- The $2 billion investment is due to Ford's previously announced capital cuts in its electric vehicle business

- Vehicle to Grid (V2G) Energy Ecosystem Closed Loop: Ford's entry into energy storage is a crucial step in building a Vehicle to Grid (V2G) energy ecosystem

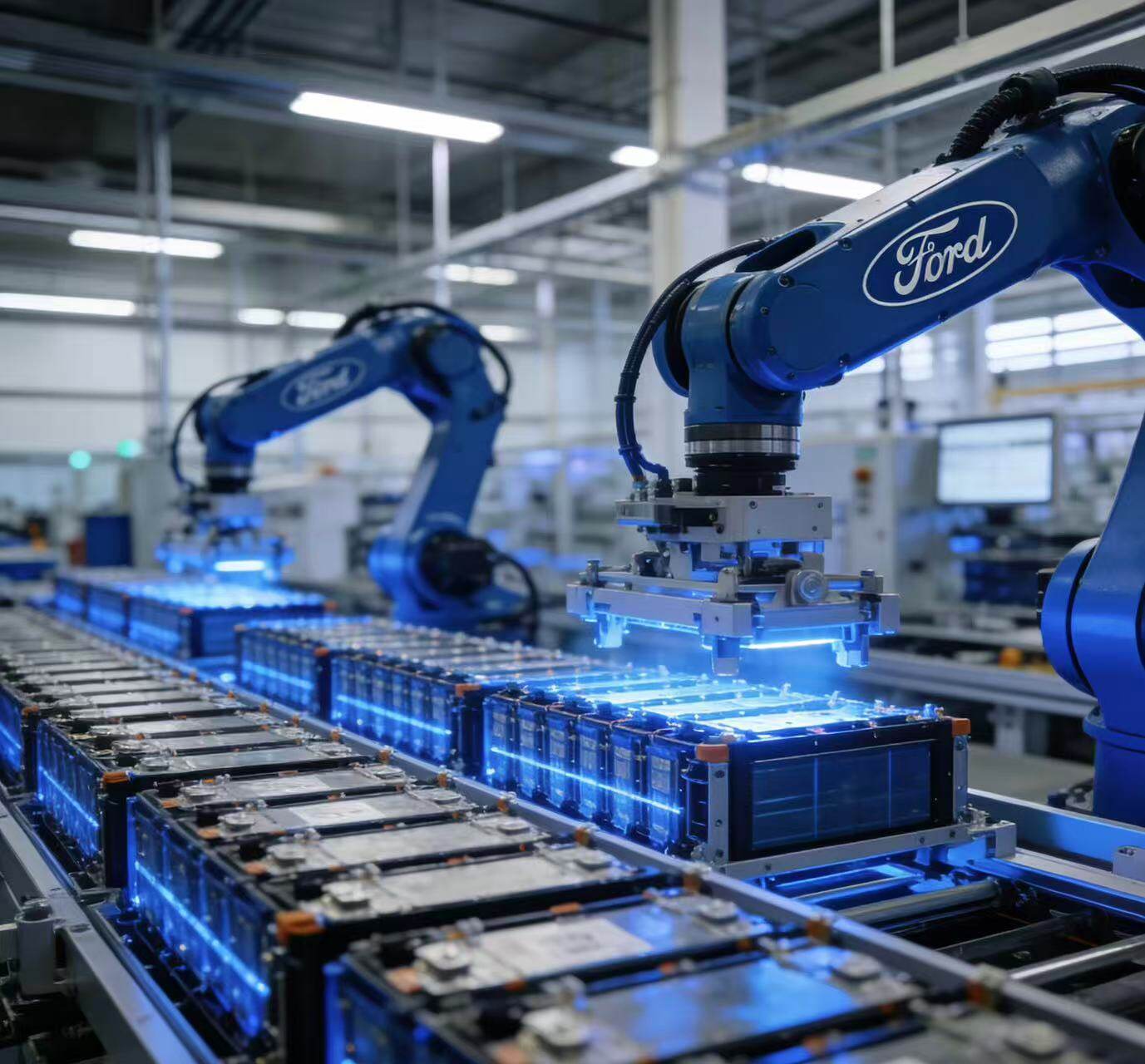

The global energy storage industry has welcomed a heavyweight "cross-border player". American automotive giant Ford announced today that it will invest up to $2 billion to establish a 20GWh annual lithium iron phosphate (LFP) battery energy storage system (BESS) plant at its Marshall Mega Campus in Michigan, USA. This decision marks Ford's strategic expansion of its business focus from traditional automobile manufacturing to energy storage. This move is seen by the industry as a strong "assault" on the energy storage market and will have a profound impact on the existing market landscape.

Ambition from 'wheels' to' grid '

Ford's decision is not groundless, but a significant adjustment in its new energy strategy.

Capital redirection: The $2 billion investment stems from Ford's previously announced capital cuts for its electric vehicle business. This indicates that Ford is shifting its resources from the fiercely competitive consumer electric vehicle market to an energy storage track that is also full of potential but still forming a competitive landscape.

The 'Second Growth Curve': Faced with the challenge of lower than expected profits in the electric vehicle market, Ford urgently needs to open up new growth points. The energy storage market, especially large-scale energy storage systems (BESS) for power grids, data centers, and businesses, is considered one of the most certain growth areas in the next decade.

The "Vehicle to Grid" (V2G) energy ecosystem closed loop: Ford's entry into energy storage is a crucial step in building a "Vehicle to Grid" (V2G) energy ecosystem. In the future, Ford's electric vehicles can serve as distributed energy storage units, working in conjunction with large energy storage stations to form a massive virtual power plant (VPP) that provides flexible services to the power grid.

20GWh production capacity and lithium iron phosphate technology

Ford's "Charge Horn" is full of confidence, with its core weapons being huge production capacity planning and mature technological routes.

Amazing production capacity target: An annual production capacity of 20GWh is a highly impactful figure. This is equivalent to nearly one tenth of the global new installed capacity of large-scale energy storage by 2024. Once put into production, Ford will quickly become one of the leading global energy storage battery manufacturers.

Technical authorization cooperation: The factory will produce lithium iron phosphate batteries based on CATL technology authorization. This collaboration ensures that Ford can quickly acquire industry-leading, cost-effective, and safe LFP battery technology, laying a solid foundation for the market competitiveness of its products.

Lock in key customers: Ford has made it clear that its energy storage products will primarily target commercial and industrial (C&I) customers such as grid level energy storage projects and data centers. This precise positioning avoids direct competition with home energy storage products such as Tesla Powerwall and enters the more profitable and stable demand B-end market.

Disruptor or new player?

Ford's entry will undoubtedly throw a huge stone into the calm energy storage lake.

Intensifying market competition: Currently, the global energy storage market is mainly dominated by companies such as CATL, BYD, Tesla, Fluence (a joint venture between Siemens and AES). The addition of Ford, especially its strong manufacturing capabilities and brand influence, will make market competition exceptionally fierce.

The rise of the "car company army": Ford is not the first car company to enter the energy storage industry. Tesla has long been an energy storage giant, and General Motors has also announced its energy storage plan. The addition of Ford marks the collective effort of the "car company army" with advantages in vehicle manufacturing experience and battery technology accumulation in energy storage, which will form a "three country kill" situation with traditional battery manufacturers and energy companies.

Supply Chain Reshaping: As a giant with a century of manufacturing experience, Ford's entry may create new demands for upstream supply chains of raw materials such as lithium, iron, and phosphorus, and may even trigger a new round of supply chain integration and investment.Editor/Bian Wenjun

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~