- Over the past two years, there has been a nearly fivefold increase! Can Nigeria's huge budget cure the country's arteriosclerosis

- From numbers to asphalt, interpreting the market opportunities and practical challenges behind Nigeria's massive road budget

On the bumpy A2 national highway, heavy trucks struggle to move forward, while a road budget document worth up to 3.23 trillion naira inside the Nigerian parliament building is sparking heated debate - can this money fill the huge gap in the country's infrastructure, or will it fall into the maze of fiscal appropriations again?

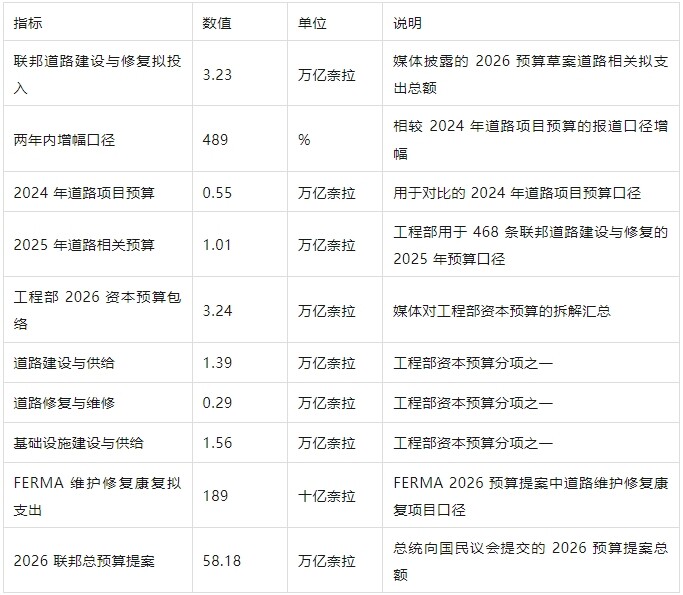

The 2026 budget document recently disclosed by the Nigerian Ministry of Engineering shows that the proposed expenditure for federal road construction and repair has reached 3.23 trillion naira, an increase of about 489% in two years compared to the 2024 road project budget of 548.56 billion naira, making it a significant leap in Nigeria's infrastructure investment history.

Considerations behind historic growth

The overall budget size of Nigeria in 2026 is 58.18 trillion naira, which includes high deficits and debt repayment arrangements. The federal government has given higher priority to road infrastructure, and the 3.23 trillion naira road special budget is the most direct manifestation of this policy shift.

From the perspective of budget composition, the total capital budget envelope of the Ministry of Engineering is approximately 3.24 trillion naira, of which 1.39 trillion naira is used for road construction and supply, 285.62 billion naira is used for repair and maintenance, and another 1.56 trillion naira is used for infrastructure construction and supply.

Behind the significant increase in budget is the severe situation of Nigeria's road network. According to FERMA, the Federal Road Maintenance Agency of Nigeria, over 60% of federal roads in the country are in poor or very poor condition, severely restricting economic development and public travel.

Analysis suggests that the government hopes to drive economic growth, create employment opportunities, improve logistics efficiency, and reduce transportation costs nationwide through large-scale road investments.

Industrial layout under sub item budget

The budget document clearly lists the different uses of funds and provides clear guidance for market participants. The 1.39 trillion naira used for road construction and expansion mainly corresponds to the main engineering quantities of roadbed, pavement, bridge and culvert nodes, drainage, and earthwork.

The repair and maintenance part will focus on fast turnover small section projects, which will first drive the demand for asphalt, modifiers, milling, paving, compaction equipment, and maintenance services. This structural design means that market opportunities will be released in stages.

The specific types of projects mentioned in the budget also reveal market opportunities: projects such as segmented reconstruction, repair of damaged sections, double amplitude expansion, emergency bridge maintenance, drainage and roadbed reinforcement have a high frequency of occurrence.

The common characteristics of these projects are that the sections can be divided, the construction period is relatively controllable, and the demand for materials and equipment is concentrated. For contractors and suppliers, opportunities will be prioritized in two types of orders: segmented repair and re paving projects for main corridors, and specialized engineering packages for bridge and culvert nodes and drainage systems.

In addition to the large budget of the Ministry of Engineering, the federal road maintenance agency FERMA plans to spend approximately 189 billion naira on road maintenance, repair, and rehabilitation in its 2026 budget proposal, with a total budget proposal of approximately 229 billion naira, of which approximately 191 billion naira are marked as capital expenditures for roads and bridges.

Although maintenance projects have small amounts and scattered locations, they are equally important for building a nationwide maintenance network. Such projects often rely more on local construction forces and rapid mobilization capabilities.

Double obstacles to budget implementation

Although the budget size is encouraging, infrastructure investment in Nigeria has always faced implementation challenges. At present, the 2026 budget is still in the stage of congressional review, and will enter the legislative level for project review and balance discussion. Project priorities and implementation pace will still be repeatedly reviewed.

The budget execution rate in Nigeria has been consistently low, with an overall federal government budget execution rate of less than 40% in 2023 and a capital budget execution rate of less than 30%. This high budget, low execution model has become a structural problem that constrains the development of infrastructure.

Fiscal constraints are another major challenge. Nigeria's overall budget for 2026 includes a high deficit and debt repayment arrangements, with a budget deficit of 23.85 trillion naira accounting for over 4% of GDP, which has drawn attention from external institutions such as the International Monetary Fund to its fiscal sustainability.

The increase in budget size does not automatically mean faster cash disbursement. Contractors and suppliers need to pay special attention to the design of contract terms, ensure clear payment paths, and link payments with project progress. Meanwhile, introducing financial institutions and insurance tools to share risks as much as possible is a key strategy to improve project feasibility.

The true increase in market volume depends on two key factors: the granularity of the list of items reviewed by Congress, and the degree of strengthening of fiscal appropriations and enforcement discipline. Only when specific projects are clear and funding mechanisms are sound, can budget figures be converted into actual project quantities.

Economic considerations beyond roads

There are deeper strategic considerations behind Nigeria's large-scale road investment. As the largest economy in Africa, Nigeria is seeking to consolidate its regional leadership position through infrastructure development and promote regional integration within the framework of the African Continental Free Trade Area.

The improvement of the road network will directly reduce logistics costs and enhance the competitiveness of Nigeria's manufacturing industry. At present, logistics costs in Nigeria account for as much as 40% -60% of the final price of goods, far higher than the global average.

In addition, large-scale road construction is expected to create a large number of job opportunities and alleviate Nigeria's long-standing problem of high unemployment. It is estimated that every 1 billion naira of road investment can directly and indirectly create about 150-200 job opportunities.

From a broader perspective, the improvement of road infrastructure helps strengthen economic connections across Nigeria, promote domestic market integration, and provide reliable guarantees for the transportation of products in key industries such as agriculture and mining.

The road construction in Nigeria, after a sudden increase in budget, is standing at the intersection of opportunities and challenges. On the one hand, large-scale investment is expected to improve Nigeria's weak infrastructure and drive the development of related industries; On the other hand, Nigeria's long-standing issues of poor budget execution, fiscal constraints, and governance challenges have cast a shadow over the actual effectiveness of this massive investment. Keywords: international news, transportation news

In the government building in Abuja, the capital of Nigeria, decision-makers must be acutely aware that the key to truly improving the country's road conditions lies not only in the size of budget figures, but also in the improvement of implementation mechanisms, governance capabilities, and adherence to fiscal discipline. Only when funds are effectively converted into high-quality projects can Nigeria's roads truly become the arteries of economic development, rather than the quagmire of resource waste.Editor/Cheng Liting

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~