- 2026 Deepwater Bomb! How HSAI pulls Grab to build a steel moat of 'physical AI' in Southeast Asia

- HSAI not only signed Grab as its exclusive distributor in Southeast Asia, but also invested $10 million in capital to jointly lock in channels and production capacity

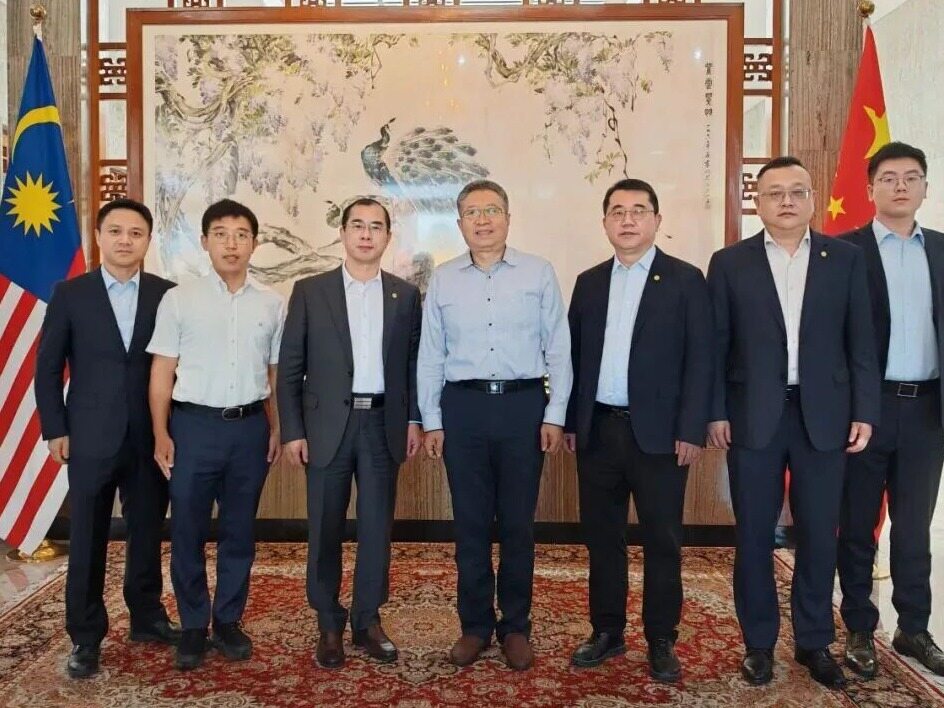

On February 4, 2026, HSAI dropped a "deep water bomb" on the entire Southeast Asian market in Singapore and reached a strategic partnership with local tech giant Grab. This is not just a sales agreement, but also a thunderous action to elevate from a simple buying and selling relationship to a community of shared destiny.

Hand over the shovel that sells water to the landlord

In this game, Grab's identity is extremely unique and dominant: it is not only the exclusive distributor of HSAI LiDAR in eight Southeast Asian countries, but also a super traffic gateway covering over 800 cities.

What does this mean? This means that HSAI no longer needs to spend years building its own local promotion team and exploring channels in unfamiliar foreign jungles. Grab's three trump cards of ride hailing, food delivery, and digital finance have instantly become the "highway" for HSAI products. From the autonomous driving fleet of Punggol in Singapore, to logistics robots in Bangkok, to high-precision mapping in Kuala Lumpur, all places that require the "Smart Eye" now have only one supplier - HSAI, and can only be purchased through Grab.

This channel exclusive strategy directly breaks through the trust barriers in the local market. For Southeast Asian customers, after-sales service is no longer a wait across oceans, technical support is right beside them; For HSAI, this is not only a harvest of market share, but also a blow to competitors' dimensionality reduction. While others are still knocking on doors to find customers, HSAI is already sitting in Grab's cockpit.

10 million US dollars is not an investment, it is a "investment statement"

If you think this is just a simple business cooperation, then you underestimate Li Yifan's ambition. Turning the timeline back to September 2025, Grab's name prominently appeared on the cornerstone investor list in the prospectus for HSAI's Hong Kong IPO - with a subscription of $10 million in real money, placing it on par with top institutions such as Hillhouse Capital and Taikang Life Insurance.

This is an extremely clever "backdoor" move: first lock in benefits with capital, and then fulfill commitments through channel decentralization.

Since Grab has already paid, it will never allow HSAI to be left unfinished in Southeast Asia. This dual identity of "shareholder+exclusive agent" has transformed Grab from a simple channel provider to an "escort" for HSAI. As Grab co-founder Chen Bingyao said, "Equipping robots with smart eyes" is not just a slogan, but also a comprehensive "practical inspection" of HSAI technology by Grab using its complex urban operation scenarios (autonomous driving travel, robot delivery). Products that can pass Grab's rigorous scenario verification are hard currency in the entire Southeast Asian market.

Strategic positioning of the Galileo factory in Thailand

The channels have been laid out, capital is in place, and the final piece of the puzzle is production capacity.

HSAI's ambition is not just to sell goods, but to reap the dividends of the entire Southeast Asian "physical AI" explosion. The Deloitte report predicts that the demand for AI driven automation in the region will "surge" in the manufacturing and logistics industries. In order to catch this sky high wealth, HSAI has already set up the "Galileo" factory in Bangkok, Thailand, which is expected to start production in early 2027.

This is not only to avoid trade barriers, but also for ultimate cost control and response speed. By leveraging the advantages of Thailand's electronic manufacturing industry cluster, HSAI will achieve a closed-loop system of "local production, local sales, and local services". When the production capacity doubles from 2 million units in 2025 to 4 million units in 2026, Grab's channel network will become the best "flood discharge area" to digest this huge production capacity.

From 'selling hardware' to 'selling infrastructure'

This combination of punches has completely changed the valuation logic of HSAI.

In the past, the market viewed HSAI as a "car parts manufacturer" and focused on the price war of in car LiDAR; Now, through deep binding with Grab, HSAI is evolving into an 'AI perception infrastructure platform'.

Lidar is no longer just the "bulge" on the roof of the car. It is the embodied intelligent eye, the cerebellum of robots, and the nerve endings of smart cities. Extending from the automotive market to robotics, logistics, and industrial automation, the market size has grown from billions to billions. HSAI no longer provides cold hardware, but an integrated solution of "hardware+software+services". Keywords: Southeast Asia, Hesai Technology

The collaboration between HSAI and Grab is a textbook level example of China's hard technology going global. It is no longer simply product output, but a three-dimensional war of "technology output+capital binding+local manufacturing". On the eve of the explosion of physical AI and embodied intelligence, HSAI has already used this heavy punch to build a moat in Southeast Asia that is difficult for competitors to cross. While others are still gazing up at the stars, HSAI has stepped on Grab's shoulder and planted the banner of "Made in China" on every city street in Southeast Asia.Editor/Cheng Liting

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~