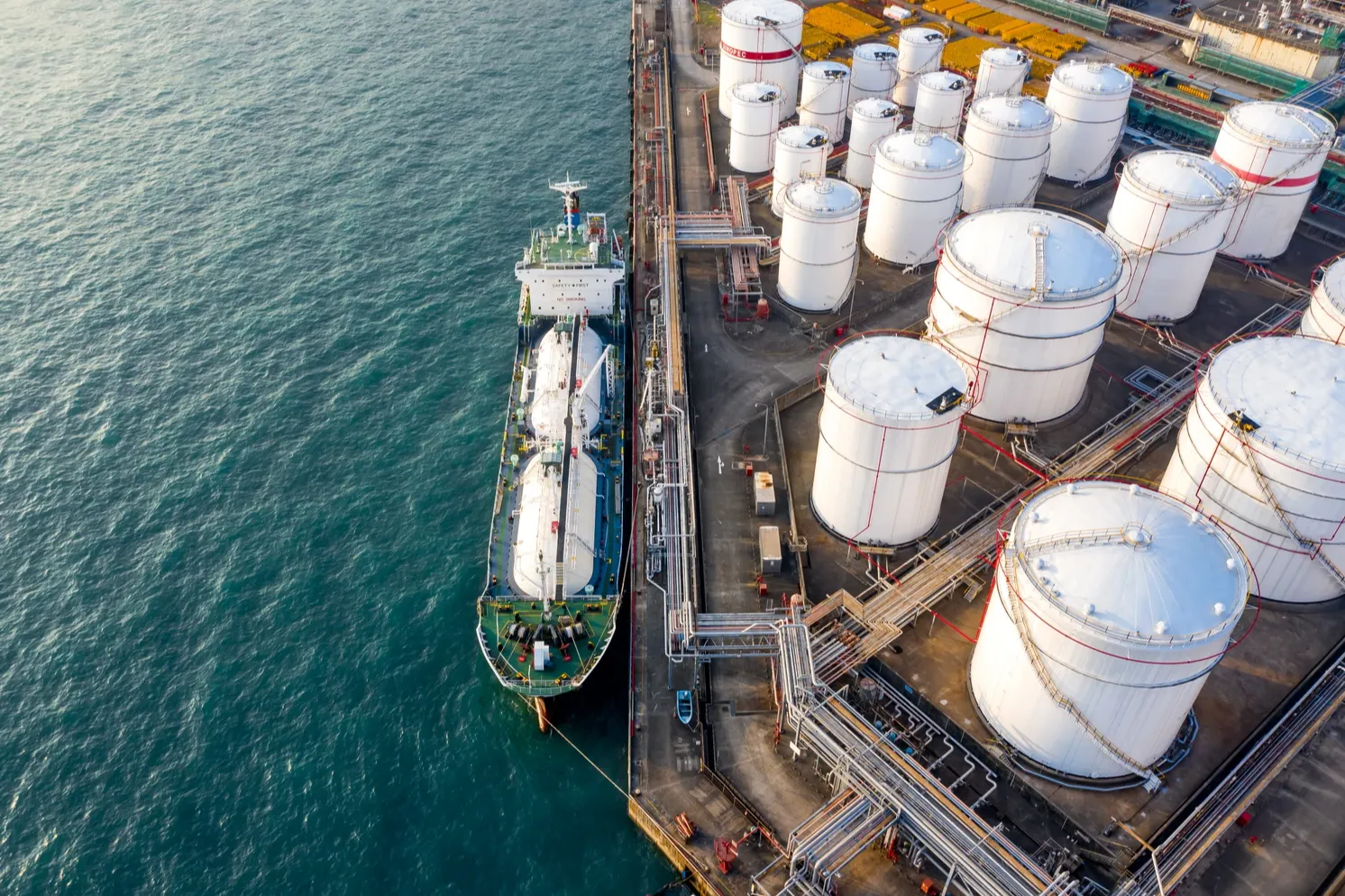

- The departure of this oil tanker marks a crucial step in its strategy to expand energy import channels and diversify supply risks

- The departure of this oil tanker has become the latest signal to connect the energy links between Asia and Africa and promote the multipolarization of global energy trade

A tanker carrying one million barrels of crude oil sailed eastward on Christmas Eve at the port of Alzeh in Algeria. This is not only a trade between two national oil companies, but also a strategic commitment spanning 25 years.

On December 24, 2025, the oil tanker of Pertamina, the Indonesian national oil company, set sail from the port of Alzeh in Algeria, transporting 1 million barrels of crude oil back to the country for the first time. The background of this transportation is the oilfield service contract just signed a few days ago and the extension agreement of the 25 year production sharing contract. As a former founding member of OPEC, Indonesia imports 840000 barrels of oil today, exceeding its daily production of 600000 barrels.

The road of energy cooperation spanning 24 years

The energy cooperation between Algeria and Indonesia is not a spur of the moment, but rooted in a partnership that has lasted for over 20 years. As early as 2002-2003, the two countries signed an annual cooperation agreement and maintained stable spot trading from 2006 to 2013. The substantial breakthrough in cooperation occurred in 2014, when the Indonesian National Oil Company obtained the operating rights of the Menzel Lekimait oil field block in Algeria, thus deeply intervening in oil and gas development in the region.

According to the agreement in June 2023, Indonesia's national oil company and its partners plan to invest over $800 million in Algerian oil fields for drilling 12 oil wells, constructing liquefied petroleum gas extraction plants, and solar energy projects. This agreement brings a development cycle of 25 years or even a possible extension of 10 years for the oil field.

Indonesia's breakthrough in diversifying energy imports in North Africa

The 1 million barrels of crude oil shipped this time are based on three service contracts signed between Indonesia's National Oil Company and Algeria's National Oil Company on December 22, 2025. These contracts specify the unloading of crude oil, condensate oil, and liquefied petroleum gas in the oilfield blocks.

For Indonesia, importing crude oil from Algeria this time is not just a simple trade, but a crucial step on the national energy strategy chessboard. The energy landscape in Indonesia has undergone significant changes in recent years. Despite being one of the founding members of OPEC, Indonesia has now become a net importer of oil. Data shows that Indonesia imports approximately 840000 barrels of oil per day, of which 240000 barrels are crude oil and 600000 barrels are refined oil.

Indonesia has a high concentration of oil imports. The import volume of oil and gas in the first quarter reached 9 billion US dollars, accounting for 16.4% of the total import volume. Singapore has long been Indonesia's largest source of oil imports, accounting for 54% of its total imports. In order to reduce dependence on a single source of imports, Indonesia is actively promoting its import diversification strategy. This strategy is not only driven by economic considerations, but also influenced by geopolitical factors.

Importing crude oil from Algeria marks Indonesia's first inclusion of North Africa in its crude oil supply map, which is an important milestone for the country to diversify its supply sources. The Menzel Lekimet oil field block produces approximately 35000 barrels of crude oil per day and is expected to produce 150 million barrels of oil equivalent oil and gas resources during its production cycle.

The Asian African Energy Link and the World Energy Trade Pattern

Algeria's first export of crude oil to Indonesia is not only a milestone in energy cooperation between the two countries, but also foreshadows the possible changes in the global energy trade pattern in the future. This cooperation model provides a reference for other countries seeking diversified energy supply.

As the energy demand of emerging economies in Asia continues to grow, African oil producing countries are actively seeking connections with the Asian market. Algeria's successful opening up of the Indonesian market this time may trigger other African oil producing countries to follow suit, gradually changing the traditional global energy trade flow.

For Indonesia, importing crude oil from Algeria this time is just a part of its energy strategy. Faced with geopolitical challenges and domestic energy security needs, Indonesia has planned to gradually reduce oil imports from Singapore and instead increase imports from the Middle East and the United States. This plan is expected to be implemented within the next six months.

Indonesia is still considering increasing imports of energy products from the United States as a bargaining chip in tariff negotiations with the US. Energy Minister Bachrir stated that Indonesia may increase its imports of crude oil and liquefied petroleum gas from the United States to help achieve its goal of purchasing $18 billion to $19 billion worth of American products.

On December 26, 2025, Sasuke Uda, the President and Director of the International Exploration and Production Company of Indonesia's National Oil Company, stood in the office of the Jakarta headquarters, with a world map displaying the real-time trajectory of oil tankers in front of him. Keywords: international news, energy news

As the light with the Pertamina logo slowly crossed the Mediterranean, he knew that this tanker carrying one million barrels of crude oil was crossing not only the ocean, but also the threshold of a country's energy security strategy. As a company leader, he is more aware of the hidden data behind this transportation - the huge gap between the daily domestic production of 600000 barrels and the import demand of 840000 barrels, as well as the fragile supply chain with a single channel import ratio of up to 54% from Singapore.Editor/Cheng Liting

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~