- Middle Eastern sovereign fund invests $1.5 billion in Prolos, adding core assets of China's new infrastructure

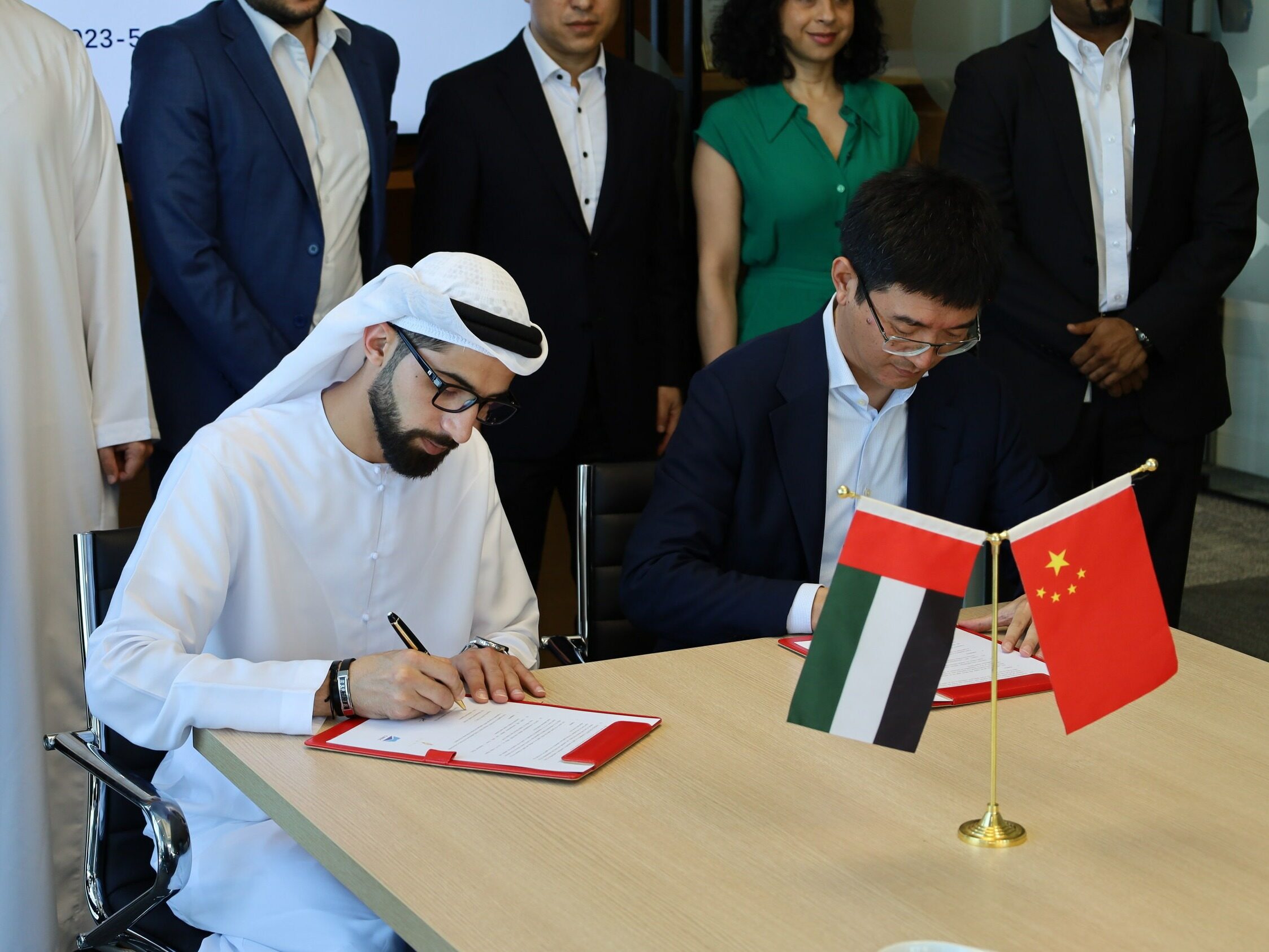

On August 28, 2025, Abu Dhabi Investment Authority (ADIA), a globally renowned sovereign wealth fund, announced a strategic investment in Prolos Group, with an initial deployment of $500 million and plans to add up to $1.5 billion. This investment is directly injected into the company level, reflecting the deep recognition of international long-term capital for Prolos' overall strategy and operational capabilities as a new economic infrastructure platform.

Prolos originated from modern logistics facility operations and has now developed into a composite infrastructure platform covering logistics warehousing, data centers, cold chain, and new energy. Its asset management platform GCP manages assets worth 80 billion US dollars and has established a dual wheel drive model of "investment+operation". In China, Prolos has locked in over 1.4GW of data center IT capacity, operated 33 cold storage facilities with a total capacity of over 4.8 million cubic meters, and actively laid out distributed photovoltaic and energy storage systems.

As an international capital with a long-term presence in the Chinese market, ADIA has previously participated in infrastructure investments such as logistics and data centers in China through multiple funds. This direct investment in the parent company of Prolos not only demonstrates firm confidence in China's economic structural transformation, but also reflects a high consensus among international capital on the growth potential of China's new infrastructure sector, including computing power, green energy, and smart logistics.

From a macro perspective, since 2025, Middle Eastern capital has continued to increase its asset allocation to the Chinese market. Against the backdrop of the dual acceleration of industrial digitization and energy transformation, China's new infrastructure is expanding from traditional forms to a new paradigm of deep integration of data energy computing power. Platforms such as Prolos, which possess the ability to operate and capitalize on multiple assets, are becoming an important interface for international patient capital to enter China's core assets.

This is not only an ordinary financial investment, but also a systematic 'vote' on China's new quality productivity infrastructure. In the wave of global capital reallocation, China is continuously attracting the deep participation of long-term investors such as ADIA with its complete industrial chain, clear energy transformation path, and continuously optimized business environment. (This article is from the official website of Jian Dao www.seetao.com. Reproduction without permission is prohibited, otherwise it will be prosecuted. Please indicate Jian Dao website+original link when reprinting.) Jian Dao website editorial column editor/Yang Beihua

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~