- The consortium is composed of institutional investors from China, Saudi Arabia, South Korea, the UAE and the United States

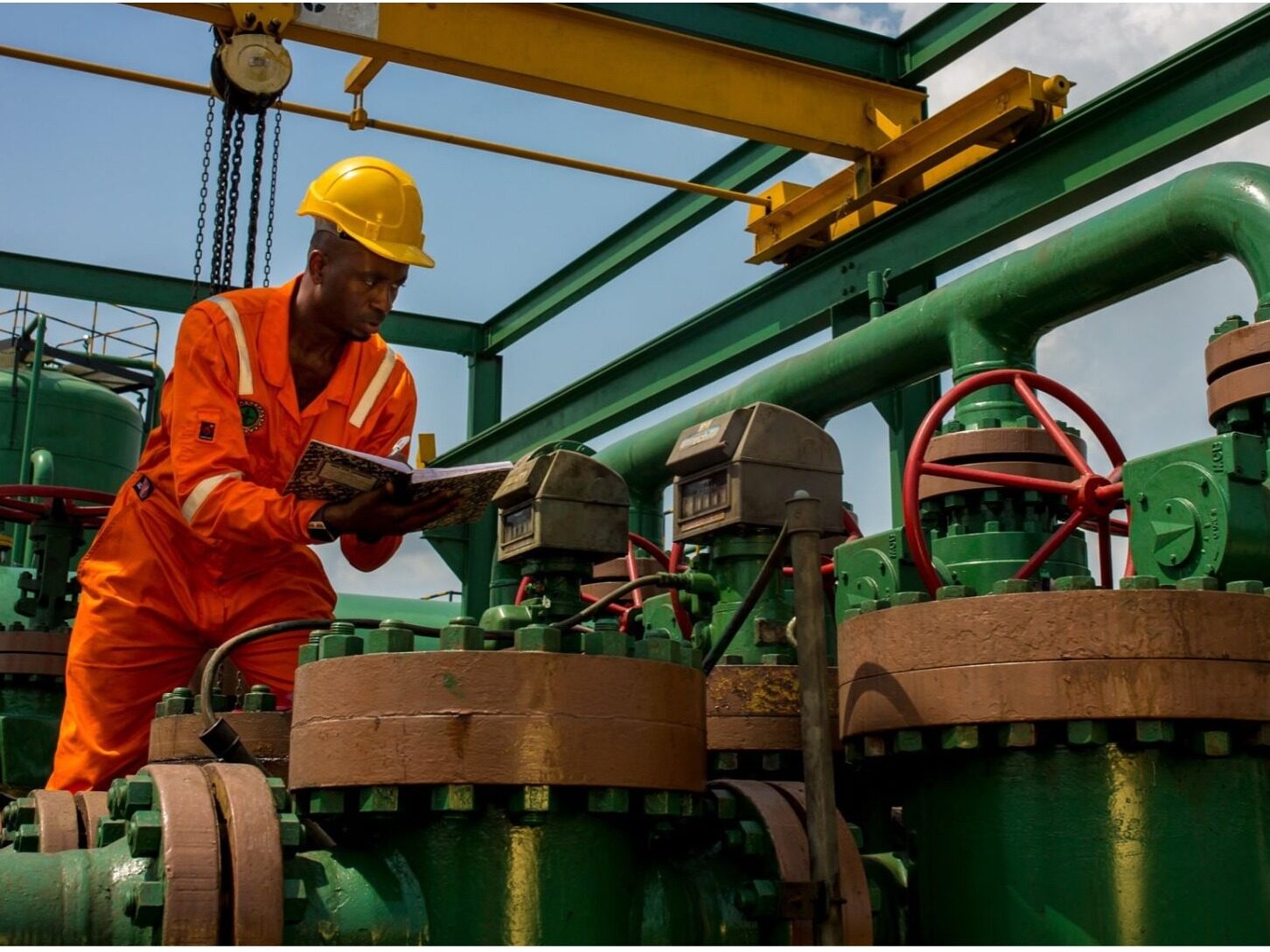

Saudi Aramco's oil pipeline at the Ras Tanura refinery in Saudi Arabia. Saudi Aramco’s transaction with a consortium led by EIG valued its pipeline business at US$25.3 billion.

Saudi Aramco is the world’s third-largest company by market capitalization and the largest crude oil exporter. The company has entered into a $12.4 billion transaction with a consortium led by EIG Global Energy Partners to acquire 49% of its oil pipeline business .

This transaction is Saudi Aramco's largest since its listing on the Tadawul exchange in 2019, when it raised more than $29 billion. It attracted a group of global investors from Asia, North America and the Middle East, including Abu Dhabi's sovereign fund Mubadala.

The new joint venture, Aramco Pipeline, will lease and use the state-owned oil company’s stable crude oil pipeline network, which connects oil fields to the downstream network for a period of 25 years. Aramco President and CEO Amin Nasser said: “The interest we have received from investors shows that we are confident in our operations and the long-term prospects of our business.” “We plan to continue to explore opportunities and leverage our industry-leading capabilities for Saudi Arabia attracts suitable investment."

The agreement was first announced in April, allowing Saudi Aramco to profit from its pipeline assets while retaining overall ownership and operational control of the network. Saudi Aramco said that the transaction does not impose any restrictions on Saudi Aramco's actual crude oil production, depending on the production decision made by Saudi Arabia. EIG said in a statement on its website that the consortium is composed of institutional investors from China, Saudi Arabia, South Korea, the UAE and the United States.

The state-owned oil company made a profit of 183.7 billion riyals (50 billion U.S. dollars) last year and announced last week that it plans to enter the debt capital market by issuing dollar-denominated Islamic bonds. It did not disclose how much funds it intends to raise, but stated that the funds will be used for "general corporate purposes or any other designated purposes" in the Islamic bond offer document. Editor/Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~