- China Minmetals Corporation successfully acquires Brazilian nickel ore for $500 million, with a production capacity of 40000 tons

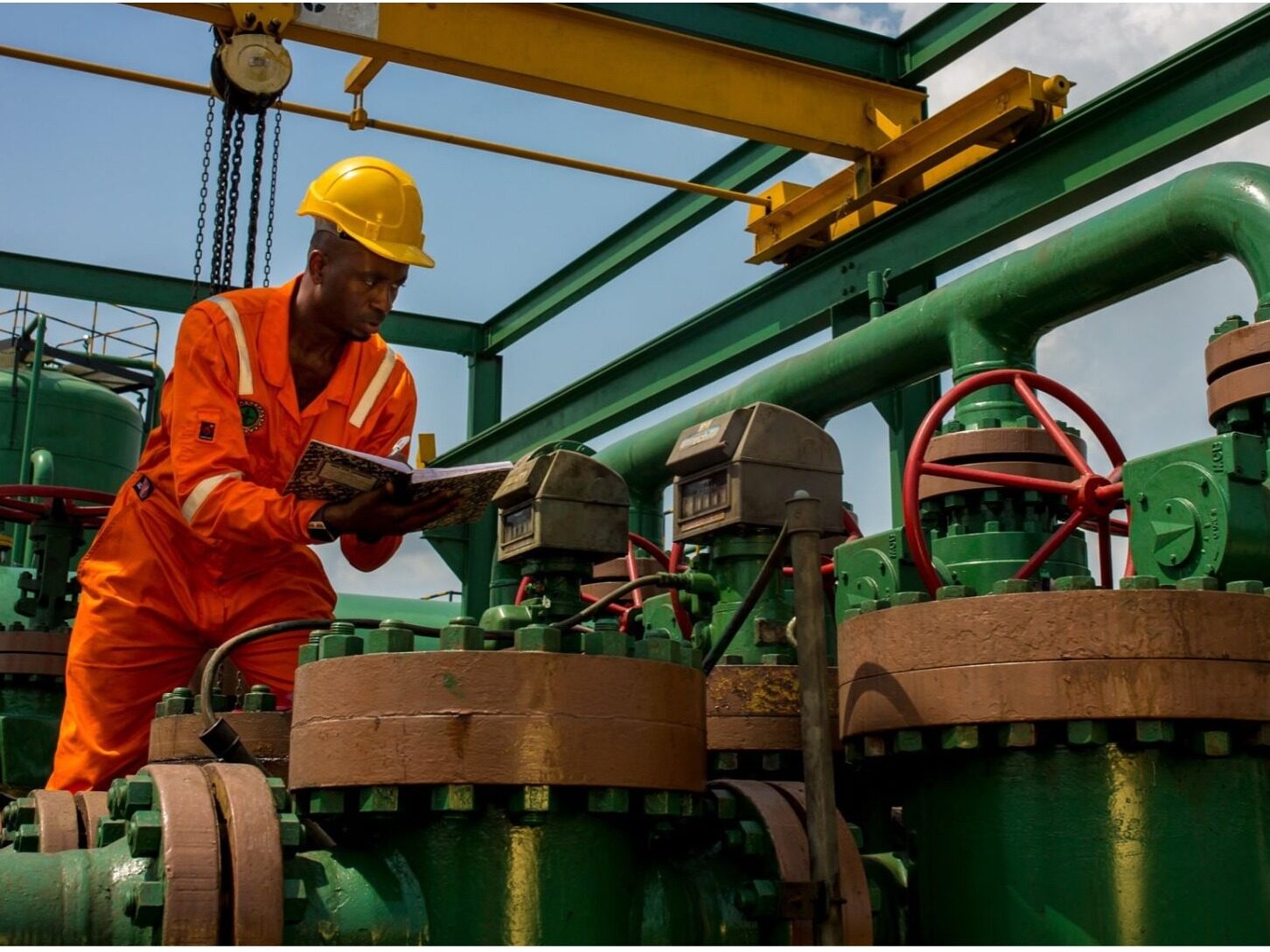

China Minmetals Resources Co., Ltd. successfully acquired the nickel mining assets of Anglo American Group in Brazil for no more than $500 million in early 2025, including two mines and two processing plants, with an annual production capacity of 40000 tons of nickel iron, mainly used in the stainless steel industry. Half a year after the completion of this transaction, the American Iron and Steel Institute raised doubts, stating that the transaction may enhance China's control over global nickel resources and demanded that the US intervene in the investigation.

Previously, the Dutch company Corex, which participated in the bidding, also proposed a bid of up to $900 million but was unsuccessful. Its actual controller has requested that Anglo American explain the reasons for the decision and complained to the EU and Brazilian antitrust agencies, stating that China already accounts for about 60% of global nickel production. This transaction will further exacerbate market concentration and affect the security of the EU supply chain.

Anglo American responded that China's actual share of global nickel production is about 52%, and emphasized that the transaction decision is not only based on the quotation, but also takes into account the buyer's execution ability and operational background. As a state-owned enterprise in China, Minmetals Resources has the financial strength and cross-border project experience, which is conducive to the smooth implementation of transactions. The acquisition is part of Anglo American's global business restructuring and asset optimization strategy.

In recent years, Chinese companies have continuously strengthened their global layout of nickel resources. Nickel, as the core raw material for stainless steel and power batteries, continues to gain strategic importance. The acquisition of Minmetals Resources comes at a low nickel price, which is in line with its long-term strategy of expanding its base metal business and strengthening global resource control. The company expects that with the steady growth of the stainless steel industry and the increasing demand for electric vehicle batteries, there may be a supply gap in the nickel market in the future.

Brazilian experts analyze that large-scale mining acquisitions require a comprehensive evaluation of multiple factors. Although Corex offers a higher price, its transaction faces more complex regulatory approvals and financing uncertainties; With stable funding and operational experience, Minmetals Resources can complete transactions faster, reduce execution risks, and better meet the strategic needs of sellers.

Chinese enterprises actively participate in global mineral resource development through market-oriented means, bringing capital and technology to resource rich countries and promoting international production capacity cooperation. Against the backdrop of accelerating global green energy transition, ensuring stable supply of key mineral resources has become a common concern for all countries. (This article is from the official website www.seetao.com of Jian Dao. Reproduction without permission is prohibited, otherwise it will be prosecuted. Please indicate Jian Dao website+original link when reprinting.) Jian Dao website infrastructure engineering column editor/Yang Beihua

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~