centered on technological innovation.

Huaneng Qingneng Institute: a leader in clean energy technology research and development

Huaneng Clean Energy Institute was established in 2010 and is a state-owned research institution directly under China Huaneng Group Co., Ltd. Its main business is the research and industrialization of clean energy technology, covering core technology fields such as wind power, photovoltaics, energy storage, and carbon capture.

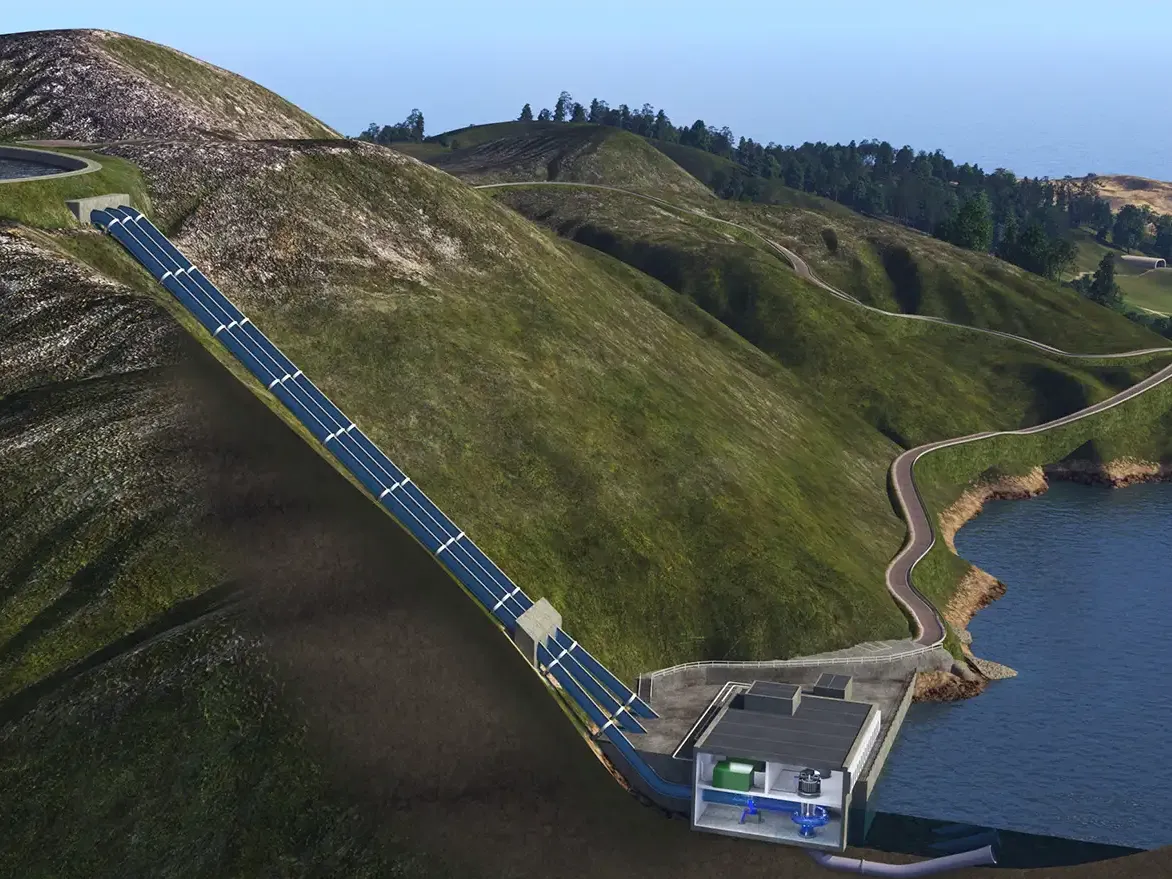

The institute has 14 national and provincial-level research and development platforms, with a total of more than 2900 authorized patents, leading the development of one international standard, and winning one first prize for national scientific and technological progress. We have built the world's largest 35 kV high-voltage direct mounted energy storage power station, achieving breakthroughs in engineering applications in fields such as perovskite photovoltaics and decentralized energy storage systems.

Huaneng Qingneng Institute continues to deepen its innovative practices in the field of energy storage, promoting the deep integration of energy storage technology with new power systems. The salt cavern compressed air energy storage project has been completed in Jintan, Jiangsu, achieving the first commercial application of non supplementary compressed air energy storage; Successfully put into operation the country's first thermal power unit peak shaving and frequency regulation module lava energy storage project in Shandong; Build a comprehensive energy base in Gansu to support the largest domestic energy storage project with a capacity of 600000 kW. Keywords: Energy Storage Latest News, Energy Storage New Energy News

The completion of the 8GWh energy storage frame mining will further consolidate Huaneng Group's leading position in the energy storage field, providing strong support for China to build a new type of power system and achieve the "dual carbon" goal.Editor/Yang Meiling

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~