- The deep-water berths and automation level of a port determine its international competitiveness

Four cranes stand tall at the port terminal, and huge container ships slowly dock. Dongjiakou Port Area of Qingdao Port is experiencing a billion dollar wave of port infrastructure construction.

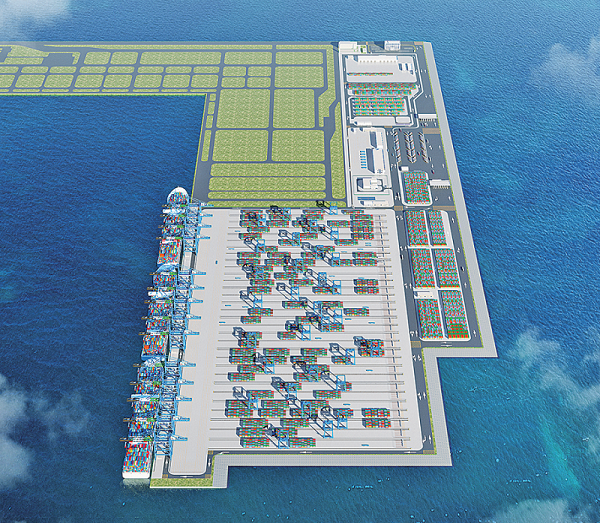

Qingdao Port recently announced an investment of 15.7 billion yuan to build two major dock projects in Dongjiakou Port Area. This huge investment will be used to build the first phase of Dongjiakou Container Terminal and Dongjiakou General Terminal. The project construction period is about 4 years and is expected to be completed in 2029. This is not only an expansion of Qingdao Port itself, but also reflects a moderately advanced strategic logic in global port competition - when production capacity is still sufficient, leading ports have begun to lay out for the next decade.

A crucial step in addressing future competition

As the fourth largest port and fifth largest container port in the world, Qingdao Port is facing a critical strategic turning point. The throughput capacity of its core container operation area, Qianwan Port Area, is approaching saturation, while competitors in Northeast Asia are accelerating infrastructure construction. Tianjin Port Group plans to invest approximately 22.9 billion yuan in the construction, renovation, and expansion of 15 dock projects by the end of the 14th and 15th Five Year Plans; Busan Port in South Korea has announced an investment of approximately 71.2 billion yuan to build the Zhenhai New Port Area.

Under such competitive pressure, Qingdao Port has adopted a dual track strategy: on the one hand, it has invested 17.2 billion yuan in upgrading and renovating the Qianwan Port area, with an expected annual container throughput capacity of over 6 million TEUs; On the other hand, a new construction project worth 15.7 billion yuan has been launched in Dongjiakou Port Area, aiming to build it into the second largest container operation port area in Qingdao Port.

According to the Overall Plan of Qingdao Port (2035), Dongjiakou Port Area will undertake the main incremental transportation needs of Qingdao Port, with a planned investment of over 40 billion yuan to construct multiple key projects. After completion, the throughput capacity will exceed 700 million tons, equivalent to building another Qingdao Port.

Combining automation and specialization

The two projects invested in this time have their own characteristics, reflecting Qingdao Port's pursuit of specialization in port functions. The first phase of the container terminal will invest 9.097 billion yuan to build three container berths, with a coastline of 1167 meters and a designed annual throughput capacity of 3.2 million TEUs. It is particularly noteworthy that the terminal and yard are built according to fully automated standards, which will be another leap in the automation level of Qingdao Port. The General Terminal will invest 6.615 billion yuan to construct seven 30000 to 70000 ton general berths, with a shoreline length of 1668 meters and a designed annual throughput capacity of 14.33 million tons. This project will mainly undertake the transfer of some bulk and miscellaneous goods from Qianwan and Dagang Port areas, serving the needs of industries such as grain and oil processing, steel, etc. in the port area and surrounding areas. The two major projects are expected to be completed in 2029, which will significantly enhance the comprehensive service capabilities and market competitiveness of Qingdao Port.

Balance between long-term strategy and short-term pressure

As a listed company, Qingdao Port needs to find a balance between long-term strategy and short-term financial performance. The capital financial internal rate of return for these two projects are 8.15% and 8.02%, respectively, which exactly meets the benchmark rate of return of 8% set by the National Development and Reform Commission for coastal port projects.

From a financial perspective, Qingdao Port has the confidence to implement this huge investment. In the first three quarters of 2025, the company achieved a revenue of 14.238 billion yuan, a net profit attributable to the parent company of 4.18 billion yuan, a debt ratio of only 25.01%, and a weighted average return on equity (ROE) of 9.47%, ranking among the top listed companies in Chinese ports.

Qingdao Port stated in the announcement that both projects can further enhance the company's competitiveness and profitability, and will not have a significant adverse impact on the company's financial and operating conditions. However, port infrastructure projects have a long investment cycle, high cash flow pressure in the early stages, and require a ramp up in throughput after being put into use, which puts higher demands on the company's financial management and operational capabilities. Global port competition has entered a new stage of advanced investment. When Tianjin Port expands and Busan Port builds a new port area, if Qingdao Port does not follow suit, it may face the risk of being marginalized in the future. Keywords: Logistics News Network, Latest News on Port Logistics

This billion dollar port infrastructure competition may ultimately translate into overcapacity and debt risks for some ports, but it may also shape a new hub pattern for global trade in the next decade.Editor/Cheng Liting

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~