- Li Ka-shing decided to sell the oil asset, which has been acquired by Canadian oil sands producer Cenovus Energy for RMB 19.3 billion.

In December 1986, Li Ka-shing seized the opportunity of the plunge in oil prices (the oil price was only $11 per barrel at the time) and acquired 52% of the Canadian oil company Husky Energy for HK$3.2 billion. Li Ka-shing once said, "This is the greatest investment in his life." However, in 2020, when oil prices plummeted, Li Ka-shing sold it.

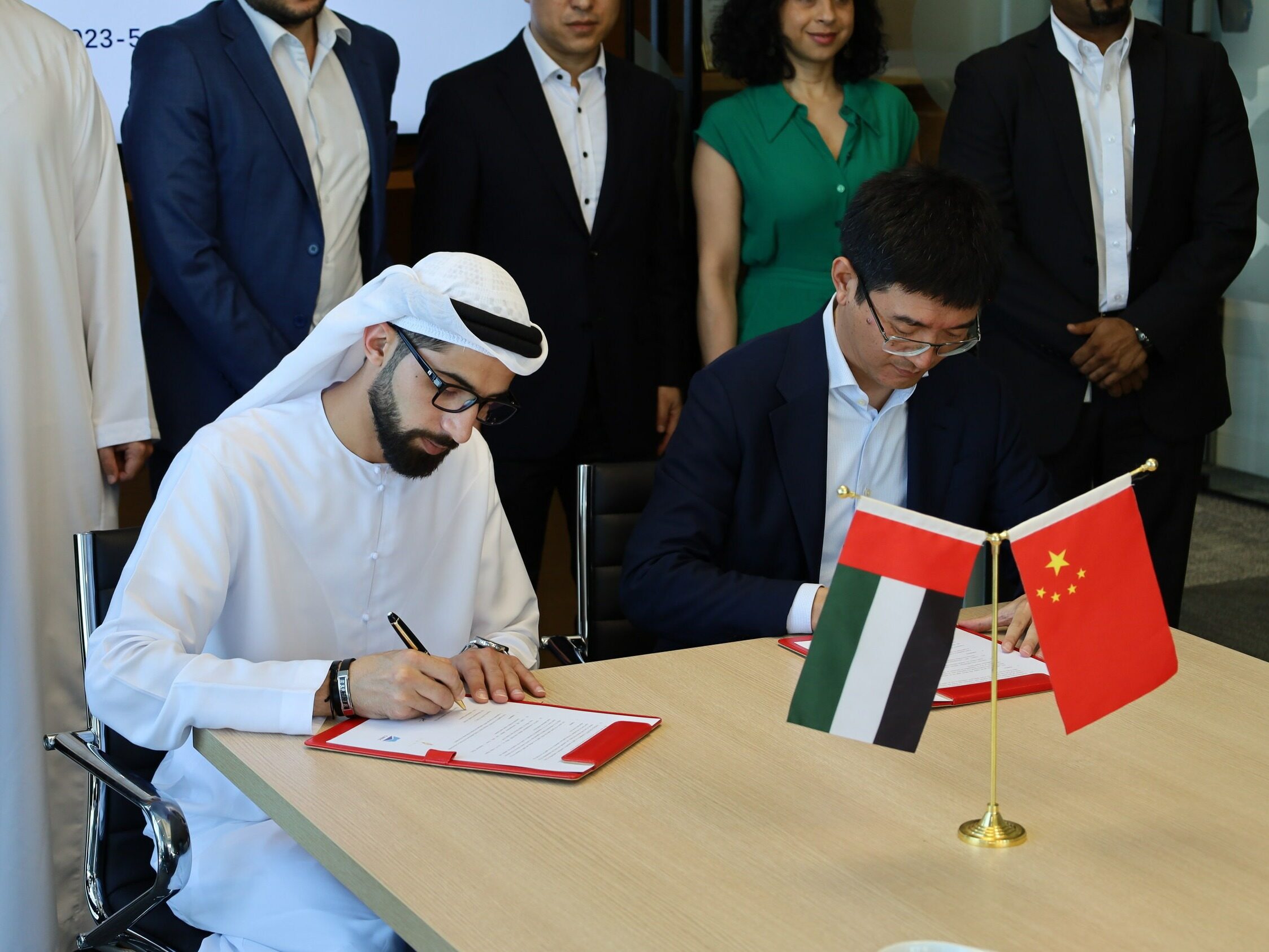

It is reported that Cenovus Energy announced on October 25 that it agreed to merge with Husky Energy on an all-stock basis. The combined company will become Canada’s third largest oil and gas producer, but it will still be operated by Cenovus Energy, while Li Ka-shing and Its Changhe Industrial will hold 27% of the shares. Including debt, the total value of the acquisition is 23.6 billion Canadian dollars.

Why is the price of oil also plummeting. Li Ka-shing seized the opportunity more than 30 years ago and won the "greatest investment of his life", but sold it more than 30 years later?

According to BP’s "Energy Outlook 2020" on October 14, unlike the period of rapid growth in international oil demand more than 30 years ago, the continued growth phase of oil demand in 2020 may have ended. At present, only the strong market demand in China remains on the demand side, which can boost the international oil market. Without the support of strong market demand, bargain-hunting is likely to trap oneself.

Therefore, under the impact of multiple factors such as the new crown epidemic and the plunge in oil prices, Li Ka-shing, who has been bargaining in the oil market for 30 years, also decided to stop.

In fact, in recent months, the North American oil and gas industry has suffered heavy losses. Li Ka-shing's sale of oil and gas assets is only a microcosm of North American oil transactions. Just 4 days ago, the largest shale oil deal in 2020 had just been concluded. ConocoPhillips announced on October 19 that it had acquired the drilling company Concho Resources in an all-stock transaction, with a stock value of up to $9.7 billion. Editor/Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~