- This marks the first time that the country's core power infrastructure has been opened to international private capital

In the vast land of Somalia region in eastern Ethiopia, nightfall often signifies the arrival of darkness. Although the roar of large hydropower stations has brought abundant electricity in recent years, the outdated transmission network is like an invisible barrier, blocking the light from the national main power grid. Recently, with the signing of a $400 million Joint Development Agreement in Addis Ababa, the capital of Ethiopia, the lights on this land are expected to be fully illuminated. This is not only a huge investment, but also a fundamental transformation in asset attributes and financing models, which has dropped a "deep water bomb" on the infrastructure development of the entire African continent.

Where did the $400 million go?

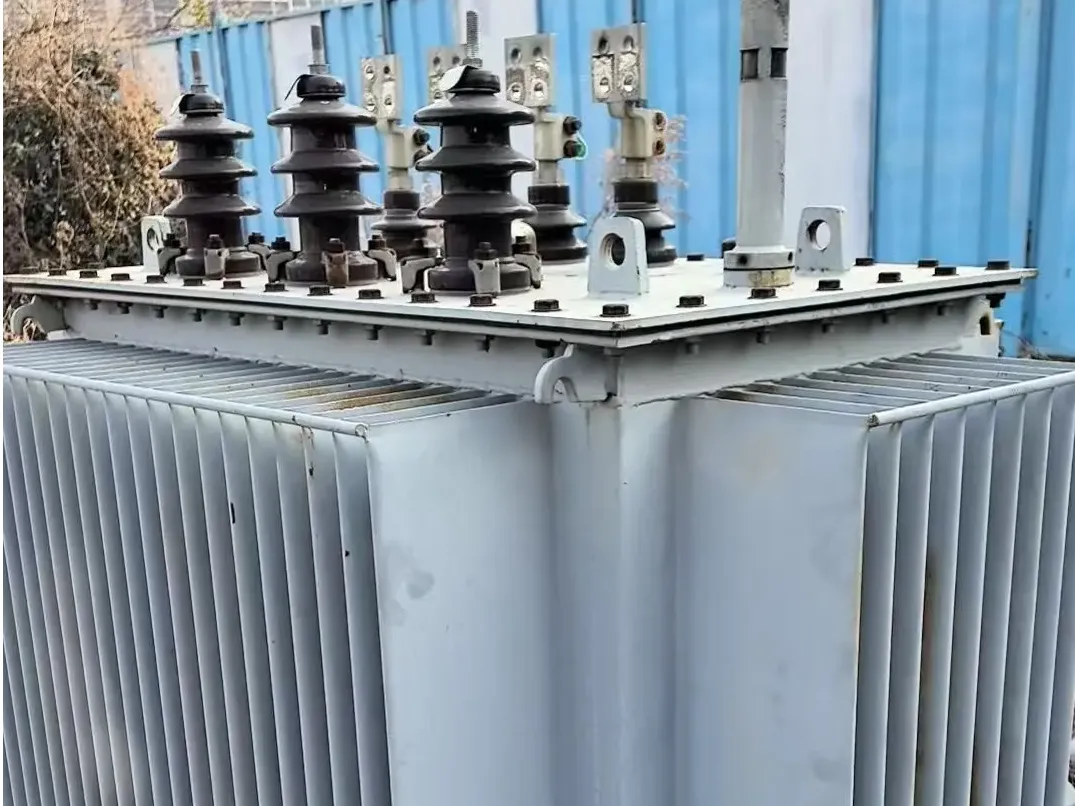

According to the agreement, this $400 million investment will be precisely directed towards two key projects aimed at connecting Ethiopia's power "Ren Du Er Mai".

The Degehabur Kebulidehar line (206 kilometers, 132 kV): This line shoulders an important mission for people's livelihoods. It will connect the eastern Somali region to the national main power grid for the first time, providing stable electricity supply to residents in the long suffering eastern region.

Hulso Ayisha Line (198 kilometers, 400 kV): This line focuses on future energy strategies. It plans to develop the abundant renewable energy sources in the northeast of the country, such as wind and solar energy, and enhance the grid interconnection capability with neighboring Djibouti, laying the foundation for electricity exports and regional energy cooperation.

Why introduce private capital?

Currently, Ethiopia is facing an awkward contradiction: while its power generation capacity has increased, its transmission network is lagging behind.

Although the country's power generation has significantly increased with the commissioning of large hydropower stations, the outdated transmission network still results in about half of the population lacking reliable electricity supply. More seriously, industrial enterprises frequently encounter power outages, which seriously restricts economic development. Relying solely on government financial appropriations is no longer sufficient to meet the enormous demand for infrastructure. Introducing international private capital such as Gridworks from the UK and adopting the PPP (Public Private Partnership) model is not only a means to address the funding gap, but also a bold attempt by Ethiopia to open up to international capital in the core power infrastructure sector.

The 'hidden reefs' and risks behind opportunities

Despite its broad prospects, this pioneering model also comes with significant risks, and its success is highly dependent on a stable institutional environment.

Payment risk: The project's revenue is entirely dependent on the payment capacity of the Ethiopian National Electricity Company. If the overall financial situation of the country's power system deteriorates, there may be a risk of payment delays or requests for renegotiation of agreements.

Policy risk: The commercial feasibility of the project is based on a long-term stable transmission pricing and cost recovery mechanism. This mechanism has not yet undergone full cycle verification in Ethiopia, and subsequent policy, legal, or regulatory changes may directly affect investors' returns.

Asset sinking risk: Transmission lines have path uniqueness and once built, they are deeply embedded into the national power grid with almost no other use. If major changes occur, investors will have little flexibility in disposing of or exiting assets, facing the dilemma of "getting in, not getting out".

In addition, the security situation in some areas of Ethiopia remains unstable, and the British Foreign Office has issued a travel ban on regions including parts of Somalia where the project is located, casting a shadow over the smooth implementation of the project.

The ultimate success or failure of this project will not only depend on a $400 million investment and the physical extension of 404 kilometers of transmission lines, but will also become a "touchstone" for testing whether private capital can enter the African transmission infrastructure field on a large scale and sustainably. Its experience and lessons will have a profound impact on the infrastructure development of the entire African continent and serve as an important window for observing Africa's economic transformation.Editor/Yang Meiling

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~