- Can state-owned enterprises catch the price increase trend and attract industry attention?

At the end and beginning of the year, the photovoltaic industry is facing a triple cost blow of high silicon material prices, soaring silver prices, and the cancellation of export tax rebates, accelerating the restructuring of the industrial chain pattern. As the terminal export of the industrial chain, whether components can smoothly transmit cost pressure depends on the tolerance of central state-owned enterprises as downstream core purchasers for component price increases, which has become the key to the industry's turning point.

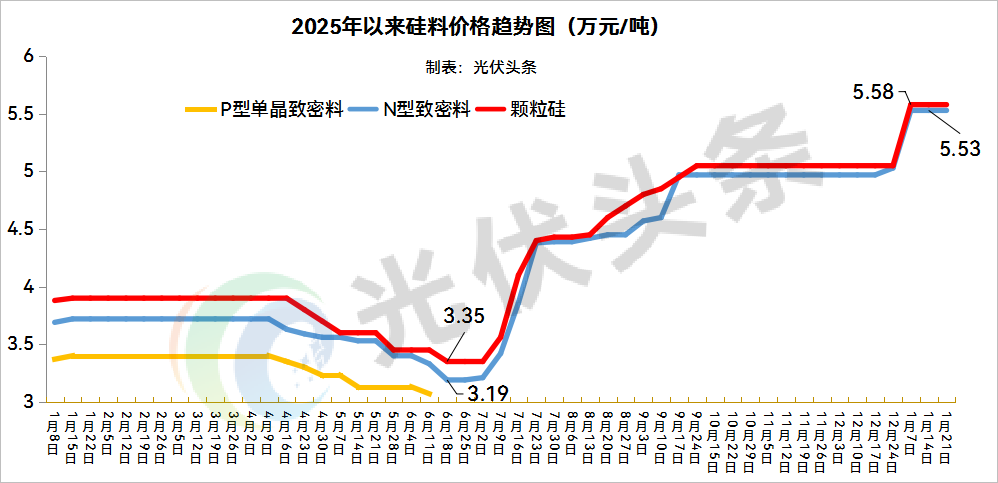

In 2025, the price of silicon materials showed a trend of "bottoming out in the first half of the year and rising in the second half of the year". The price of N-type dense materials dropped from 37000 yuan/ton at the beginning of the year to 31900 yuan/ton. In the second half of the year, it gradually increased with the implementation of industry anti involution measures, and remained stable at 55300 yuan/ton at the end of the year, maintaining a high level in January 2026.

The profit margin of silicon material leaders has been repaired first. The silicon wafer, battery, and component ends have attempted to follow suit by limiting production and ensuring prices, but after being summoned by the Municipal Supervision Administration, such measures have been terminated, and downstream cost transmission has been hindered.

Silver surged 268%, making silver paste the top cost item

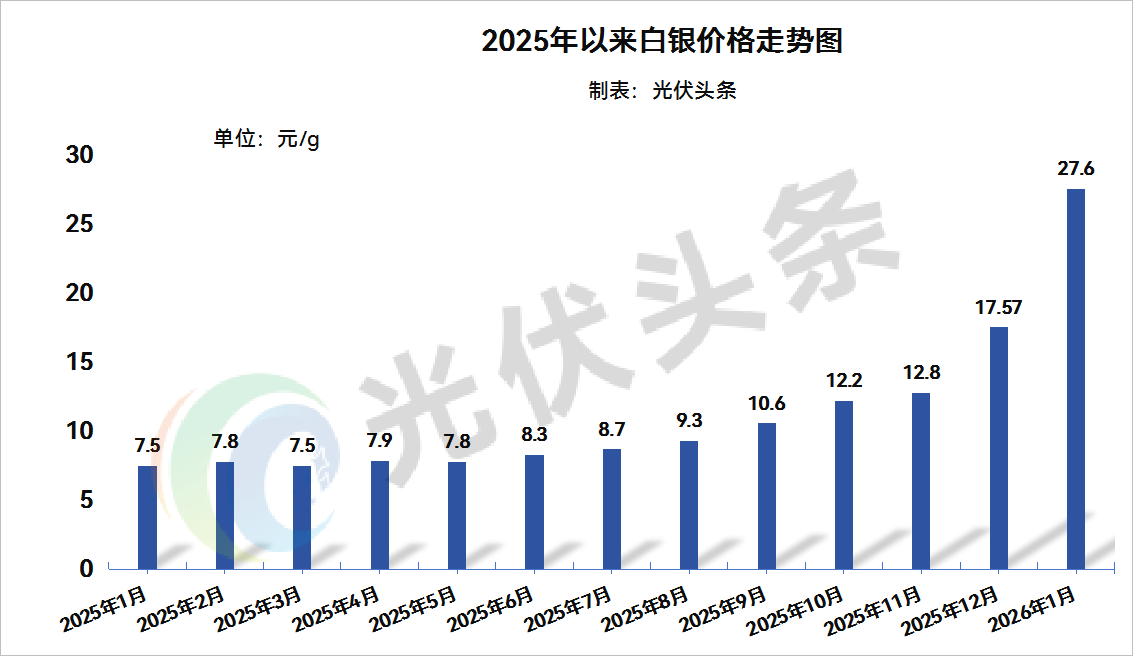

The soaring price of silver, the core material for photovoltaic cell electrodes, further exacerbates cost pressures. At the beginning of 2025, the price of silver was only 7.5 yuan/g, but it has now risen to 27.6 yuan/g, an increase of 268%. Based on a silver consumption of 10mg/W for battery cells, the cost of silver per watt of battery cells is 0.27 yuan.

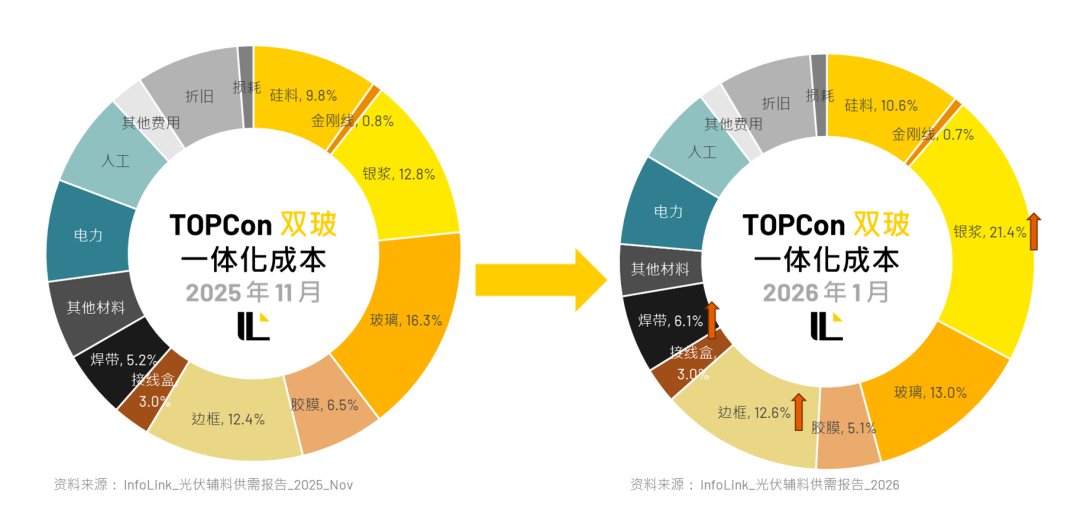

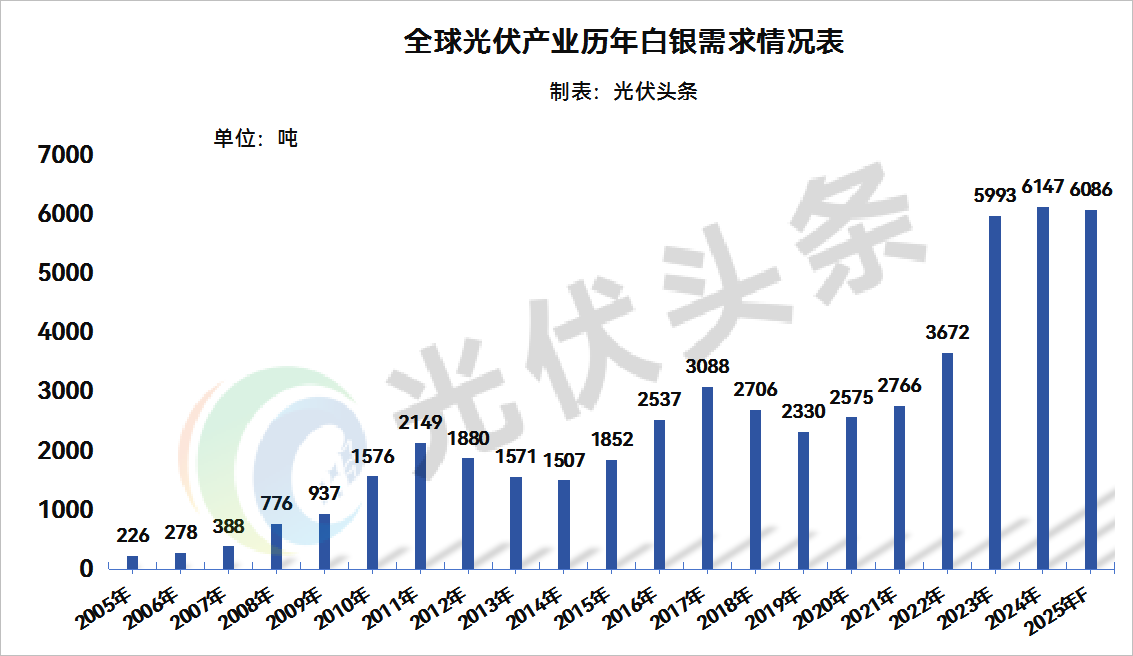

The proportion of silver paste cost continues to rise, reaching 17% in December 2025 and 21.4% in early 2026, almost twice the cost of silicon materials, ranking first in component cost. Since 2021, the global demand for silver has continued to exceed supply, with the photovoltaic industry being the main demand increment. Coupled with risk aversion and a surge in industrial demand, silver prices are unlikely to fall in the short term, forcing the industry to accelerate the iteration of low/no silver technologies. However, in the short term, it still needs to bear high price pressure.

Export tax rebate cancelled, component companies forced to raise prices

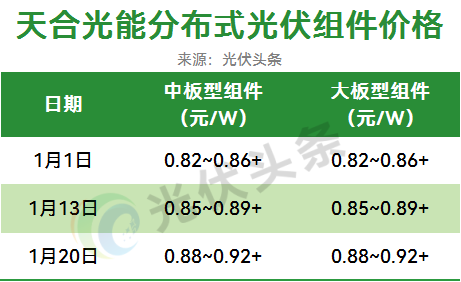

On January 8, 2026, the export tax rebate policy for photovoltaics was officially cancelled, directly reducing enterprise profits - the export profit of a single 210R module decreased by 46 to 51 yuan. Previously, the four major component leaders had a total tax refund of 17.428 billion yuan in 2024. After the cancellation of tax refunds, the company's cash flow was under pressure and they raised their quotations one after another. Tianhe Solar has raised prices twice within a month, with component prices rising to around 0.9 yuan/W. High end TOPCon components are approaching this price range, and lightweight and efficient products have exceeded 1 yuan/W.

State owned enterprises accept price increases, and quality requirements are simultaneously improved

Under the pressure of cost, component prices have continued to rise since December 2025, with 0.75 yuan/W becoming the mainstream pricing range and widely recognized by owners of state-owned power plants. In recent bidding, projects related to Guangdong Energy and National Energy Group have been priced at around 0.75 yuan/W, and the average price of centralized procurement by Three Gorges Group and Guangzhou Development has also been concentrated between 0.75 and 0.766 yuan/W. The cost transmission mechanism has been preliminarily implemented.

However, against the backdrop of a decline in new energy electricity prices, central state-owned enterprises have a clear tolerance for component price increases and are simultaneously raising the quality threshold. In the 8GW centralized procurement of Huadian in 2026, the efficiency requirement for 6GW components is 23.8%. Huaneng's annual centralized procurement will exclude inefficient components below 23.1%. Coupled with the reduction in centralized procurement scale, there is still uncertainty in the transmission of component prices.

In the short term, the industry has entered a parallel stage of cost digestion and capacity clearance, with the silicon material sector benefiting first. However, due to the high cost of silver paste, it is difficult to repair the profitability of battery cells and components, and the differentiation of enterprises has intensified. In the mid-term, the iteration of silver reduction/silver free technology will accelerate, and efficient components will become the core lever for leading enterprises to seize the market. In the long run, 2026 is expected to become the starting point for the photovoltaic industry to bid farewell to low price and extensive competition, optimize the industrial pattern through mergers and acquisitions, and promote the industry's transformation towards high-quality development driven by technological innovation and refined management.(This article is from the official website www.seetao.com of Jiandao. Reproduction without permission is prohibited, otherwise it will be prosecuted. Please indicate Jiandao website+original link when reprinting.) Jiandao website photovoltaic column editor/Yin Jiahui

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~