- Chinese companies are accustomed to the supply chain efficiency of "same day ordering, next day delivery" in China

When Chinese battery companies went overseas with the world's top power battery technology and a huge investment of over 2.4 billion US dollars to try to replicate the industrial miracle of "CATL", no one expected the project to come to a halt on the eve of production. The construction of production lines has been hindered, supply chain connections have broken, and local regulatory policies have undergone sudden changes. A series of difficulties have abruptly put an end to this seemingly unstoppable "plan to go global".

This is not an isolated case. In recent years, from the overseas factories of photovoltaic giants facing trade barriers to the localized operation of home appliance companies being deadlocked, more and more Chinese manufacturing companies have faced the dilemma of "technology output, difficult production capacity landing, and difficult system rooting" in their "overseas stories". Why does the former competitiveness frequently "fail" once crossing national borders, despite having hard advantages such as technology patents, cost control, and production capacity? What is the bottleneck of China's "system going global"?

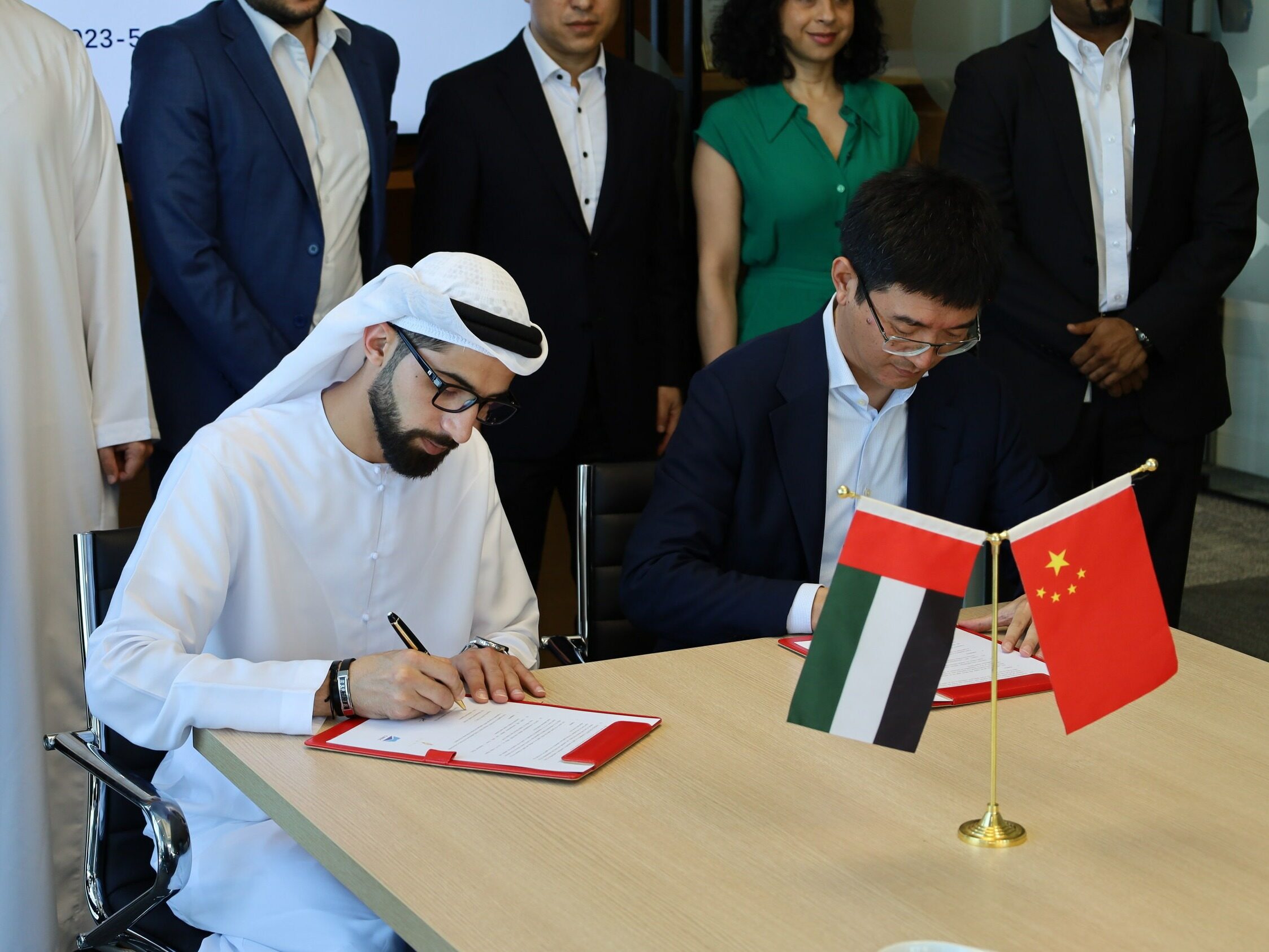

Technology ≠ Passport: 'Non Market Barriers' in Geopolitical Games

The technological hard power of Chinese manufacturing has long been recognized globally. In the fields of new energy, home appliances, mechanical equipment, etc., Chinese enterprises rank among the world's top in terms of product performance and core patent numbers, and some technologies even achieve "reverse output". But the competition in overseas markets is never just a competition of technology and price, but also mixed with multiple repetitive and miscellaneous factors such as geopolitics and ideology.

The overseas projects of the above-mentioned battery companies have suddenly undergone a "safety review" at a critical juncture. The originally approved approval process has been temporarily suspended, and the import of core equipment has been restricted. Even local partners have chosen to withdraw due to external pressure. This kind of "non market factor" intervention makes the technical demonstration and market research in the early stage of the enterprise become the foundation - when "Made in China" is labeled with a specific label, no matter how prominent its technological advantages are, it is difficult to break through the artificially set barriers.

Similar cases have occurred in multiple industries: overseas factories of photovoltaic companies have been subject to high anti-dumping duties, citing "disputes over production capacity subsidies"; 5G equipment companies have been excluded from infrastructure projects in some countries due to "security concerns"; New energy vehicle companies may face additional quota restrictions even if they meet local technical standards. These barriers are not aimed at product quality or technical defects, but rather at the identity attribute of "Made in China", putting companies in a dilemma of "compliance but non-compliance".

Capacity ≠ Implementation: The 'Adaptation Gap' between Supply Chain and Localization

The core competitiveness of Chinese manufacturing lies in the construction of a complete supply chain system from raw materials, components to finished products. This "full chain advantage" is easy to handle in the domestic market, but it is prone to "adaptation" after going abroad. Many companies mistakenly believe that "moving factories overseas" is equivalent to "expanding their systems overseas", but overlook key issues such as localized adaptation and compliance linkage in the supply chain.

Taking overseas factory construction as an example, Chinese companies are accustomed to the supply chain efficiency of "same day ordering, next day delivery" domestically, but they have encountered problems such as prolonged import cycles of raw materials, substandard quality of local components, and doubled logistics costs overseas. When the above-mentioned battery companies built factories overseas, they had planned to use the mature domestic supply chain model, but found that some core components could not be directly adapted due to local environmental standards and technical specifications being different from those in China; However, searching for local suppliers again is facing the problems of insufficient production capacity and high costs, leading to repeated delays in the construction of production lines.

Even more challenging is the complexity of localized operations. There are significant differences in the rule system between overseas markets and domestic markets, from employee recruitment and labor regulation adaptation to tax planning and environmental standard implementation. When a household appliance company was building a factory in Europe, frequent employee disputes arose due to unfamiliarity with the local union system; Another mechanical equipment company was fined heavily for failing to meet local carbon emission standards. These 'detailed' issues, seemingly unrelated to core technology, directly affect the efficiency of production capacity implementation and even lead to the failure of the projectEditor/Bian Wenjun

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~